Navigating Crypto Regulations in 2025: What DOJ Investigations Mean for Investors and How Bitlet.app Can Help

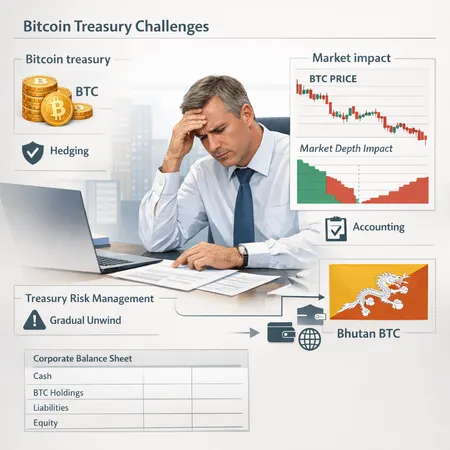

As 2025 unfolds, cryptocurrency investors face growing challenges due to intensified investigations by the U.S. Department of Justice (DOJ) targeting the crypto space. These investigations aim to clamp down on fraudulent activities and enforce stricter compliance, which can affect trading, holding, and investing strategies.

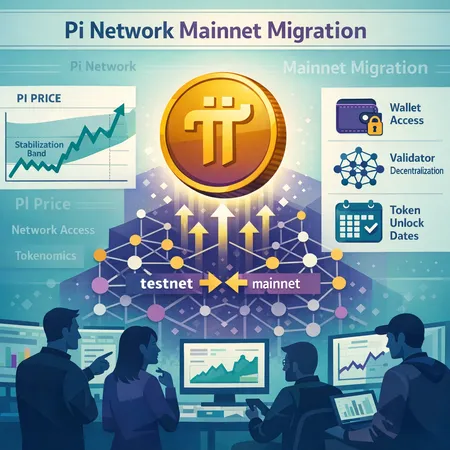

For investors, understanding these regulatory changes is crucial. Heightened scrutiny means that platforms and transactions are under closer examination, which could impact liquidity and asset accessibility. Navigating this evolving environment requires not just awareness but also strategic tools that provide flexibility and security.

This is where Bitlet.app steps in as a valuable resource. Bitlet.app offers an innovative Crypto Installment service that allows investors to purchase cryptocurrencies now and pay over time through manageable monthly installments. This service helps mitigate risk by spreading out investment costs rather than committing a large sum upfront—a particularly advantageous feature in uncertain regulatory climates.

Moreover, Bitlet.app prioritizes compliance and security, ensuring that users can trade and invest confidently amid regulatory changes. For anyone looking to manage crypto investments effectively in 2025, leveraging Bitlet.app's offerings can make a meaningful difference.

In conclusion, as the DOJ continues its efforts to regulate cryptocurrency markets in 2025, investors must stay informed and choose platforms that offer both security and flexibility. Bitlet.app's Crypto Installment service is a practical solution to help navigate these challenges and maintain steady investment growth despite regulatory pressures.