Bitcoin Tug-of-War: $70k Breakdown vs. $90k+ Political Rally — What Traders Should Do

Summary

Introduction: a classic tug-of-war

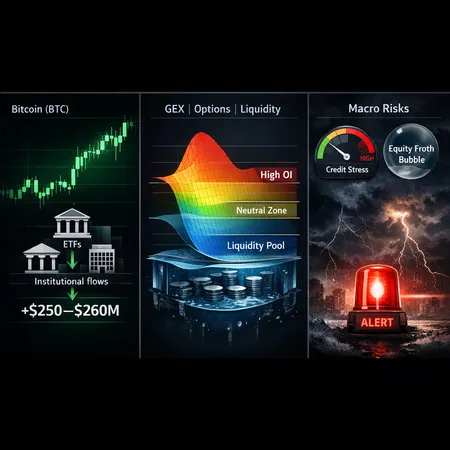

The past few days have reinforced that Bitcoin is trading less like a single narrative and more like a negotiation between competing forces. On one side, technical studies and weakening ETF flows suggest a path lower toward $70,000. On the other, political escalation tied to the Powell probe and on-chain signs of whale accumulation have triggered rallies above $92,000, complicating the decision to rotate into or out of BTC.

For many traders the key question is simple: which signal will dominate? This piece breaks down the most credible inputs — technicals, ETF flows, on-chain behavior, and macro/political risk premia — and then translates them into concrete watchlists and trade rules. For context, Bitcoin remains the main price engine, but narratives from DeFi, options markets and risk-premia tokens like PREMIA also matter as hedging and sentiment gauges. Bitlet.app users will find the levels below useful for sizing recurring buys or hedges.

Where price stands and why the headlines matter

Late rallies above $92k grabbed attention. Coverage tied the move to legal escalation around Federal Reserve Chair Jerome Powell — headlines that lift risk premia and push some capital back into BTC as an alternative or hedge NewsBTC. Still, the bounce proved fragile: gains faded and prices slipped back below $91,000 in fast intraday reversals, a sign that headline-driven spikes can be short-lived CoinDesk.

Separately, analysis linking the Powell probe to elevated risk premia helps explain why politically-driven headlines can move crypto more than usual — investors are repricing systemic policy uncertainty alongside macro risk Cointelegraph.

Why that matters for traders

Political news can create short, sharp squeezes that look like structural breakouts but often lack the follow-through of organic demand (e.g., inflows from institutions). If you are trading the move, distinguish between a headline-driven spike and a demand-driven trend. The former can be faded; the latter should be respected.

Technicals warning: the case for $70k

A cluster of technical studies flagged recently suggests a risk of a deeper correction. Some analysts highlight triple-bearish technical signals (momentum divergence, pattern failure, and break of key moving averages) that imply downside room toward ~$70k if support levels give way CryptoPotato.

Key technical points traders should monitor:

- Weekly closes matter more than intraday spikes. A failure to reclaim and hold a weekly close above $88,500 is bearish; conversely, a sustained weekly close above that level reduces the odds of a 70k retest (more on this below).

- Momentum divergence. If RSI and MACD continue to roll over while price chops higher on headlines, the setup is classic for a sharper reversion when flows dry up.

- Pattern risk. Broken support zones often act as catalysts for accelerated selling — especially when ETF outflows remove a natural buyer.

Technicals don't operate in a vacuum: layering in flows and on-chain metrics improves the signal-to-noise ratio.

ETF outflows: $681M is not trivial

Weekly US spot-BTC ETF outflows of approximately $681 million are material and cannot be ignored; sustained redemptions reduce the steady bid that had been underpinning recent rallies Crypto.News. When institutional-sized vehicles are pulling funds, headline-driven retail or short-term flows have to be larger to offset the deficit.

Implications:

- Even a modest continuation of outflows increases probability that technicals will assert themselves and produce a deeper pullback.

- Outflows amplify the impact of large sell orders (miners or whales) because fewer passive buyers are standing by.

On-chain: whales, mining difficulty and the $88,500 trigger

On-chain data paints a less one-sided picture. Several reports note renewed whale accumulation and large wallets reshuffling positions — activity that can provide surprisingly resilient support around pivotal levels Coinpaper.

Why the $88,500 weekly close is repeatedly referenced:

- It acts as a psychological anchor and a technical pivot. A confirmed weekly close above it attracts algorithmic buyers and reduces stop-run vulnerability.

- Whales have been active around that band; their behavior often determines whether bounces stick.

Mining difficulty dynamics add another dimension. When difficulty rises, miner selling pressure often increases as miners need to monetize to cover higher costs and capital expenditures. Conversely, difficulty drops can relieve miner pressure and support price if selling subsides. Watch how difficulty, miner flows, and large wallet movements synchronize — a confluence of whale accumulation and falling miner sell pressure can negate weak ETF flows.

