What the U.S. Strategic Bitcoin Reserve Means for Future Cryptocurrency Investments

As the cryptocurrency landscape continues to evolve, recent developments have placed the spotlight on the U.S. Strategic Bitcoin Reserve (USB). This initiative aims to bolster national financial security by enabling the country to hold and manage a significant amount of Bitcoin. But what does this mean for future cryptocurrency investments?

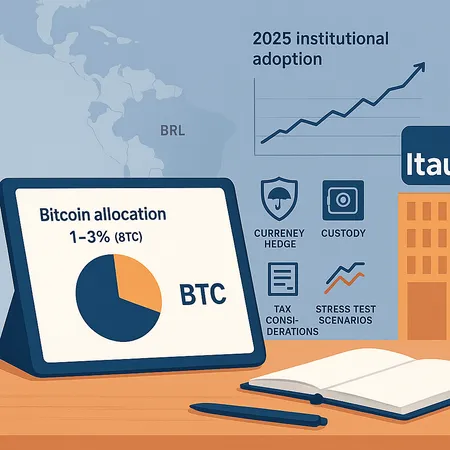

Increased Legitimacy: The establishment of a strategic reserve signifies a growing acceptance of Bitcoin as a valuable asset, enhancing its legitimacy. This can lead to more institutional investment and mainstream adoption, which may drive prices higher.

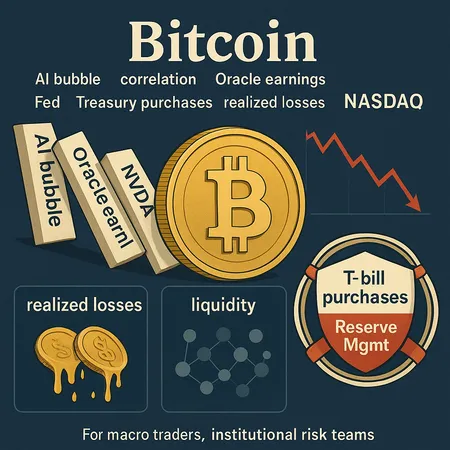

Market Stability: The reserve can act as a stabilizing force in times of market volatility. By holding Bitcoin, the U.S. could potentially intervene in the market to mitigate extreme fluctuations that affect investors and the economy at large.

Innovative Investment Opportunities: With the introduction of such a reserve, investors and crypto enthusiasts may find new ways to engage with Bitcoin and other cryptocurrencies. For instance, platforms like Bitlet.app are revolutionizing how individuals can invest by offering a Crypto Installment service. This feature enables users to buy cryptocurrencies now and pay in monthly installments, making it more accessible for everyday investors.

Global Influence: The U.S. holds a prominent position in the global arena. By implementing a strategic Bitcoin reserve, the country may influence global cryptocurrency regulations and norms, positioning itself as a leader in digital currency governance.

Long-Term Growth Prospects: As the reserve grows, it may attract more innovation in the cryptocurrency space. Companies and developers could create new products and services that respond to increased governmental interest and support in the crypto sector.

In conclusion, the U.S. Strategic Bitcoin Reserve is a game-changer for the cryptocurrency market. It lays a foundation for increased legitimacy, potential market stability, and innovative investment options, like those offered by Bitlet.app. As we move forward, it's essential for investors to stay informed and consider how these developments might impact their cryptocurrency strategies.