Why Circle’s 66% Revenue Jump and Rising USDC Circulation Matter for Stablecoins in 2026

Summary

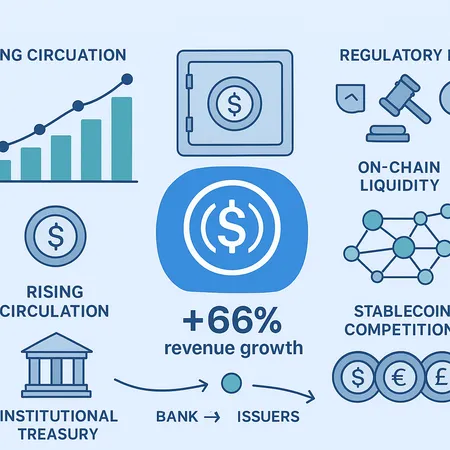

The quarter at a glance: why 66% revenue growth and rising USDC circulation are meaningful

Circle’s report showing 66% year-over-year revenue growth alongside expanding USDC circulation is a signal that goes beyond a corporate beat‑up: it reflects real changes in how dollar liquidity is created and monetized inside the crypto economy. For institutional readers, the headline combines two mechanisms that sustain market structure: monetizable reserve income and scale of on‑chain and off‑chain circulation. The former drives earnings; the latter drives network effects — lower slippage, deeper pools, and easier treasury settlement.

Scale matters in payments and markets. A larger circulating supply of USDC reduces frictions for liquidity provisioning on exchanges, for trading desks providing two‑way quotes, and for corporate treasuries that need quick, low‑cost dollar rails. But it also increases scrutiny: the bigger the float, the more important the reserve composition, yield sources, and banking relationships become.

Circle’s business model and reserve income: what powers profitability

Circle’s economics can be broken down into a few repeatable drivers:

- Reserve income: interest earned on cash equivalents, short‑dated Treasuries, repo, and other high‑quality liquid assets backing USDC. With a large float, even modest yields generate substantial revenue.

- Platform fees and services: APIs, institutional custody, treasury services, and FX or settlement fees add diversified revenue atop pure reserve yield.

- Float monetization: timing mismatches between minting/redemption flows create working capital opportunities for short-term investment.

Together these lines explain how a payments‑style business can report outsized revenue growth when circulation expands and yields are favorable. Yet the model is sensitive to market rates and counterparties: a drop in short‑term Treasury yields compresses reserve income, while stress in banking partners can raise funding costs or force more conservative asset mixes.

Circle’s disclosures (attestations and portfolio breakdowns) matter because the market and regulators read them to assess risk. Attestations give regular snapshots, but they are not full audits; policymakers are increasingly focused on frequency, granularity, and third‑party verification of reserves.

What rising USDC circulation means for on‑chain liquidity and market structure

Increasing USDC circulation has immediate technical and economic effects on on‑chain markets:

- Deeper liquidity pools and tighter spreads: More USDC in circulation means larger stable pairs on DEXs, lower slippage for large trades, and more reliable AMM provision. That benefits institutional market makers and OTC desks that route orders through on‑chain liquidity.

- Settlement efficiency: Corporates and funds can move dollar liquidity on‑chain without repeated USD bank rails, reducing settlement time and operational overhead.

- Network effects vs. concentration risk: A dominant USDC supply concentrates liquidity in certain chains and venues, improving efficiency but increasing systemic linkage between Circle, its custodial banks, and the broader crypto plumbing.

For DeFi applications, abundant USDC reduces the cost of capital and margin for certain strategies, which can fuel growth in lending, synthetics, and collateralized products. But more USDC also amplifies the importance of reserve transparency — traders and treasuries must trust that on‑chain dollars correspond to safe, liquid off‑chain assets.

Comparing USDC to WLFI (USD1) and issuer‑deployed coins on AB Chain

The competitive field is fragmenting along two axes: issuer trust/compliance and on‑chain nativity. Consider three archetypes:

- USDC (Circle): Large, regulated issuer with broad exchange and custodial support, high on‑chain liquidity, and well‑publicized reserve attestations. Strengths are network effects and institutional trust; weaknesses include regulatory targeting and counterparty concentration.

