Bitcoin Breakout: What the 8‑Week Reversal Means Ahead of the FOMC and ETF Flows

Summary

Quick takeaway

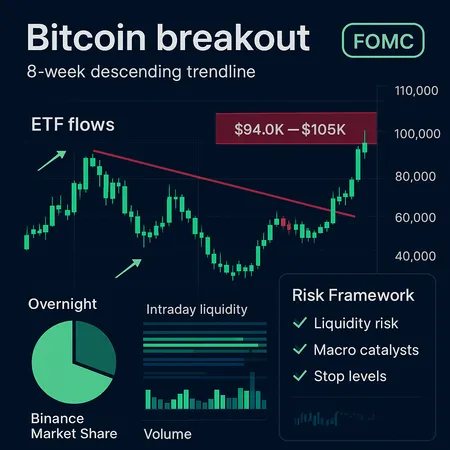

The market just recorded a meaningful technical event: a break above an 8‑week downtrend for BTC. That breakout is bullish only if price closes above key thresholds and volume/flow dynamics support follow‑through. ETF flows — both the incumbent, high‑volume funds and new niche products that time exposure — plus exchange concentration (notably Binance) are now material determinants of intraday liquidity and directional persistence. Ahead of the FOMC, traders should plan for volatility and adopt a scenario‑based sizing and stop framework.

The breakout: what happened and what counts as confirmation

Cryptodaily flagged the move as a breakout from an 8‑week downtrend, a technical structure that often precedes trend changes when confirmed by volume and momentum reporting the breakout. In plain terms, a single breach of a trendline is interesting; sustained closes above it on increased participation are required to call it a regime shift.

Key confirmation signals to watch now:

- Daily close above the trendline and the short‑term moving averages (e.g., 21–50 DMA) on above‑average volume. That suggests real buyer conviction rather than a short squeeze.

- Higher‑timeframe confirmation: a weekly close that respects the breakout level reduces the chance of a retest into previous lows.

- Volume profile and bid/ask imbalance during market hours — persistent bids on pullbacks and absorptive liquidity at higher prices are bullish signs.

For many traders, Bitcoin remains the primary bellwether for crypto allocations, so the stakes here extend beyond tactical spot trades.

Technical levels: targets, resistance zones, and invalidation

Analysts and tickers are converging on a cluster of levels that define the near‑term map. Cointelegraph outlined price levels to watch ahead of the FOMC that align with current technical supply zones (the $94k–$105k corridor is the most important) context on levels.

Practical levels traders should use:

- Immediate support (short‑term): $82k–$88k. If price retests and holds here with demand, the breakout is still intact.

- First major resistance: $94k–$98k. This is a clearly defined supply band where short‑term sellers and profit‑taking could show up.

- Higher resistance / target band: $100k–$105k. Breaching and sustaining above ~$105k opens the next leg and would be interpreted as a broader reclaim of the cycle highs.

- Invalidation level for this breakout: a daily close below $78k. A decisive move beneath that flips the short‑term edge to the bears and likely invites deeper retests.

Actionable rules of thumb:

- Longers can consider trimming into the $94k–$105k band instead of averaging up blindly.

- Shorters should wait for structural failure (daily close below the trendline + velocity) rather than fade the first push.

ETF flows and exchange concentration: liquidity risk in focus

ETF flows are no longer background noise. Large products can move hundreds of millions intraday and shape orderbook depth. Cryptoslate recently documented a roughly $150 billion market cap lift in a 24‑hour window tied to concentrated inflows and momentum context on $150B inflows. That magnitude of flow compresses reaction time for traders and increases the chance of gap moves.

Exchange concentration matters because most flow execution routes through a handful of venues. Coinpaper reports Binance’s dominant share of Bitcoin trading — meaning liquidity, orderbook depth and execution costs in many regions are heavily influenced by one exchange Binance market share data. When a concentrated exchange processes large ETF-related flow, it can steepen intraday rallies or exacerbate selloffs if liquidity dries up.

Practical consequences:

- Intraday liquidity risk: thin bid/ask corridors on certain venues can create large slippage when ETFs or big spot desks rebalance.

- Cross‑venue arbitrage windows: price divergence between venues (e.g., OTC fills vs exchange book) can persist during heavy ETF flow. Execution strategy matters — passive limit entries can sometimes out‑perform aggressive market orders.

For execution and allocation teams using platforms and services, including tools like Bitlet.app, be mindful of venue selection and fill quality when routing large flows.

Novel ETFs and market timing: why AfterDark matters

A new class of niche ETF strategies is emerging. The AfterDark product, which targets overnight BTC exposure while skipping U.S. hours, is a clear example of time‑targeted allocation that can change where and when liquidity arrives AfterDark ETF description. These funds don’t just add capital; they time it.