The Powell probe and risk premia: a wildcard

Political headlines around a Powell probe have increased perceived policy risk, effectively raising a risk premia on risky assets including BTC. Analysts note that this probe is priced as a component of uncertainty that can inflate asset class volatility and, in some cases, divert capital into perceived hedges or alternative stores of value Cointelegraph.

Two important consequences:

- Short-term rallies can be triggered by escalating headlines even if the underlying flow picture (ETF redemptions) is weak. We saw this with the spike above $92k linked to Powell-focused headlines NewsBTC.

- If the probe meaningfully raises uncertainty, risk premia on BTC could stay elevated, supporting higher realized volatility and creating opportunities for option sellers and volatility strategies (PREMIA-style protocols and options markets become more relevant as hedges or speculation).

Two scenarios that matter to traders

Below are balanced scenarios with triggers and tactical guidance.

Bearish base case — Breakdown toward $70k

Triggers:

- Weekly close below $88,500.

- Continued spot-BTC ETF outflows at or above current weekly cadence (~$681M).

- Technical pattern failure: momentum divergence + break of major moving averages.

What happens:

- Reduced institutional bid accelerates selling. Whales may opportunistically distribute into weak hands, and miners could sell into liquidity vacuums if difficulty rises.

Tactics:

- Trim long exposure incrementally; avoid panic sells. Use layered short entries or put options for protection rather than all-in shorts.

- Size position so a forced unwind at $70k is survivable — think 1/3 exposure on spot, remainder in hedges or cash.

- Consider option hedges via liquid markets or protocols that let you express risk-premia views (e.g., PREMIA markets), understanding counterparty and liquidity risks.

Bullish alternate case — Political risk lifts BTC above $95k

Triggers:

- Escalation in the Powell probe that meaningfully raises risk premia and keeps headlines flowing.

- Large whale accumulation combined with weekly close > $88,500 and abating ETF outflows.

- Mining sell pressure subsides (difficulty stabilizes or miners reduce sales).

What happens:

- Headline momentum draws fresh bids and short-covering; price can accelerate as algo and CTA flows chase.

Tactics:

- If you believe the political-risk narrative, use scaled entries: buy on daily pullbacks rather than chasing intraday spikes.

- Keep hedges small and staggered (tight stops for momentum trades). Alternative hedges include inverse ETFs or dynamic option collars.

Practical watchlist and rules for intermediate traders

- Primary levels: Support: $88,500 (weekly close), $82,000, $75,000. Resistance: $92,000–$95,000, then $100,000 psychological.

- Flow and on-chain triggers: monitor weekly ETF flow tallies and large wallet transfers; a renewed inflow trend reduces the chance of $70k.

- Mining and difficulty: watch difficulty adjustments and miner wallet activity — rising difficulty plus increased miner selling is a bearish overlay.

- Trade rules:

- If weekly close < $88,500: reduce net-long exposure by 25–50% and add hedges.

- If weekly close > $88,500 with declining outflows: consider adding to size via staggered buys on 4–8% pullbacks.

- Use stop-losses tied to technical structure, not headlines. Define loss as a percent of portfolio (e.g., 2–3%).

Risk management and position sizing

This is a higher-volatility regime: political headlines can produce outsized intraday moves. Keep position sizing disciplined: no single BTC trade should risk more than a small fraction of your portfolio. Use options or inverse instruments to hedge if you expect short-term headline risk but want to maintain a long-term allocation.

Takeaway: trade the triggers, not the noise

Right now, neither side of the tug-of-war is clearly dominant. Technicals and ETF outflows give a credible path to $70k if $88,500 fails and redemptions persist. At the same time, political escalation around the Powell probe has proven capable of producing violent, short-lived rallies above $92k and could keep volatility elevated, which makes hedging and disciplined sizing essential.

For intermediate traders: define your thesis, pick your edge (momentum fade vs. headline chase vs. resilience play), and use the levels and rules above to manage risk. Keep an eye on ETF flows, whale moves, mining difficulty, and weekly closes — these are the concrete datapoints that will break the impasse. Use tools, hedges and platforms (including Bitlet.app) to implement recurring and conditional strategies rather than betting everything on a single headline.

Sources

- https://cryptopotato.com/70k-bitcoin-is-a-matter-of-time-analyst-warns-as-triple-bearish-signs-emerge/

- https://www.newsbtc.com/bitcoin-news/bitcoin-tops-92000-trump-powell-fight/

- https://cointelegraph.com/news/powell-investigation-risk-premia-bitcoin-analysts?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- https://crypto.news/bitcoin-price-forms-bullish-reversal-pattern-while-weekly-etf-outflows-hit-681m/

- https://coinpaper.com/13680/bitcoin-whales-return-as-88-500-close-sets-next-price-trigger?utm_source=snapi

- https://www.coindesk.com/markets/2026/01/12/bitcoin-s-early-gains-fade-fast-as-prices-fall-back-below-usd91-000