XRP Episode: ETF Inflows, WisdomTree Withdrawal, XRPL Liquidity and Treasury Signals

Summary

Executive overview

The latest XRP episode combined two powerful market forces: substantial spot ETF inflows and observable liquidity shifts on the XRPL — both of which helped lift price and compress spreads. At the same time, a high‑profile formality from WisdomTree (the withdrawal of its S‑1) injected uncertainty and a sharp, short‑term reaction. This article unpacks the mechanics behind the rally, why on‑chain liquidity matters, what the WisdomTree withdrawal signals to institutions, and practical takeaways for traders and corporate treasuries evaluating XRP as a payment or treasury instrument.

What actually happened: inflows, liquidity and the WisdomTree announcement

Late‑cycle flows into spot XRP ETFs were the headline driver — flows that, according to reporting, surpassed $1 billion and materially increased XRPL activity as ETF managers and market makers sourced inventory and arbitrage opportunities (crypto.news). At the same time, liquidity on XRPL — both in native XRP order book depth and escrow movements — tightened, which magnified price moves when demand hit order books.

But the narrative wasn’t one‑directional. WisdomTree formally withdrew its S‑1 filing for an XRP ETF application; outlets covered both the filing withdrawal and the immediate market reaction (Cryptopolitan, CoinSpeaker). That removal generated a near‑term sell impulse and renewed questions about regulatory clearance, even while other fund flows continued to show demand.

Short takeaway: demand (spot inflows) and supply dynamics (XRPL liquidity) created the technical breakout; regulatory headlines created the whipsaw.

Why spot ETF inflows matter more than headlines in many cases

Spot ETF inflows are a direct source of net new fiat demand. Unlike derivative-led rallies, ETFs typically require physical acquisition of the underlying (or equivalent exposure), meaning market makers buy XRP on exchanges or via OTC desks to back fund shares. That activity:

- Reduces available exchange inventory and can widen the gap between spot and theoretical fair value.

- Forces arbitrage flows that pull liquidity from native rails — in this case, the XRPL — which can accentuate price moves.

- Signals sustained institutional interest beyond short‑term speculation.

When flows are measured in the hundreds of millions or billions, these effects are non‑trivial. The $1B+ inflow milestone reported in the press was enough to change market microstructure for XRP for days, not just hours (crypto.news). For traders, that means a structural bid beneath prices that can persist until supplies replenish.

XRPL liquidity: why on‑chain depth amplified the move

The XRPL is designed for low‑latency settlement and has an active market for XRP IOUs and direct XRP trading pairs. Two liquidity observations mattered during the episode: first, sizable XRPL transfers and escrow movements signaled material repositioning; second, on‑chain order books and exchange depth showed that the marginal demand would eat into thinner layers of liquidity.

That combination explains a typical pattern we saw: tight ranges break quickly, spreads compress as arbitrageurs try to capture the mispricing, and then slippage appears for large market buys. For execution desks and corporate treasuries considering XRP, execution cost becomes as important as headline volatility.

Why the WisdomTree withdrawal mattered — and what it didn’t change

WisdomTree’s withdrawal of its S‑1 is not the same as a regulatory denial. Still, the market interpreted it as a signal that the approval path may not be smooth, which produced immediate price pressure (Cryptopolitan, CoinSpeaker). Why that matters:

- Perception of regulatory friction increases headline risk and can transiently shrink risk appetite from some institutional desks.

- Withdrawals create uncertainty about the timeline for a broad, retail‑friendly on‑ramp via ETFs — and in the short run that can compress the marginal buyer base.

What the withdrawal didn’t do: it didn’t erase existing fund flows into other vehicles nor the on‑chain liquidity shift already generated by earlier ETF buying. In other words, the structural demand driver remains intact even if the approval probability is now ambiguous.

Ripple stays private — implications for institutional adoption

Ripple’s announcement that it will remain private changes a few institutional considerations (Cryptopolitan:

- Ripple remaining private removes the equity‑market route for institutional exposure to the company itself, which some corporate treasuries or strategic investors might have considered as a diversification or partnership strategy.

- It also signals that Ripple can focus on long‑term product and commercial deals without the short‑term pressure of quarterly reporting — potentially attractive for enterprise partners who value stability in protocol development.

- Governance and capital structure stay concentrated, which matters for some compliance and counterparty assessments: treasuries will put more weight on commercial contracts and Ripple’s partner network than on public disclosures.

In practice, this means institutions evaluating XRP as an asset will need to weigh protocol-level liquidity and counterparty arrangements rather than relying on public equity disclosures from Ripple to assess risk.

