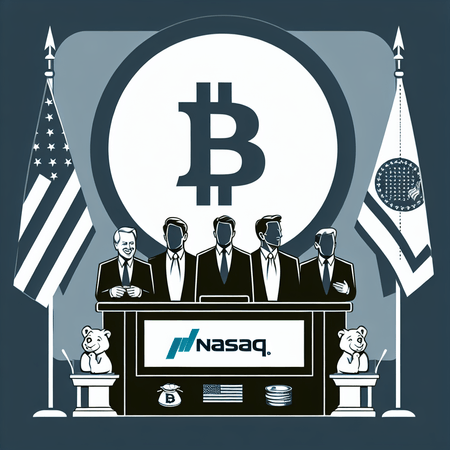

American Bitcoin's Public Debut on Nasdaq: The Trump Family's Influence and Future Implications

In a groundbreaking event, American Bitcoin recently made its public debut on Nasdaq, drawing attention from investors and regulators alike. This listing not only signifies the growing acceptance of cryptocurrencies in mainstream finance but also highlights the potential influence of major political figures on the market.

The Trump family has long been associated with financial ventures and, given their political visibility, their endorsement of American Bitcoin may signal a shift in how cryptocurrencies are perceived by the public and lawmakers. Analysts speculate that their involvement could lead to more favorable regulations for Bitcoin and other cryptocurrencies, potentially ushering in a new wave of investment and development in the crypto space.

The implications of this debut extend beyond immediate market reactions. As cryptocurrencies continue to blur the lines between traditional finance and alternative investments, the regulatory landscape will likely evolve. Stakeholders from various sectors, including those tied to the Trump family, may push for changes that could either facilitate or restrict the growth of digital assets, depending on aligning interests.

For individuals interested in entering the world of cryptocurrency, services like Bitlet.app provide unique offerings such as the Crypto Installment service, allowing users to purchase cryptocurrencies like Bitcoin now and pay for them in monthly installments. This approach makes investing in digital assets more accessible for all, especially during times of market volatility.

As American Bitcoin sails into the future on Nasdaq with the Trump family's influence, the broader impact on cryptocurrencies and the market remains to be fully seen.