Reconciling $2.9M Bitcoin Forecasts with Near‑Term Stress: A Macro Primer

Summary

Why some forecasts paint Bitcoin as a multi‑million dollar asset

Extreme long‑run price forecasts for BTC are not purely wishful thinking — they are arithmetic models built on a handful of strong assumptions. VanEck’s $2.9M‑by‑2050 scenario, for example, is anchored in treating Bitcoin as a scarce global reserve and settlement layer; scale those assumptions across global money supply and you get very large nominal valuations VanEck report.

Put simply, the model answers: if Bitcoin captures X% of global private and institutional settlement/reserve demand while supply remains capped, what is the implied price? Replace X with high adoption and you get hyper‑bull numbers. These forecasts also implicitly assume sustained institutional adoption, deep liquid markets, and a political/regulatory environment that allows large pools of capital (pensions, insurers, sovereign wealth funds) to hold meaningful BTC allocations.

That arithmetic is useful because it translates qualitative narratives (store‑of‑value, digital settlement) into numbers. But it also hides fragility: change the adoption path, the reserve share, or regulatory risk, and the headline number collapses quickly.

What behavioral and policy shifts would validate the “$1M–$3M” narratives

There are different strains of hyper‑bull sentiment — Arthur Hayes has reiterated a $1M‑per‑BTC view as an example of a rapid adoption path, while others (like Raoul Pal) lay out scenarios where Bitcoin becomes an institutional reserve asset. To make those outcomes more than rhetorical, several shifts must materialize together:

- Institutional adoption on a fiduciary basis: Pension funds, asset managers and insurers need clear accounting, custody and regulatory precedents to hold meaningful allocations. South Korea’s move toward launching spot Bitcoin ETFs by 2026 is the kind of policy signal that nudges institutional adoption forward South Korea ETF signal.

- Global ETF and regulated vehicle proliferation: Wider availability of spot ETFs in major markets lowers operational barriers and creates on‑ramp flows. The faster and broader these products roll out, the more credible the reserve narrative becomes.

- Macro regime shifts: Sustained inflation surprise, unchecked fiscal expansion or loss of confidence in fiat systems would catalyze demand for scarce digital alternatives — a macro tail risk that converts sentiment into flows.

- Behavioral change among allocators: Risk committees must accept crypto’s volatility and liquidity profile, adjust liquidity buffers, and create rebalancing rules to hold BTC as a strategic asset rather than a speculative one.

These are big, slow, interdependent changes. They can happen — and in some regions are already underway — but timing is highly uncertain. That uncertainty is why even staunch long‑term bulls disagree on timing and peak levels. See Arthur Hayes’ reiteration of the $1M thesis for a behaviorally driven example of this class of forecast Hayes $1M comment.

Near‑term stress signals that matter today

Even if the long‑term arithmetic is intact, markets are path‑dependent. Short and medium‑term stressors can produce large drawdowns, force deleveraging and slow or reverse adoption momentum.

- ETF flows and manager transfers: January’s pullback and ETF outflows are a reminder that even regulated vehicles can see rapid reversals; spot ETF outflows in early 2026 informed wider weakness across BTC and ETH ETF outflows article. Large asset managers moving inventory (e.g., BlackRock transfers between accounts or strategies) amplify volatility and can temporarily depress liquidity.

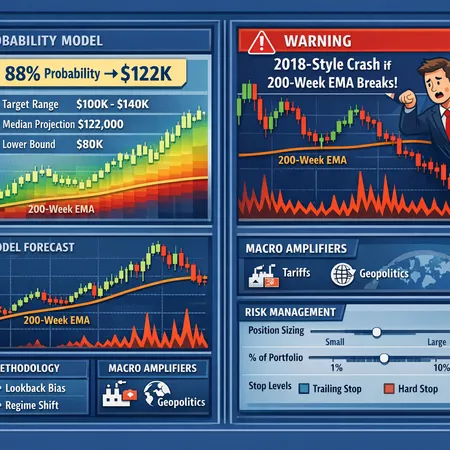

- Technical and sentiment stress: Persistent MACD troughs, large negative breadth indicators and extreme retail sentiment are classic warning signs. Recent technical analysis has highlighted MACD lows that historically precede significant downside extensions unless quickly corrected technical stress signals. That doesn’t invalidate long‑term value, but it raises the probability of near‑term pain.

- Options and volume dynamics: Elevated put skew, rising implied vol, and concentrated open interest near key strikes increase the chance of violent intraday moves — especially when liquidity thins. Options markets can both hedge and exacerbate moves, as gamma waterfalls cause dealers to hedge dynamically.

Taken together, these factors create a market that can retrace materially even as the long‑run narrative remains. For allocators who must mark to market or manage liquidity, that path risk is decisive.

Reconciling the tail case with short‑term risk: a structural checklist

The right mental model is not to choose one narrative and ignore the other. Instead, treat the extreme bullish price as a conditional outcome and manage the probability and path.

- Make the long‑run case conditional. Frame $1M–$3M scenarios as outcomes contingent on adoption, regulation and macro regime shifts. Assign probabilities rather than certainties.

