Analysis

Standard Chartered’s call that Ethereum could fall roughly 30% before rebounding has reignited debate about short-term pain versus structural upside. This article breaks down the bank’s thesis, exchange-holdings trends, Vitalik’s FOCIL proposal and actionable trading/positioning strategies across time horizons.

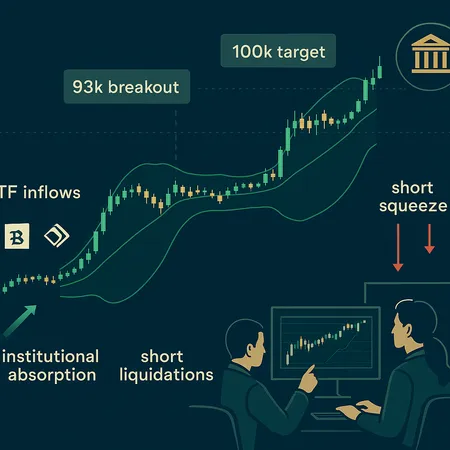

Bitcoin’s move above $93K has reignited breakout narratives, but whether this is the start of a sustained run to $100K+ depends on institutional absorption, short squeezes, and macro tailwinds. Traders should monitor ETF flows, derivatives positioning, Bollinger-band momentum, and key support/resistance levels to size risk.

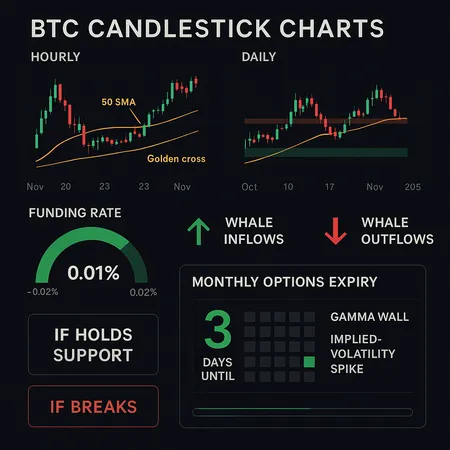

Bitcoin’s late-November consolidation has many calling a bottom — but the signal set is mixed. This guide breaks down technical structure, on‑chain flows, funding and the looming monthly options expiry, then gives scenario-based trade and monitoring checklists for the next 30–90 days.

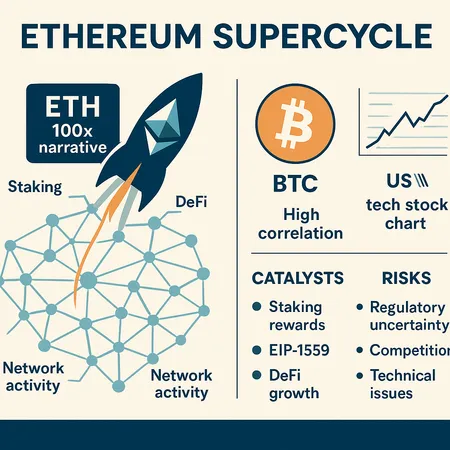

Tom Lee and others argue Ether (ETH) may be entering a Bitcoin-like supercycle; this article assesses that bullish case against evolving BTC correlation to US tech, macro flows, and network fundamentals. We provide a checklist of catalysts and risks for long-term investors deciding whether to rotate into ETH.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility