Itaú's 1–3% Bitcoin Allocation: A Practical Playbook for Latin American Wealth Managers

Summary

Executive snapshot

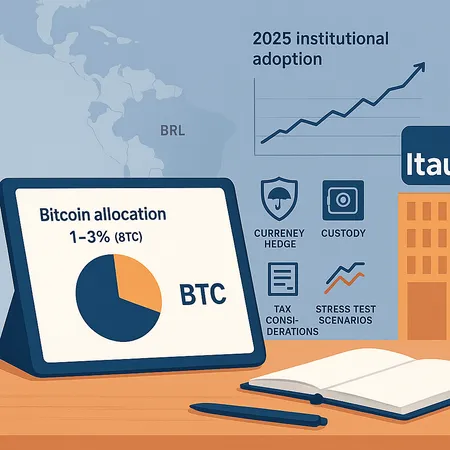

Itaú — Brazil’s largest private bank — has again put a public figure on how much of a portfolio should sit in Bitcoin: 1%–3% as a long-term allocation aimed at diversification, currency hedging and enforcing investment discipline. That guidance is part of a growing institutional comfort with BTC as a strategic exposure, rather than a speculative allocation. For managers in Latin America, where currency risk and inflation are front of mind, Itaú’s view is timely and actionable.

For many investors, Bitcoin now serves two practical roles: a non‑correlated economic hedge in some regimes and an asymmetric return engine for a small slice of the portfolio. Bitlet.app clients and advisers should read this piece as a toolkit: why Itaú recommends 1%–3%, how to build it into local portfolios, tax/custody tradeoffs, and concrete entry/position‑sizing playbooks.

Why Itaú recommends 1%–3%: diversification, currency hedge, discipline

Itaú’s public rationale—covered by industry outlets—centers on three pillars: portfolio diversification, currency hedging and long-term discipline. Their messaging is consistent across summaries and deeper reporting: see the bank’s stance described in Cointelegraph and in local press coverage summarized by Coinpedia and Cryptopolitan.

- Diversification: A small BTC position can improve portfolio metrics (Sharpe ratio, tail-risk profile) because BTC historically shows limited correlation with traditional assets over certain periods.

- Currency hedge: For Chilean, Brazilian or Argentine investors, BTC can act as a partial hedge against local currency depreciation or FX controls in extreme scenarios.

- Discipline: The 1%–3% band enforces a fixed, manageable exposure that prevents emotional trading and large ad‑hoc bets.

Read the coverage of Itaú’s recommendation here: Cointelegraph’s writeup, a regional perspective at Coinpedia, and a concise summary at Cryptopolitan.

How this fits wider institutional adoption in 2025

Throughout 2025, institutional narratives matured: allocations are increasingly framed as strategic tilts rather than tactical bets. High‑profile asset managers and family offices have been experimenting with small, regulated BTC exposures, using custody services and allocating via ETFs or balance‑sheet instruments. Itaú’s public percentage gives advisers a concrete benchmark — it’s not an outlier but rather a formalization of what many allocators have already been testing.

Institutional adoption tends to drive infrastructure improvements (regulated custody, clearer audit trails, better reporting), which reduces implementation friction for retail and wealth managers. The upshot: the 1%–3% number is defensible in client conversations because it mirrors a market‑level trend toward limited, governance‑friendly BTC exposure.

Portfolio construction examples for Latin American investors

Below are practical examples using three risk profiles and three local contexts. All examples express BTC exposure as a percentage of total investable assets.

Conservative client (risk‑averse, preservation focus)

- Base portfolio: 60% local government bonds, 30% global investment grade & US treasuries, 10% equities (local & global).

- BTC allocation: 1% (within the 1%–3% band).

- Rationale: small tail‑risk hedge against local currency shocks while keeping portfolio volatility low.

Balanced client (growth with capital preservation)

- Base portfolio: 45% equities (30% global, 15% local), 35% bonds, 20% alternatives/liquidity.

- BTC allocation: 2% — taken from the alternatives/liquidity sleeve; rebalanced annually.

- Rationale: growth orientation, accepts BTC’s volatility as a long‑term return enhancer.

Aggressive client (high risk tolerance, long horizon)

- Base portfolio: 70% equities, 20% bonds, 10% alternatives.

- BTC allocation: 3% (top of Itaú’s band), funded by reducing small cap equity and alternatives exposure.

- Rationale: long horizon investors who can withstand larger drawdowns may accept slightly higher BTC share.

Local currency and FX layering

Latin American investors must view BTC allocation through the lens of FX exposure. If a client’s liabilities are in USD, a BTC position can be a partial complement to USD cash. Conversely, if liabilities are local currency, BTC offers a hedge only if BTC rallies relative to that currency.

Practical tip: compute two portfolio statements side by side — one in local currency, one in USD — to quantify the hedge benefit. For example, a 2% BTC stake that rises 50% during a local currency devaluation can significantly offset real losses in domestic assets.