What this means for intraday patterns:

- Shifted liquidity windows: if enough assets allocate overnight, you’ll see stronger-price action and thinner markets during U.S. trading hours. That can magnify late‑night breakouts or early U.S. reversals.

- Volatility decomposition: instead of a single ‘open’ effect around U.S. hours, the market may develop multiple micro‑sessions aligned with ETF rebalancing and settlement cycles.

- Strategy crowding: time‑targeted ETFs may exacerbate scheduled moves (e.g., daily/weekly rebalances), creating recurring intraday patterns that traders can map and exploit.

Combine that with Binance’s execution gravity and you have a market where timing exposure is as important as direction.

A risk framework for traders and allocators ahead of the FOMC

The FOMC is a classic volatility catalyst. Add concentrated ETF flows, exchange concentration, and a recent technical breakout, and you have a complex environment. Here’s a concise, practical risk framework for intermediate traders and allocators.

- Scenario mapping (before you size a position)

- Bull case: breakout holds, volume confirms, ETFs keep adding — plan for a run to $100k–$105k.

- Neutral case: breakout squeaks higher into $94k–$98k and stalls — expect chop and mean reversion opportunities.

- Bear case: false breakout or FOMC shock to risk assets — fast retest to $78k or lower.

- Position sizing and scaling

- Use smaller initial sizes for directional trades ahead of FOMC (e.g., 25–50% of intended allocation) and scale in on confirmation.

- Prefer staggered entries with limit orders to avoid paying flow‑driven slippage.

- Stop logic and mental stops

- Define explicit stop levels tied to technical structure (e.g., below $78k invalidation for longs).

- Use wider stops with reduced size when liquidity is uncertain; use tighter stops only when you can accept execution risk.

- Liquidity and execution rules

- Avoid large market orders on a single exchange if Binance liquidity is thin at the moment; consider splitting orders across venues.

- If you’re an allocator, request VWAP/POV execution strategies to hide trail and avoid moving markets during ETF rebalances.

- Options and hedges

- If you expect a violent FOMC reaction, buy cheap puts for tail protection or sell call spreads to fund hedges. Options are useful when directional conviction is low but tail risk is high.

- Post‑event discipline

- After the FOMC, reassess flows and orderbook health before adding to positions. Be ready to tighten stops or take profits if ETF flows reverse.

Positioning checklist: tactical do’s and don’ts

- Do: Trade around confirmed daily closes and on-volume validation rather than intraday noise.

- Do: Monitor exchange orderbooks and ETF flow prints; adjust execution paths if slippage spikes.

- Don’t: Assume liquidity will be there during scheduled ETF rebalances or FOMC—plan for the opposite.

- Don’t: Over‑leverage on the premise that ETFs will only buy; they can and do sell quickly during risk events.

Scenarios — short playbook

- Conservative long: wait for a weekly close above the breakout and place step‑in buys with stop just below the retracement; take profits into $94k–$105k.

- Tactical swing: enter on a successful retest of the breakout zone, size modestly, use options protection for FOMC days.

- Event short: only consider if daily momentum fails and a close below $78k follows; use tight stops and small size.

Final thoughts

The recent Bitcoin breakout matters — but context is everything. ETF flows (both incumbent mega‑funds and novel time‑targeted products), exchange concentration (with Binance as a liquidity fulcrum), and the FOMC calendar create a higher‑stakes environment for intraday and swing traders. Treat the breakout as a conditional edge: trade it with position sizing discipline, watch the $94k–$105k supply band, respect the $78k invalidation, and account for liquidity risk in execution.

For intermediate traders and allocators, mapping probable flow windows and adding scenario‑based sizing will outperform guessing the next headline. As these dynamics evolve, actionable awareness of ETF mechanics, venue risk, and macro catalysts will separate savvy execution from costly surprises.

Sources

- https://cryptodaily.co.uk/2025/12/its-happening-bitcoin-btc-breaks-8-week-downtrend-resistance-bull-run-back-on

- https://cointelegraph.com/news/bitcoin-price-levels-to-watch-2025-last-fomc-meeting?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- https://coinpaper.com/13001/binance-takes-the-bitcoin-trading-driver-s-seat-among-exchanges-as-btc-eyes-105-k-comeback?utm_source=snapi

- https://cryptoslate.com/crypto-market-adds-150-billion-in-24-hours-what-happened-today/

- https://crypto.news/bitcoin-afterdark-etf-targets-btcs-overnight-edge-skips-u-s-hours/