- Model path risk explicitly. Run stress tests where large outflows, ETF liquidity squeezes or regulatory shocks cause 40–70% drawdowns before adoption continues. See early 2026 ETF outflows as a live example of how flows can hurt price even with positive long‑term fundamentals.

- Differentiate between liquidity and valuation risk. Liquidity squeezes are acute and often short; structural valuation changes (e.g., permanent disqualification of BTC as a reserve asset) are chronic and require different responses.

This framework lets a manager say: “I believe in Bitcoin’s upside under X conditions, but I will size and hedge to survive Y shock.” That distinction is operationally powerful.

Positioning by horizon: tactical, medium, and strategic approaches

Below are practical playbooks tailored for wealth managers and allocators who need to balance conviction with fiduciary risk management.

Tactical (0–6 months)

- Prioritize liquidity and stop‑loss buffers. For clients who may need cash within a year, reduce spot exposure and retain liquid hedges (short futures, protective puts).

- Use options to express conviction without full downside exposure — for example, buying puts as insurance or selling covered calls to monetize rangebound expectations if appropriate to mandate.

- Avoid concentration at market turning points. After ETF outflows or on MACD signals, consider scaling into dollar‑cost averaging rather than large one‑time purchases.

Medium (6–24 months)

- Scale exposures with a rules‑based approach. Set target bands and rebalance triggers (e.g., 1–3% strategic target with 25% rebalancing bands). This converts volatility into a feature rather than a bug.

- Leverage regulated vehicles for client comfort: spot ETFs or segregated custody structures reduce operational friction and are often easier to explain to trustees. South Korea’s ETF pathway is a reminder that regulated access can accelerate flows South Korea ETF signal.

- Monitor derivatives metrics. Keep an eye on put‑call skew, open interest, and exchange inventory transfers as early warnings of liquidity stress.

Strategic (5+ years)

- Treat Bitcoin as a tail‑risk/real‑asset allocation, sized to client risk budgets (common allocations in institutional discussions range from 0.5% to 5% of AUM depending on risk tolerance).

- Use scenario analysis: produce value estimates under multiple reserve share assumptions (e.g., 1%, 5%, 20% of global liquid reserves) and stress‑test for market structure shocks. VanEck’s arithmetic becomes useful here to frame upside ranges VanEck report.

- Operationalize custody and governance. Hardware cold storage, multi‑sig setups, insured custody, and clear governance around rebalancing and liquidity are essential.

Practical risk management tools and sizing guidelines

- Rebalance on volatility: define rebalancing bands and be disciplined — don’t let narrative override rules after big runs or crashes.

- Use options for tail protection: buying long‑dated puts is expensive, but it caps worst‑case losses for clients who can’t tolerate deep drawdowns.

- Maintain client liquidity horizons: match liquid liabilities with liquid assets; treat BTC as less liquid than public equities in stressed markets.

- Document the thesis: ensure clients and trustees understand the conditional nature of the long‑run forecast and the triggers that would cause you to change the allocation.

Operational checklist and market structure considerations

- Custody: choose providers with proven institutional controls and insurance. Multi‑custodian strategies reduce single‑point risk.

- Compliance and reporting: establish tax, AML/KYC and audit workflows early; these are often the gating items for larger allocators.

- Execution: use reputable venues, understand counterparty credit, and watch for concentrated inventory movements from large managers (e.g., observed BlackRock transfers) that can spike temporary volatility.

- Integration: weave crypto exposures into overall asset‑liability frameworks and stress tests. Tools like Bitlet.app can streamline installment, earn, or P2P flows for certain client use cases while you maintain strategic custody elsewhere.

Conclusion: a pragmatic reconciliation

The arithmetic that underpins $1M–$3M+ Bitcoin outcomes is simple and compelling if the world evolves in a particular way: broad institutional adoption, regulated access, and macro regimes that favor scarce digital reserves. But markets are path‑dependent, and near‑term stressors — ETF outflows, manager transfers, technical and options stress — can inflict severe, prolonged drawdowns that matter for fiduciaries.

For wealth managers the right posture is conditional conviction: believe the long‑run case while sizing, hedging and operationalizing to survive the short run. Use probability‑weighted scenarios, explicit path‑risk modeling, and horizon‑specific strategies to keep client portfolios intact while participating in potential upside. Lastly, keep monitoring the two fronts: macro/regulatory shifts that validate the reserve story, and market‑structure signals that demand tactical caution.

Sources

- https://coinpaper.com/13632/van-eck-sees-bitcoin-at-2-9-million-by-2050?utm_source=snapi

- https://u.today/hayes-bitcoin-to-1m?utm_source=snapi

- https://cointelegraph.com/news/bitcoin-ether-etf-outflows-january-2026-pullback?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- https://cryptopotato.com/worse-than-the-covid-crash-bitcoins-new-record-low-signal-explained/

- https://coinpedia.org/news/south-korea-signals-bitcoin-etf-launch-by-2026-in-major-crypto-policy-shift/