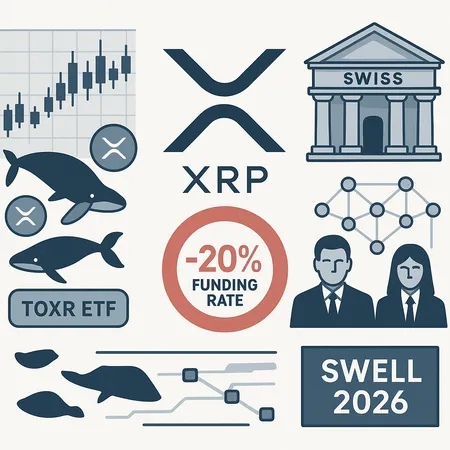

Is XRP Becoming Payments Infrastructure? Whale Moves, -20% Funding Shock, Swiss Banking, and Swell 2026

Summary

Executive overview

In the span of a few weeks XRP has been at the center of four distinct but interlinked stories: sizable on‑chain whale redistributions during the TOXR ETF launch window, an unprecedented negative perpetual funding spike, a Swiss banking partnership enabling real‑world payments, and Ripple’s public commitment to Swell 2026. Seen together, these events force a practical question for institutional investors and compliance officers: is XRP moving from a high‑volatility speculative token into a genuine payments infrastructure asset, or are we witnessing a transitory narrative overlay on top of the same trading dynamics? This article examines each event, explains market mechanics, and offers a disciplined institutional assessment.

Whale reorganizations during the TOXR ETF window — what on‑chain evidence shows

On‑chain analytics firms and market outlets reported that roughly 600 million XRP was redistributed into seven wallets in the immediate TOXR ETF launch window. Coinpaper covered this movement and characterized it as a rapid redistribution among large addresses, signaling a whale reorganization rather than a simple sell‑off. Such behavior can be interpreted several ways: custodial rebalancing across exchanges and OTC counterparties, internal treasury management by a large holder, or a staged distribution to mitigate surveillance flags.

Operational motives are plausible. Large holders preparing for ETF‑era flows often need to split holdings across custody providers to manage counterparty risk, meet KYC/AML expectations, and enable localized settlement. That said, redistribution also increases short‑term liquidity available to the market if those wallets are exchange‑connected. For compliance teams, the key takeaway is not panic but context: wallet fragmentation can be both a sign of institutional onboarding and a precursor to elevated market liquidity and volatility.

Interpreting the -20% perpetual funding‑rate event: short‑term risks and structural implications

A separate but related shock was the extreme negative funding‑rate event: XRP perpetuals briefly saw funding fall to roughly -20%, an anomaly covered in depth by CoinTribune. Practically, a negative funding means shorts are being paid to hold positions; a dramatic plunge to -20% reflects outsized short pressure and funding‑rate arbitrage gone awry.

Why it matters: such spikes indicate stress in the perpetuals market ecosystem. Market makers and leveraged traders adjust positions quickly when funding becomes that punitive, which can trigger forced deleveraging, cascading liquidations, and acute price dislocations. For institutional players this creates several implications:

- Counterparty risk rises as leveraged counterparties may default or withdraw liquidity.

- Hedging costs become unpredictable: basis trades between spot and perpetuals can be expensive to maintain.

- Market signals decouple from on‑chain fundamentals during funding shocks, making short‑term price moves unreliable as indicators of adoption.

A rational institutional approach is to treat funding anomalies as red flags for short‑term execution risk: use conservative leverage, prefer OTC or block trades for large execution, and ensure counterparties have robust margin and settlement practices.

Swiss banking adoption — bridging crypto rails to regulated payments

Perhaps the most concrete step toward payments utility is the reported Swiss banking partnership described by CryptoPotato. The coverage details how Ripple secured a breakthrough in Europe with banking partners that can settle real‑world payments using Ripple technologies and rails. This is significant for three reasons:

- It demonstrates regulated corridors for fiat↔crypto settlement, essential for corporate treasury use cases.

