Can Ether Launch a 'Supercycle'? Weighing Tom Lee's Thesis Against BTC's Structural Shift

Summary

Introduction: What people mean by an ‘Ether supercycle’ and why it matters

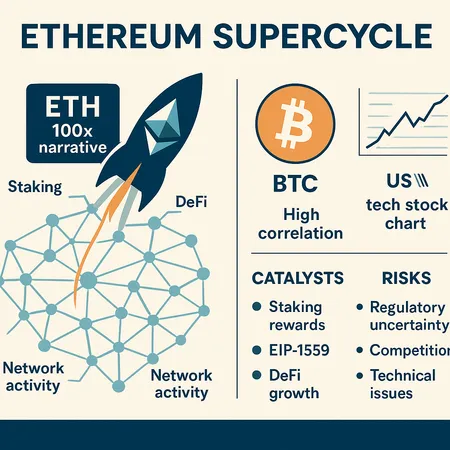

When commentators — most notably Tom Lee via BitMine coverage — say Ether may be entering a “supercycle,” they mean a prolonged, multi-year period of price appreciation driven by structural changes: network upgrades, product-led demand (DeFi, L2s, NFTs), and large-scale capital rotation from BTC and traditional markets into ETH. That narrative promises returns that far outpace a typical bull run, sometimes implying 10x–100x moves in altcoin cycles off a new narrative wave.

This thought experiment matters because allocation decisions at institutional and HNW levels can amplify moves. A sustained rotation into ETH would change portfolio construction, custody needs, and product development across crypto. But bullish headlines deserve a sober interrogation: does the macro, ETF flows, and fundamentals actually add up to a durable supercycle? Or is this a marketing-friendly rebranding of a standard altcoin rally?

The bullish case: why proponents believe ETH can run much higher

Proponents point to several interlocking arguments:

Network transformation: The Merge and subsequent roadmap items (MEV mitigation, sharding on the horizon) are framed as a supply-side shock and improved utility for ETH. Lower issuance and the burn mechanism during high activity periods can create disinflationary or deflationary pressure on supply.

Product adoption: Layer-2s, DeFi composability, and programmable money use cases concentrate activity (and fees) on Ethereum. As demand for blockspace increases, so does the argument that ETH becomes a scarce utility token.

Narrative and rotation: After multiple BTC cycles, narrative leadership can shift. Tom Lee’s argument — covered in Cointelegraph and expanded in other outlets — posits that ETH is now entering a structural phase similar to BTC’s earlier supercycle, driven by broader investor recognition of ETH as a major financial infrastructure asset (Tom Lee's claim).

Allocation mechanics: If institutions adopt ETH exposure (via ETFs or custody), inflows could be large and persistent. Report coverage amplifying this view appears in several pieces that interpret BitMine/Tom Lee coverage as a signal ETH may be beginning Bitcoin-2017-style growth (CryptoNews coverage).

Those points combine technical, product, and capital flow narratives—plausible in isolation. Together they paint the supercycle picture: sustained demand, constrained supply, and broad allocational re-rating.

The other side: Bitcoin’s correlation shift and why it complicates the thesis

A less-discussed complication is Bitcoin’s evolving market role. Recent analysis shows BTC’s correlation to “risk-on” US tech equities has increased, while correlations to gold or macro-hedge narratives have weakened analysis here. That trend matters for two reasons:

Market beta behavior: If BTC behaves more like a technology risk asset than a store-of-value, capital flows into crypto become more sensitive to macro liquidity and equities cycles. In such regimes, altcoin rallies are often either amplified (during risk-on) or crushed (during risk-off) depending on global risk appetite.

Structural liquidity: BTC remains the deepest crypto market; it often leads sentiment and provides the liquidity rails that altcoins rely on to rally. Even if ETH has a superior utility narrative, ETH’s price dynamics are still tethered, at least partially, to BTC movement and cross-market risk trends.

So the question isn’t only whether ETH fundamentals are improving; it’s also whether macro and BTC-led market structure supports an independent supercycle for ETH. The data suggest crypto capital frequently moves as blocks—if BTC corrects or decouples into tech-like swings, ETH’s prospective supercycle is more conditional and episodic than independent.

Fundamentals: on-chain supply/demand, L2s, and composability

Evaluating a supercycle demands looking beyond narrative to raw on-chain mechanics:

Issuance & burn: Since the Merge, ETH issuance dropped materially, and EIP-1559 burning can remove ETH during high activity. This makes ETH’s monetary policy more elastic to usage—higher usage burns more ETH. Over time, that could create disinflationary pressure.

Demand drivers: DeFi TVL, stablecoin minting, and L2 rollup activity are the clearest demand proxies. Growth in these areas boosts on-chain fees and, therefore, the burn rate. But L2s also capture some demand: successful rollups may lock-up value in their token economies or reduce fees on mainnet, altering how burns scale.

