Capitalizing on Bitcoin's $75,000 Surge Amid Political Events Using Bitlet.app

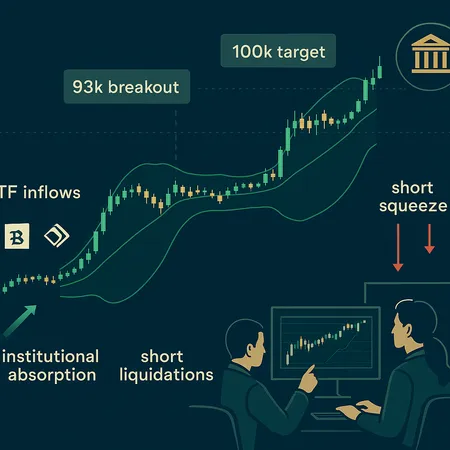

The cryptocurrency market has witnessed an extraordinary surge recently, with Bitcoin hitting the $75,000 mark amidst dynamic political events worldwide. Such price movements often create exciting opportunities for both seasoned and new investors looking to capitalize on this momentum.

However, the challenge many face is the hefty upfront cost involved in buying Bitcoin outright. Recognizing this barrier, Bitlet.app steps in with an innovative solution: a Crypto Installment service. This feature allows prospective buyers to purchase Bitcoin immediately and pay for it in manageable monthly installments instead of a lump sum.

This approach not only reduces financial strain but also enables investors to take full advantage of current price surges without delay. By utilizing Bitlet.app's Crypto Installment service, users can strategically position themselves in the market during significant events that influence Bitcoin's price.

Moreover, Bitlet.app offers a secure and user-friendly platform, making the process of purchasing and managing crypto assets hassle-free. As the political landscape continues to impact Bitcoin's valuation, leveraging tools like Bitlet.app can be a smart move to maximize returns while maintaining financial flexibility.

In conclusion, capitalizing on Bitcoin’s impressive $75,000 surge is now more accessible than ever with Bitlet.app’s installment payment system, paving the way for broader participation in the crypto revolution.