- Bank involvement brings KYC/AML controls and compliance oversight absent in peer‑to‑peer token swaps.

- Local clearing relationships reduce settlement friction and can drive predictable flows rather than speculative trading spurts.

From a compliance perspective, bank partnerships are a necessary, though not sufficient, condition for maturation. Banks introduce monitoring, reporting, and operational discipline; they also demand clarity on custody, sanctions screening, and transaction provenance. If Ripple’s partnerships scale, they lower one of the principal adoption barriers for corporates looking to use XRP as a rails token.

Swell 2026 — a narrative catalyst for institutional confidence

Ripple confirmed the return of its Swell conference in New York for 2026, according to CoinPedia. Swell historically serves as a focal point for product roadmaps, banking partnerships and institutional narratives. Announcing Swell 2026 signals three practical intentions: a diplomatic push to cement banking relationships, showcase product maturity, and create a venue for counterparties to sign binding agreements or pilots.

Narrative events matter in crypto because institutional adoption is as much about relationships and legal comfort as it is about tech. A well‑executed Swell can accelerate due‑diligence cycles, surface new payment pilots, and bring treasury teams into direct contact with custodians and banks. But narrative alone won’t reduce funding volatility or eliminate derivatives risk — it can, however, move institutional sentiment from watchful to engaged when paired with demonstrable production integrations.

Synthesis: payments infrastructure or continued trading volatility?

Bringing the pieces together: the on‑chain whale redistribution suggests operational activity consistent with institutional custody and liquidity management. The Swiss banking adoption shows a pathway to legitimate payments usage. Swell 2026 creates a calendared institutional engagement point. At the same time, the -20% funding event is a reminder that derivatives and speculative flows remain dominant behavioral drivers for price.

A useful framing is to see XRP’s evolution as layered adoption: the bottom layer (payments rails, bank corridors, compliance controls) is beginning to firm up; the top layer (futures, leveraged retail, memecoin capital chasing) still injects high noise. Real maturation requires the bottom layer to absorb more volume so that payments flows become a material share of on‑chain activity and liquidity demand.

Practical guidance for institutional investors and compliance officers

Custody and segregation: insist on institutional custodians that support on‑chain transparency and allow whitelisting and control of outgoing flows. Wallet fragmentation observed around TOXR suggests custodial rebalancing — verify counterparty custody practices.

Execution strategy: avoid market‑on‑exchange fills for very large sizes during periods of funding stress. Use block trades or OTC desks; hedge basis exposure rather than naked spot positions when funding rates are extreme.

Monitoring: set up real‑time alerts for both large on‑chain transfers and funding‑rate anomalies. A -20% funding event is actionable intelligence — pause automated trading or rebalance hedges when funding departs normal ranges.

Compliance controls: validate bank partners’ AML/KYC regimes and demand contractual clarity on sanction screening for cross‑border settlements enabled via Ripple rails.

Time horizon: treat Swell 2026 and bank rollouts as multi‑quarter catalysts. Operational adoption (invoice settlement, treasury operations) often lags partnership announcements by months to years as legal and technical integrations complete.

Bottom line

XRP is moving toward a bifurcated future: plausible and growing utility as a payments conduit underpinned by banking relationships, paired with continued trading volatility driven by derivatives markets. The recent whale redistribution around the TOXR window and the return of Swell strengthen the institutional case; the funding‑rate shock underscores continuing execution risk. Pragmatic institutional adoption will depend on durable payment flows, robust custodial arrangements, rigorous compliance standards, and active risk management against derivatives‑driven price dislocations.

For market participants tracking this transition, treat each data point as part of a mosaic. For many traders, XRP will remain a liquid speculative instrument for some time; for compliance officers and treasury teams, the Swiss banking corridors and future Swell milestones are the real items to watch as potential enablers of payments utility rather than pure price appreciation. Note also how these developments interact with broader DeFi liquidity and cross‑rail settlement dynamics — payments rails don’t exist in isolation.

Bitlet.app users and institutional clients should follow both on‑chain signals and off‑chain integrations before committing capital or product design decisions.