Stress scenarios: modeling drawdowns and currency shocks

We recommend stress‑testing any Bitcoin allocation against (a) BTC crash scenarios and (b) local currency devaluation events.

Scenario A — BTC drop 50% in 12 months

- A 2% BTC allocation becomes 1% of the portfolio — net portfolio impact: -1% of total NAV. For most balanced portfolios this is manageable; the long‑term upside remains.

Scenario B — Local currency devalues 30% while BTC rises 50%

- For an investor with foreign‑currency liabilities, BTC’s 50% gain offsets a portion of devaluation, improving real wealth.

Combined scenario — BTC drop 50% and local currency weakens 20%

- This highlights the risk of non‑perfect correlation. The portfolio manager must quantify client tolerance and set rules: e.g., rebalancing thresholds, maximum drawdown limits per client.

Tax and custody considerations (Latin American reality)

Taxation and custodial frameworks vary widely across Latin America. Wealth managers should do local legal and tax due diligence for each jurisdiction.

- Tax: Capital gains tax treatment for BTC can differ (income vs capital gains, taxable at realization vs accrual). In some countries, reporting requirements for crypto transfers are strict. Advisors should coordinate with tax counsel and maintain clean trade records (timestamps, counterparty, receipts).

- Custody: Options fall into three buckets — self‑custody (private keys), institutional custodians (regulated banks/custodians), and exchange custody. Each has tradeoffs:

- Self‑custody: maximum control, operational burden and key‑management risk.

- Institutional custody: higher fees, but better regulatory comfort, insurance and audit trails; suits advisory clients and fiduciaries.

- Exchange custody: convenient for trading, mixed custodial risk; use only regulated and reputable platforms.

Given evolving compliance expectations, many advisers will prefer institutional custodial arrangements for client assets. The infrastructure maturation noted in 2025 reduces custody friction, but advisers still need to document client consent and governance for crypto exposures.

Practical entry and position‑sizing strategies

Itaú’s 1%–3% band is a target, not an execution plan. Below are implementable strategies tailored for retail clients and advisory relationships.

- Dollar‑Cost Averaging (DCA): Split the planned allocation over 3–12 months to mitigate timing risk. For volatile BTC, this smooths entry price.

- Lump‑sum with volatility budget: If a client prefers quicker entry, cap the BTC allocation to the lower band (1%) and increase only after volatility subsides or after disciplined rebalancing signals.

- Rebalance‑to‑target: Use calendar rebalancing (quarterly/annual) or threshold rebalancing (e.g., rebalance when BTC moves ±25% from target weight). This enforces sell discipline on rallies and buy discipline on dips.

- Tranching linked to macro triggers: For clients sensitive to FX, tranche purchases during windows of local currency weakness to amplify hedging benefits. Only do this with clear rules and documented risk limits.

- Hedged access for conservative clients: Use capped structured products or short‑dated derivatives to simulate exposure with defined downside. This is advanced and requires suitable counterparties and compliance checks.

Risk controls to set with clients: maximum drawdown tolerance, minimum time horizon (commonly 3–5 years for BTC allocations), and explicit consent for custody method.

Implementation checklist for wealth managers

- Document investment thesis and client suitability tied to Itaú’s 1%–3% guideline.

- Run scenario analysis in local currency and in USD to evaluate FX benefits.

- Choose custody model and perform KYC/AML checks on counterparties.

- Establish execution plan: DCA schedule or lump sum; set rebalancing thresholds.

- Align tax reporting process with local counsel; maintain detailed records.

- Generate a client brief that explains tail risks, expected volatility, and the rationale for the chosen percentage.

Final considerations and takeaways

Itaú’s public 1%–3% allocation acts as a pragmatic benchmark for wealth managers: it neither crowns Bitcoin as a central portfolio pillar nor dismisses it as speculative noise. For Latin American clients, the currency‑hedge angle is especially meaningful, but it must be quantified and not assumed. Use Itaú’s range as an input to a disciplined process: suitability assessment, custody decision, tax planning and clearly documented execution.

Institutional adoption in 2025 has made implementation cleaner — better custodians, clearer products and mainstream reporting standards. That does not eliminate risk, but it lowers operational barriers for advisers who want to offer controlled BTC exposure.

If you manage client portfolios in the region, start by modeling a 1% allocation and run the stress scenarios outlined here; then iterate toward 2–3% only when the client’s horizon, liquidity and risk tolerance justify it.

Sources

- Itaú’s recommendation summary: Cointelegraph coverage — https://cointelegraph.com/news/itau-asset-recommends-3-percent-bitcoin-allocation-2026?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- Regional perspective: Coinpedia summary — https://coinpedia.org/news/brazils-largest-bank-itau-backs-bitcoin-as-long-term-portfolio-hedge/

- Concise coverage of the 1%–3% band: Cryptopolitan — https://www.cryptopolitan.com/itau-calls-for-1-3-bitcoin-positioning/