Are corporate treasuries actually considering XRP? The evidence

Reports have noted that more treasuries and corporate finance teams are exploring XRP for operational use cases, particularly where fast settlement and low fees are priorities (U.Today). The calculus for treasuries typically rests on:

- Settlement speed and predictability (XRPL is high on this metric).

- Liquidity and the ability to convert back to fiat with minimal slippage.

- Custody and regulatory clarity in their jurisdiction.

For short‑dated, operational liquidity management — e.g., cross‑border payments or intraday FX netting — XRP's rails and the current uptick in market infrastructure make it an increasingly viable option. But institutional adoption at scale still depends on robust custody solutions, counterparty credit arrangements, and internal governance frameworks.

Trading and portfolio takeaways for practitioners

For traders and treasury managers the mixed signals recommend a disciplined, multi‑angle approach.

Tactical trading checklist

- Monitor ETF flows and prime broker inventory: sustained inflows mean structural demand and can justify carrying directional exposure.

- Watch XRPL and exchange order‑book depth in real time: when inflows pressure supply, slippage can escalate quickly.

- Hedge with derivatives where available: use futures or options to manage directional risk while capturing spot gains.

- Manage execution size: break large buys into algorithmic slices, or work OTC where depth exists to reduce market impact.

Portfolio and treasury considerations

- Custody and settlement: evaluate institutional custodians that support XRP and test settlement workflows.

- Regulatory and legal review: WisdomTree’s withdrawal is a reminder to stress‑test internal compliance scenarios.

- Liquidity stress test: model conversion back to fiat at various slippage levels and through multiple counterparties.

- Counterparty contracts: prefer counterparties with robust FX corridors and proven liquidity provision on XRPL.

Risk checklist and practical execution tactics

- Regulatory risk: build playbooks for sudden headline events (filing withdrawals, enforcement actions).

- Liquidity risk: always measure realized slippage — historical depth isn’t a guarantee.

- Custody risk: segregated cold storage and insurance matter; run tabletop exercises.

- Operational risk: test settlement, reconciliation and FX conversion processes end‑to‑end.

- Market structure risk: be ready for basis moves between ETF NAV, spot exchange prices and OTC rates.

Execution tactics

- Use algorithmic VWAP/TWAP for sizable trades; complement with controlled OTC fills.

- Keep a rolling liquidity buffer in fiat or stablecoins to avoid forced selling during headline drawdowns.

- If using XRP for payments, route through multiple liquidity providers and pre‑fund accounts where possible.

Putting the signals together: balanced interpretation

This episode shows how structural demand (spot ETF inflows) can collide with headline risk (WisdomTree withdrawal) to produce volatile — yet informative — market dynamics. The inflows and XRPL liquidity movements point to a stronger, more institutionally engaged market for XRP; the WisdomTree step back underscores that regulatory pathways remain uncertain and that timing for broad retail adoption via ETFs may be uneven.

For traders: opportunities exist in both directional trades and in providing liquidity, but execution costs and slippage must be modeled aggressively. For corporate treasuries: XRP is increasingly viable for operational liquidity and settlement, but only after careful custody, compliance, and counterparty due diligence.

Services such as Bitlet.app and institutional custody providers are part of the evolving plumbing that makes practical treasury use cases more realistic — but they’re only one piece of the puzzle.

Sources

- Report on spot XRP ETF inflows and XRPL liquidity: crypto.news — XRP price, bulls seize momentum as spot ETF inflows blast past $1B

- Coverage of WisdomTree withdrawing its S‑1: Cryptopolitan — WisdomTree withdraws S‑1 XRP ETF

- Additional coverage of the WisdomTree withdrawal and market reaction: CoinSpeaker — XRP down as WisdomTree withdraws ETF filing

- Ripple statement on remaining private: Cryptopolitan — Ripple shuts door on IPO

- Report noting corporate treasuries exploring XRP: U.Today — More treasuries exploring XRP

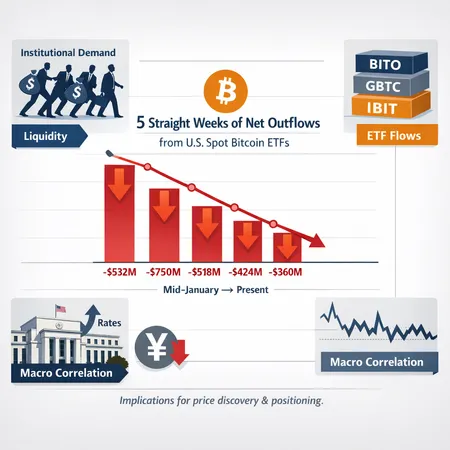

For broader context on crypto market dynamics, many traders still look to cues from Bitcoin and liquidity trends across DeFi when sizing risk and opportunity.