Composability & developer network: Ethereum’s developer density and DeFi composability remain competitive moats. That said, alternative chains and L2-native ecosystems are eating into activity; a true supercycle implies Ethereum retains or expands that developer lead.

Liquidity & custody: Institutions want custody solutions, liquid derivatives, and transparent ETFs/ETNs. Without reliable institutional-grade products, sustained inflows are unlikely.

Fundamentals are supportive but not decisive: they create a necessary but insufficient condition for a supercycle.

Macro and ETF flows: can they deliver persistent capital?

One of the hinges of the supercycle thesis is institutional flow mechanics. ETFs can transform demand dynamics by creating predictable, productized flows. But several caveats apply:

ETF timing and product design: Were ETH ETFs to arrive, their size, fee structure, and eligibility rules will matter. Spot BTC ETFs drove sizeable inflows because of demand from allocators seeking regulated, simple exposure. ETH would need comparable UX to attract the same class of buyers.

Correlated liquidation risk: In a risk-off macro downturn, institutional managers may liquidate crypto holdings en masse. That dynamic risks turning a calm rotation into a flash unwind across both BTC and ETH.

Cross-asset flows: If crypto money flows are dominated by macro-driven rotations (e.g., retail chasing yields or institutions shifting from tech equities to crypto), ETH’s performance will remain correlated to broader capital trends.

In short, ETFs can be a catalyst but are not a guarantee. Persistent, large inflows require both product availability and a stable macro environment.

Putting it together: is a sustained ETH supercycle plausible?

Short answer: plausible but conditional. Longer answer: a sustained ETH supercycle requires multiple independent gears to turn simultaneously. Specifically:

- Continued on-chain adoption that increases fee burns and real, sticky demand for ETH as a utility token.

- Institutional products (custody, ETFs) that convert passive allocators into steady buyers rather than short-term momentum players.

- A macro backdrop that favors risk assets or at least provides liquidity rather than forced deleveraging.

- Relative market leadership: ETH must maintain developer and product advantage over rival L1s and L2 ecosystems.

If one or two of these are missing, ETH may still generate large rallies, but the “supercycle” label — implying a durable regime change — would be overstated.

Checklist: Catalysts that would support an ETH supercycle

- Sustained TVL and active user growth on Ethereum L1 and dominant L2s.

- Measurable deflationary supply dynamics (net burn > issuance) over long windows.

- Launch and adoption of spot ETH ETFs or similar institutional on-ramps with sizable AUM.

- Continued developer supremacy and major DeFi protocols retaining market share vs rivals.

- A benign macro regime (low rates/liquidity) or renewed liquidity injections supporting risk-on portfolios.

- Clear regulatory clarity (or at least stable policy) that reduces institutional friction.

Checklist: Key risks that could derail the thesis

- Renewed macro risk-off that forces liquidation of risk assets, compressing flows into BTC and ETH alike.

- BTC-led contagion: as long as BTC is the liquidity backbone, sharp BTC corrections can crush altcoin rallies.

- Competitive erosion: L1/L2 rivals taking developer mindshare and liquidity away from Ethereum.

- ETF disappointment: product delays, low adoption, or flow concentration that fails to produce sticky demand.

- Technical/regulatory shocks: major smart contract exploits, persistent congestion, or adverse regulation targeting staking, custody, or DeFi.

Practical takeaway for long-term allocators

Treat the Ether supercycle thesis as a conditional hypothesis, not a fait accompli. Monitor measurable indicators (burn rates, L2 activity, custody inflows, ETF filings) and macro liquidity. For many traders, Bitcoin still sets market tone, while ecosystems around DeFi will determine whether ETH’s utility story converts into persistent demand. Use position sizing to reflect outcome uncertainty: a thesis that requires multiple positive catalysts deserves a smaller, conviction-weighted tranche rather than concentrated allocation.

Platforms and analytics tools — including what you might use on Bitlet.app for tracking flow signals and staking dynamics — can help turn these signals into timely portfolio moves.

Conclusion

Tom Lee’s ‘Ether supercycle’ thesis is compelling as a narrative: reduced issuance, burning mechanics, and exploding DeFi/L2 activity create a believable supply-demand setup. Yet market structure matters. BTC’s correlation to US tech and the deeper liquidity profile of Bitcoin make any altcoin supercycle conditional on macro and cross-asset dynamics. Long-term investors should treat the idea as plausible but fragile: watch the catalysts and risks in the checklists above, track on-chain and institutional flow metrics, and size exposure to ETH with those contingencies in mind.

Further reading: Tom Lee’s commentary on the topic can be found in recent coverage of his thesis and analysis by market outlets, including this Cointelegraph piece and related CryptoNews reporting. For the correlation shift affecting BTC, see the in-depth analysis linked earlier.