India’s Rupee‑Pegged 'Arc': Architecture, Market Impact, and the Global Patchwork of Regulated Tokens

Summary

Executive summary and why Arc matters

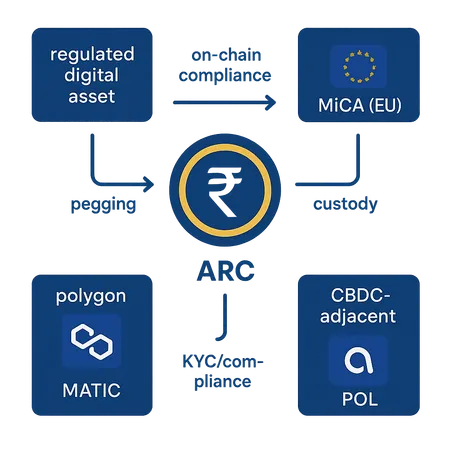

India’s announcement of a rupee‑pegged Arc token — developed with Polygon and Anq — is the clearest signal yet that major economies will prefer regulated digital assets built on permissive, scalable, and compliance‑aware rails rather than purely permissionless experiments. The model sits somewhere between a stablecoin and a CBDC: CBDC‑adjacent in intent (public money characteristics and government endorsement) but implemented as a token on public‑chain infrastructure that still allows regulated intermediaries to operate. This paper maps practical architecture choices (pegging, custody, KYC/compliance), explains why Polygon is a pragmatic choice, analyses implications for token economies such as MATIC and related partner chains (including potential effects on POL), and situates Arc in the emerging landscape alongside MiCA‑style initiatives in the EU and other regulated token projects like PI.

The announcement in context

In late 2025 India disclosed plans for Arc, a rupee‑backed token built with Polygon and Anq and targeted for an early 2026 rollout. The published reports emphasize a rupee‑pegged token issued with regulated custodianship and enterprise‑grade compliance tooling. See the core announcement and technical framing in the original coverage here.

Why this matters: India is one of the largest crypto markets by users and transactional volume. A government‑aligned, regulated token will change on‑ramp dynamics, settlement rails for crypto businesses, and how Indian banks engage with tokenized fiat. It will also influence how projects approach on‑chain compliance and AML/CTF controls at scale.

Architecture choices for a rupee‑pegged token

Designing a regulated token like Arc requires selecting tradeoffs across several dimensions: pegging model, reserve custody, mint/burn authorities, and how identity and compliance are enforced on‑chain.

Pegging models: full‑reserve, algorithmic, hybrid

- Full‑reserve custodial model: Each Arc token is backed 1:1 by rupee deposits or sovereign debt held in regulated custodians. This is the simplest regulatory narrative — easier for banking partners and auditors — but it centralizes risk with custodians.

- Algorithmic or seigniorage hybrid: Uses market mechanisms and on‑chain collateral (crypto or tokenized government securities) to maintain the peg. Less likely for Arc because regulators typically prefer explicit, auditable backing for national‑adjacent assets.

- Insurance + stabilization buffer: Even in a full‑reserve model, a small Treasury buffer (short‑dated government securities, guarantees) can smooth redemption frictions; these designs are common in high‑trust regimes.

Given the political and regulatory profile in India, a custodial, full‑reserve approach with strong auditability is the expected baseline.

Custody and reserve proofs

Custody options include bank‑held fiat, trust‑account models, and tokenized proof‑of‑reserve constructs. Arc will likely rely on licensed banks or regulated custodians for fiat deposits, with periodic third‑party attestations or cryptographic proofing to provide transparency while preserving depositor protections.

- Bank custody: aligns with banking law and deposit protections; auditors and supervisors can inspect reserves under existing frameworks.

- Tokenized reserves: cryptographic proofs on‑chain (Merkle‑tree accounting, attestations) can increase transparency for market participants while still meeting regulator requirements.

Operationally, combining traditional custody with on‑chain attestations allows regulators to assert control while enabling market participants to perform real‑time reconciliation.

Minting rights, permissioning, and KYC/compliance

A regulated token needs controlled issuance and redemptions. Typical models:

- Permissioned minters: licensed entities (banks, regulated exchanges) hold the cryptographic keys to mint/burn; mint events are logged on‑chain for audit.

- Redemption circuits via regulated intermediaries: custodians and licensing frameworks ensure AML/KYC.

- On‑chain compliance hooks: smart contract layers that enforce transfer restrictions or require attestation tokens for certain flows, enabling on‑chain compliance without exposing full identities.

Practically, Arc must implement a layered identity model: off‑chain KYC anchors (KYC providers, bank attestations) linked to on‑chain compliance tokens or credentials that gate ability to transact above thresholds. This approach balances privacy with enforceability.

Why Polygon (and Anq) was chosen

Several pragmatic factors make Polygon an attractive base for a regulated rupee‑pegged token.

- EVM compatibility and developer ecosystem: Polygon’s EVM layer reduces integration friction for wallets, exchanges, and enterprise developers already familiar with Ethereum tooling. That lowers go‑to‑market time for regulated participants.

- Scalability and cost: Polygon’s throughput and L2/sidechain variants help keep transaction costs low for retail payments and microtransactions — a crucial factor in India where low‑value, high‑frequency payments dominate.

- Modular architecture and partner stack: Polygon’s product family and its openness to permissioned deployments (plus Anq’s enterprise tooling) let architects combine public‑chain settlement with permissioned middleware for compliance.

- Governance and enterprise partnerships: Polygon’s active partnerships and emphasis on institutional use cases make it politically palatable as a bridge between public tech and regulated actors.