- WLFI (USD1): An emerging dollar‑pegged token that markets itself on cost competitiveness or different reserve mixes. These alternatives can undercut fees or offer cross‑chain features, but often trade off on custody, audit cadence, or market depth.

- Issuer‑deployed stablecoins on AB Chain: Native stablecoins issued by projects or consortia on new chains can offer integrated liquidity (no cross‑chain bridges), bespoke compliance rules, or programmable features for DeFi primitives. Their downside is bootstrapping liquidity and convincing treasuries to accept a newer issuer.

Competition is not purely price-based. Institutional treasury teams care about legal enforceability, contractual recourse, custody arrangements, and enforceable redemption mechanics. A cheap, lightly audited stablecoin may attract speculative flows and short-term on‑chain liquidity, but it is less likely to win long‑term institutional market share without stronger trust signals.

Regulatory risk and questions as the ecosystem approaches 2026

Growing dollar stablecoins raise public‑interest questions that policymakers are actively debating. Key regulatory topics include:

- Reserve transparency and audit standards: Should attestations evolve into continuous reporting or full audits? Regulators may demand standardized disclosures (asset types, maturity profile, counterparty exposure).

- Systemic‑stablecoin designation and prudential rules: If a stablecoin’s circulation reaches a level that threatens financial stability, it could be subject to bank‑like capital and liquidity requirements, restricting how reserves are invested.

- Banking partner concentration: Heavy reliance on a few banks to custody reserves creates contagion risk; regulators may press for diversification or on‑balance‑sheet protections.

- Consumer and institutional protections: Clear redemption rights, contractual clarity for institutions, and resolution regimes are likely to feature in new rules.

Heading into 2026, the regulatory trajectory seems to favor more rigorous standards rather than laissez‑faire approaches. That will raise compliance costs and may advantage larger, well‑capitalized issuers that can meet higher audit and governance bars — a dynamic that could entrench incumbents or push challengers to innovate on composability and native‑chain features instead.

How institutional treasury demand could shape market share

Institutional adoption is a double‑edged sword for stablecoin dynamics. Treasuries prize reliability, legal clarity, and operational ease. If Circle continues to deliver transparent reserves, predictable redemption mechanics, and broad custodial support, USDC stands to capture more treasury balances, reinforcing on‑chain liquidity and fee revenue. Several structural points are worth noting:

- Network effect snowball: Each corporate or fund that holds USDC increases on‑chain depth and counterparty confidence, lowering costs for the next entrant.

- Diversification behavior: Risk managers often prefer multiple rails. Even if USDC becomes dominant, treasuries may spread exposure across WLFI, issuer coins on AB Chain, and bank deposits to limit single‑issuer or single‑bank risk.

- Service integration: Treasury platforms, custodians, and commercial providers (including integrators like Bitlet.app) will influence which stablecoins are operationally convenient. APIs, settlement SLAs, and custody options matter as much as peg quality.

Institutional demand therefore rewards not only low credit risk and good disclosures but also ecosystem integration and operational reliability.

Strategic takeaways for institutional crypto and fintech leaders

- Monitor reserve disclosures and ask for institution‑grade evidence: frequency of audits, asset granularity, and counterparty exposure.

- Stress‑test operational exposure: simulate redemption runs, counterparty failure scenarios, and cross‑chain bridge outages.

- Diversify rails and counterparties: combining USDC with vetted alternatives (WLFI/issuer coins where appropriate) reduces single‑point failures.

- Engage proactively with policymakers and standard‑setters: shape disclosure frameworks and contingency arrangements before rules are finalized.

- Evaluate total cost of ownership: fees matter, but so do custody, settlement SLAs, and legal certainty.

Circle’s combination of higher reserve income and growing USDC circulation is reshaping liquidity dynamics and making certain stablecoin value propositions more durable. But the next phase — toward 2026 — will be defined as much by regulatory choices and institutional risk appetite as by on‑chain metrics. For institutional crypto and fintech teams, the prudent path is active assessment: treat stablecoin exposure like any major treasury instrument, demand transparency, and plan for multiple market scenarios.

Stablecoin trends will remain central to market structure, and watching how issuers like Circle evolve their reserve policies and partnerships will tell us whether the market consolidates around a few trusted names or splinters across chains and niches.