The Impact of Donald Trump's Pardon of Binance CEO Changpeng Zhao on U.S. Cryptocurrency Expansion

The recent pardon granted by former U.S. President Donald Trump to Changpeng Zhao, the CEO of Binance, marks a pivotal moment in the U.S. cryptocurrency landscape. Binance is one of the largest cryptocurrency exchanges globally, and Zhao's leadership has been instrumental in driving its success.

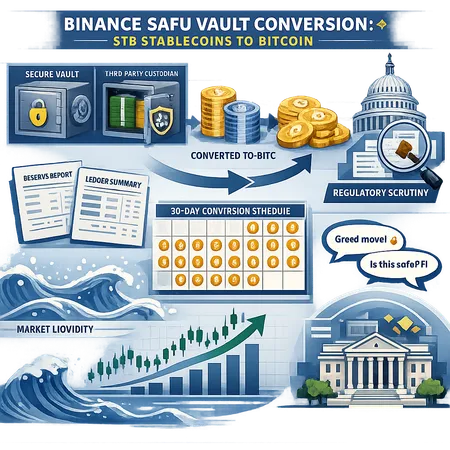

This pardon may ease some of the regulatory uncertainties previously surrounding Binance's operations in the U.S., potentially paving the way for increased business activities and innovation in the cryptocurrency sector. For investors and users alike, this development could signal a more favorable regulatory environment moving forward.

Platforms like Bitlet.app are well-positioned to benefit from such positive shifts in regulation. Bitlet.app offers a unique Crypto Installment service, enabling users to buy cryptocurrencies immediately and pay monthly in installments rather than paying the full amount upfront. This service aligns well with growing investor confidence and expanding market opportunities sparked by events like Zhao's pardon.

Overall, this pardon could accelerate the expansion of cryptocurrency adoption and infrastructure in the U.S., fostering innovation and providing more accessible entry points for new users. It's an exciting time for the crypto community, with platforms like Bitlet.app continuing to deliver innovative solutions that make cryptocurrency investment easier and more accessible.