The choice favors an ecosystem approach rather than locking Arc to a bespoke permissioned chain. For MATIC holders, greater on‑chain activity tied to a national token can translate into higher demand for Polygon’s security and transaction layers. Meanwhile, partner chains and compliance‑focused networks (frequently represented by tokens like POL) could see increased enterprise adoption for private rails and interchain settlement.

Implications for MATIC, POL and the broader token ecology

Arc’s launch will have multi‑vector effects:

- Demand for MATIC: Increased transaction volume, bridge activity, and developer deployments on Polygon can drive utility and fee capture for MATIC. If Arc uses Polygon’s mainnets or L2s for settlement, the network fee model benefits native validators and stakers.

- Revenue and staking flows: Custodians and validators operating nodes for Arc settlement may capture staking rewards or fee revenue; institutional node operators will need to align compliance requirements with validator economics.

- Partner chains and POL‑like networks: Permissioned or compliance‑first chains (represented here conceptually by POL) could become preferred options for bank‑to‑bank settlement layers, enterprise message queues, or private reconciliation rails. Expect multi‑chain architectures where Arc tokens live on interoperable ledgers and bridges enforce policy.

Token markets will price several new vectors of risk and utility — regulatory drag, central‑bank relationships, and real‑world settlement demand — so projects should avoid simplistic assumptions that Arc will be purely additive to all token valuations.

Expected market structure in India after Arc launches

Arc will not replace cash or banks overnight; instead it will layer on top of existing financial infrastructure and create a segmented market.

- Licensed on‑ramps and custodians: Banks and regulated custodians will dominate mint/redemption services; fintechs will compete on UX and integration.

- Regulated trading venues: RBI‑approved or legally compliant exchanges will list Arc pairs with strict KYC and transaction monitoring. Peer‑to‑peer activity will likely be restricted or surveilled.

- Enterprise rails and permissioned interoperability: Corporates and banks may use permissioned Polygon deployments or partner chains for high‑value settlement, while retail flows run on public L2s for cost efficiency.

- Secondary markets and international flows: Cross‑border use of Arc may emerge for trade finance and remittances, subject to capital control frameworks and foreign exchange rules.

Operationally, expect a multi‑layered ecosystem: retail wallets and payments apps, regulated custodians and exchanges, and private interbank settlement systems — each with distinct technical interfaces and compliance responsibilities. Platforms like Bitlet.app will need to ensure their KYC and custody integrations support these layers if they want to handle Arc flows legally and effectively.

How Arc fits into a global patchwork: MiCA, PI, and regulatory diversity

Arc is part of a broader shift toward regionally governed, regulated digital assets rather than a single global stablecoin standard. The EU’s MiCA framework and projects moving toward MiCA compliance provide a contrasting model: regulation‑first, harmonized across member states. For instance, projects like Pi are positioning with MiCA‑compliant white papers to make public trading and listing in the EU feasible; see reporting on Pi’s MiCA filings for comparison here.

Key contrasts:

- Scope: Arc is national and rupee‑centric; MiCA targets a harmonized regulatory baseline across multiple jurisdictions.

- Custody and oversight: MiCA imposes detailed market conduct rules for issuers and custodians; Arc’s national implementation can be stricter or more bespoke depending on domestic priorities.

- Interoperability: Expect technical bridges and compliance adapters between MiCA‑aligned tokens and national assets like Arc, but those bridges will embed regulatory policy checks.

Finally, market shaping by major stablecoin issuers and infrastructure players (for example, strategic investments into lending platforms that enlarge on‑ramps) affects liquidity and institutional appetite. Recent industry moves — such as Tether’s strategic investments into lending platforms — illustrate how stablecoin players and custodial lenders reshape lending and on‑ramp landscapes; a useful example of this dynamic is Tether’s investment in Ledn reported in CrowdfundInsider here.

Practical recommendations for regulators, project leads, and compliance teams

- Prioritize auditability and clear custody legal frameworks: Full‑reserve custody with frequent attestations reduces systemic risk and accelerates institutional adoption.

- Design layered compliance: Use off‑chain KYC anchors with on‑chain compliance tokens so that transactions can be monitored without broadcasting identities.

- Build bridges cautiously: Technical interoperability with MiCA‑compliant tokens or other national assets should include policy enforcement layers (transfer restrictions, sanctions screening) at bridging points.

- Prepare operations for multi‑rail settlement: Expect banks to prefer permissioned private lanes for large value transfers and public L2s for retail; design systems that reconcile across both.

- Engage in market education: Institutions and regulators should publish clear operational manuals for custody, incident response, and cross‑border settlement rules.

Conclusion: a pragmatic, multi‑jurisdictional future

India’s Arc shows that regulated digital assets will be a patchwork of national and regional solutions rather than a single global token. The technical choice of Polygon and partner tooling like Anq reflects a pragmatic desire to combine EVM compatibility, scalability, and compliance‑friendly middleware. For MATIC and related ecosystems, Arc could mean material increases in activity, but gains will be uneven across chains and constrained by legal frameworks. As MiCA and other regimes (and projects like PI) evolve, interoperability and policy adapters will be the real battlegrounds for liquidity.

Regulators and institutions now must shift from abstract debates about crypto ideology to detailed operational frameworks: custody law, bridge governance, and layered KYC that preserve privacy while enabling enforcement. Market participants — exchanges, custodians, and platforms such as Bitlet.app — should begin readiness programs now: integration testing, compliance playbooks, and liquidity planning. The next phase of tokenized fiat will be technical, legal, and highly local — but interoperable only where the policy glue allows it.