Celsius Network Case: Insights from Alex Mashinsky's Sentencing

The Celsius Network case has garnered significant attention following the sentencing of its founder, Alex Mashinsky. This event serves not only as a cautionary tale for the cryptocurrency industry but also offers valuable lessons to investors and users alike.

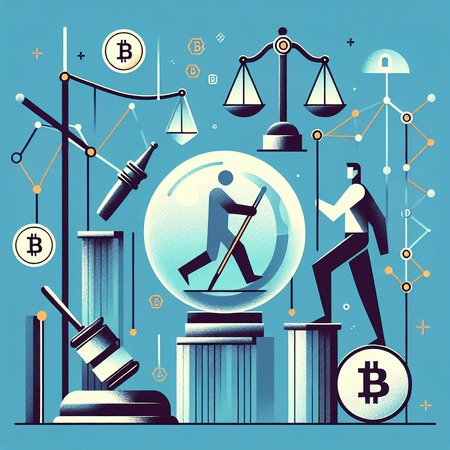

One of the key takeaways from this situation is the critical importance of transparency in the cryptocurrency space. Many investors were drawn to Celsius due to its promises of high yields on deposits; however, the lack of clear communication about risks became apparent as the situation unfolded. Investors must always seek clarity and thorough disclosures from lending platforms, as the risk of loss can be high when expectations are not managed.

Moreover, regulatory compliance is another vital lesson. The legal repercussions faced by Mashinsky underscore the necessity for crypto companies to adhere to regulations and maintain good standing with authorities. This is particularly important in a landscape that is shifting rapidly towards increased scrutiny from regulators around the world.

Lastly, the case emphasizes the inherent risks associated with lending platforms. The allure of high returns can often overshadow the potential pitfalls. Users should conduct thorough due diligence and consider their risk tolerance before tying up their assets in such platforms.

With this context, it becomes even more relevant for investors to explore more secure and innovative solutions in the crypto space. For instance, platforms like Bitlet.app provide a way to buy cryptocurrencies through their Crypto Installment service, allowing users to acquire their desired crypto by paying monthly rather than in one lump sum. This approach not only provides a manageable way to invest but also mitigates some financial risks that come with the volatile crypto markets.

Ultimately, the Celsius Network case reminds us that while the world of crypto is filled with opportunities, being informed and cautious is paramount.

Staying abreast of regulatory changes and assessing the platforms we use could safeguard investors from future pitfalls.