Ethereum's Rebound: Whale Accumulation Meets On‑Chain Forensics and Custody Risk

Summary

A rebound with a clear technical tone

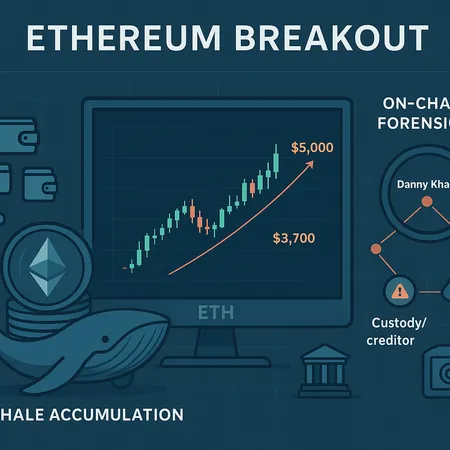

Ethereum’s price recently staged a meaningful breakout, a move that traders have been watching for weeks. Momentum indicators and structure suggest the path higher is plausible: technical analysis published this week points to an initial target around $3,710, a level traders are using as a reference for the next leg up, while other market commentators speculate about extended targets toward $5,000 if momentum and liquidity align (beincrypto analysis). Crypto markets often surprise, but the combination of on-chain flows and traditional technicals has renewed conviction among active traders after a period of range-bound action; market coverage of ETH’s breakout noted an intraday ~7% move that refreshed analyst optimism (CryptoPotato coverage).

This is not mere price euphoria: breakouts need volume and supply friction to sustain. Two forces are currently shaping that balance — whale accumulation and forensic/legal supply risk — and they pull the narrative in different directions.

Whale accumulation: supply concentration and what it implies

On-chain intelligence firms and block explorers report that large wallets have been quietly building positions. Santiment data cited in recent reporting shows a striking figure: whales accumulated approximately 934,240 ETH over a three-week window while smaller holders reduced exposure. That pattern matters because it compresses available free float and can amplify price moves when demand renews (Santiment / reporting via Crypto.News).

Why does whale accumulation matter for traders and on-chain analysts? A few pragmatic implications:

- Reduced effective supply — large addresses sitting on more ETH reduces the volume likely to hit markets for sell pressure, all else equal. That supports higher price targets if demand persists.

- Volatility profile changes — concentration increases the likelihood of outsized single-wallet moves influencing price. A large sell or re-distribution event can create sharp corrections even in a bullish trend.

- Liquidity dynamics — whales often use OTC desks, custody services, or DeFi strategies (staking, lending) to manage risk. That behaviour can mute on-chain sell signals, making on-chain flows less straightforward to interpret.

For many traders, the accumulation narrative is bullish: if liquidity is being locked up or pooled, breakout momentum can get extended. But concentration also increases counterparty and custody exposure, a point that brings us to a more sobering development.

On-chain forensics and the Danny Khan / Genesis / Kroll trace

On-chain transparency is a double-edged sword. It enables analysts to trace funds across wallets and contracts, which is invaluable — but it also exposes the legal and custodial provenance of large holdings. Recent investigative threads by on-chain sleuths tracked a movement of 3,670 ETH linked to Danny Khan amid raids and connections to the Kroll-led tracing into the Genesis/Kroll hack matters. That work illustrates how forensic links can surface and create creditor claims or seizure actions that affect holders and counterparties (ZachXBT tracing / Crypto.News).

Why this should change how traders and hodlers think about risk:

- Legal/creditor risk can be on-chain — funds tied by transactions to stolen or misappropriated assets can be frozen by exchanges, disputed in court, or targeted by recovery agents. Even if tokens are technically yours, claims can complicate selling or transferring them.

- Custodial relationships matter — assets held with third-party custodians (exchanges, lending platforms, or OTC services) may be subject to legal process, insolvency, or recovery claims. Forensic traces like the Danny Khan thread show that custody is not just an operational detail; it’s a legal vector.

- Forensic scrutiny can shift market flows — once a wallet or cluster is flagged, counterparties tend to avoid it. That can create stealth supply constraints or sudden selling when flagged assets are moved to exchanges.

On-chain investigators do important public-good work: they increase transparency and often help restitute funds. But their findings also highlight that a “clean” on-chain balance sheet is not guaranteed to stay clean — provenance matters for institutional counterparties and can affect price discovery.

Reconciling bullish momentum with security and legal tail-risks

Active traders and on-chain analysts need a framework that treats bullish technicals as one axis and custody/forensic risk as another. Here are practical steps that balance opportunity and protection.

Positioning and trade execution

- Size for uncertainty. Even in a clear breakout, cap position sizes so a single adverse event (custody flag, exchange freeze) doesn’t undo portfolio objectives. Use smaller initial positions and scale in as on-chain evidence of legitimate accumulation strengthens.

- Use layered exits. Stagger take-profits rather than all-or-nothing exits at mechanical price targets like $3,710 or higher levels near $5,000. This reduces slippage risk if flagged funds hit liquidity.

- Prefer neutral counterparties for big flows. For large fills, use OTC desks with compliance checks or custody services with clear provenance policies.

Custody and counterparty management

- Diversify custody. Don’t keep all ETH with a single exchange or custodial provider. Use a mix of self-custody (multisig), regulated custodians, and reputable platforms — including tools and services available in the Bitlet.app ecosystem for trade execution — to spread counterparty exposure.

- Prefer provable custody arrangements. Multisig setups, time-locks, and on-chain staking contracts with transparent withdrawal conditions reduce the chance that a unilateral creditor action will fully immobilize your assets.

- Know the provenance. Regularly monitor incoming balances for flagged or suspicious origins. On-chain forensic services and alerts can detect links to compromised funds; if you see a red flag, quarantine the funds and consult legal counsel.

Hedging and liquidity planning

- Hedge tail risk. Options, inverse ETF-like products, or targeted short exposure can offset the impact of a sudden flagged liquidation. Hedging is especially pragmatic when concentration and forensic risk are high.

- Keep liquidity buffers. Maintain a reserve of stablecoins or fiat to meet margin calls or to act when seized liquidity causes market dislocations.

- Monitor open interest and exchange flows. A spike in exchange inflows from large wallets can presage selling; conversely, declining exchange balances paired with whale accumulation supports bullish technicals.

A pragmatic conclusion for traders and analysts

Ethereum's current rebound is real and backed by both technicals and tangible on-chain accumulation. Price targets in the near term — the $3,700 mark highlighted by technical work and the broader speculative band toward $5,000 — are plausible if momentum, liquidity, and macro drivers align. But the story is incomplete without acknowledging the new normal of on-chain forensic scrutiny and the legal/custody vectors it exposes.

For active traders and on-chain analysts, the lesson is simple: treat bullish momentum and custody risk as orthogonal but equally important inputs. A winning trade is not just about catching the breakout; it’s about surviving and managing the idiosyncratic legal and counterparty shocks that accompany concentrated holdings. With layered exits, diversified custody, vigilant forensic monitoring, and prudent hedges, market participants can lean into upside while limiting the downside of legal and seizure risk.

Sources

- https://beincrypto.com/ethereum-price-prediction-3710-one-risk-could-delay-move/

- https://crypto.news/zachxbt-tracks-3670-eth-as-danny-khan-arrest-ties-to-genesis-kroll-hacks/

- https://crypto.news/eth-whales-scoop-934k-tokens-in-3-weeks-while-small-holders-dump-supply/

- https://cryptopotato.com/ethereum-breaks-out-with-7-gain-as-analysts-eye-further-upside/