Binance Converts $1B SAFU to Bitcoin: What It Means for Reserves, Risk and Market Liquidity

Summary

What Binance announced and why it matters

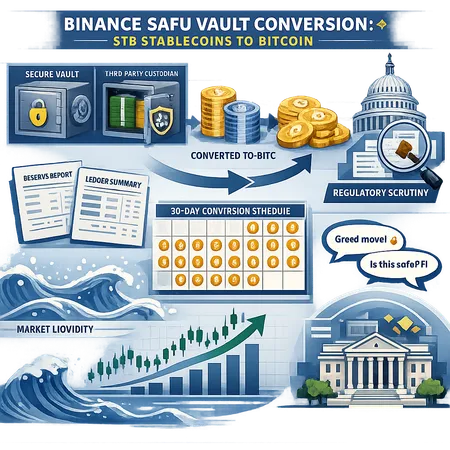

In recent coverage Binance said it would convert $1 billion of its Secure Asset Fund for Users (SAFU) from stablecoins into Bitcoin, executing the purchase on a multi-day schedule. Initial reporting surfaced the plan and timing here, and follow-up pieces explored both the mechanics and community questions about user protection and optics (see Cointelegraph and CryptoNews for contemporaneous coverage: https://cointelegraph.com/news/binance-to-convert-1-billion-safu-fund-btc?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound and https://cryptonews.com/news/binance-converts-1b-safu-fund-to-bitcoin-following-criticism-is-a-rally-coming/). Another outlet confirmed timing and the company messaging around the shift (https://www.cryptopolitan.com/binance-to-shift-1b-safu-fund/).

Why this matters: SAFU is explicitly marketed as an insurance-style reserve meant to protect users in extreme loss scenarios. Converting a large stablecoin buffer into BTC — a volatile asset — changes the reserve’s risk profile, affects the exchange’s balance sheet composition and sends a broad signal about how Binance is managing liquidity and capital.

Exchange reserve practices: from stable buffers to strategic reserves

Traditional thinking about insurance or safety reserves favors low-volatility, highly liquid assets. Stablecoins or cash-equivalent holdings fit that role: they can be deployed quickly and predictably during a bank run, hack, or large withdrawal event. Binance’s decision to allocate to BTC indicates a different philosophy — viewing part of the reserve as strategic capital that can both protect and potentially appreciate.

This is not unprecedented; exchanges sometimes hold native tokens or BTC as part of capital management. But the scale and the stated intent matter. A $1 billion shift changes the composition of exchange reserves and raises the question: is SAFU being used as an active treasury rather than a pure emergency buffer? Institutional and retail users should ask how reserves are governed, what rebalancing rules exist, and whether the exchange maintains an independent capital adequacy framework or stress-testing regime.

Custodial and counterparty risk: more BTC, different exposures

Holding BTC in a reserve creates different custodial and counterparty risks compared with stablecoins. Stablecoins — depending on issuer — introduce issuer risk (e.g., fiat backing, redemption policy) but are generally liquid at par. BTC exposure introduces:

- Price risk: BTC can lose significant value in a short period, reducing the effective size of the reserve when it’s needed most. A 30% drawdown would materially shrink a BTC-denominated reserve.

- Custodial risk: Securing large BTC holdings requires robust custody practices. If the reserve is held in exchange-controlled hot wallets, that concentrates operational risk. If custody is third-party, counterparty and custody-provider solvency become relevant.

- Liquidity profile: Spot liquidity for BTC is strong, but execution during distressed markets can be costly (wider spreads, reduced depth). Stablecoins generally trade with tighter spreads against most assets.

For institutional and concerned retail users, the key questions are: where exactly is the BTC held, what multi-sig or cold-storage controls exist, and what legal protections or ring-fencing are in place should the exchange face solvency pressure? Ask for proof points: attestation reports, proof-of-reserves cadence, and independent audits.

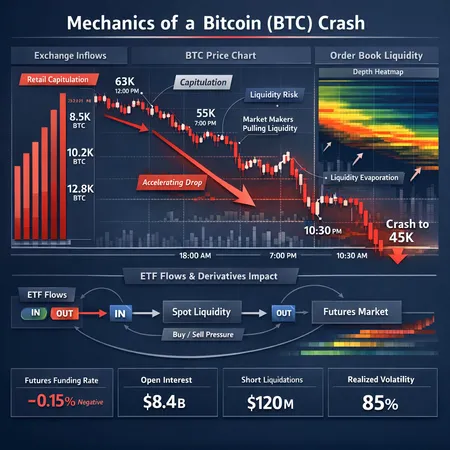

Market liquidity: a $1B buy schedule over 30 days — theory vs. practice

Binance reportedly planned a staged buy schedule. How that schedule is executed determines the real market impact. A few important mechanics:

- VWAP effect vs. headline buying: Breaking $1B into many small orders over 30 days reduces instantaneous price shock. A disciplined Volume-Weighted Average Price (VWAP) approach aims to minimize slippage.

- Liquidity windows and market microstructure: Crypto liquidity is not uniform. Overnight periods and thinner altcoin-correlated windows can amplify impact. If buys concentrate when liquidity is thin, slippage and front-running risk increase.

- Signaling and anticipatory flows: Public knowledge of a large buy can induce front-running by traders and algorithmic liquidity providers, turning a planned purchase into a price-moving event. That happened to an extent in prior announced treasury purchases by large funds.

- Funding source and on-exchange execution: Converting stablecoins into BTC on exchange order books is straightforward, but if Binance uses OTC desks for sizable tranches it could lower market footprint while relying on counterparty liquidity.

Net impact: $1B is meaningful but not market-breaking for BTC’s multi-week liquidity. It will likely support bids and tighten downside if executed quietly and with OTC support; conversely, visible, concentrated buys can create short-term volatility and attract speculative momentum. Execution choice — order slicing, use of OTC, dark pool matching — is the practical lever for controlling market impact.

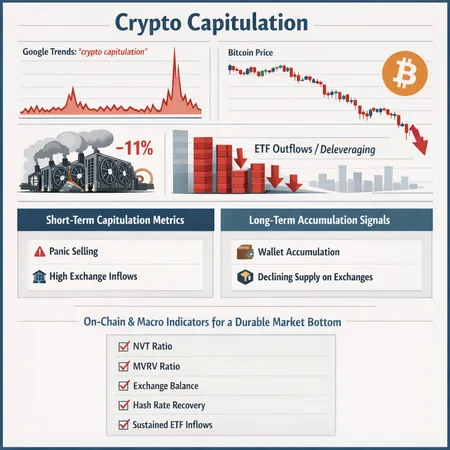

Does converting SAFU materially support BTC price, or weaken user protection?

On paper, redirecting $1B into BTC can provide price support: it increases demand and reduces available supply on order books during execution. But several caveats matter:

- Duration of support: Price support may be transitory. Unless the reserve is held long-term and not used for trading, the effect is a liquidity suction where it matters most during purchase, not a permanent supply shock.

- Offset risks: If market participants see the reserve as a price-support tactic rather than user protection, they may rebalance risk elsewhere, causing flows into derivatives or off-exchange venues.

- Protection trade-off: Replacing stablecoin liquidity with BTC reduces the reserve’s flexibility to settle redemptions or reimburse users quickly at face value. That is an explicit trade-off between potential capital appreciation and immediate user protection.

Overall, the move can nudge markets, but it is not a guaranteed long-term price anchor. For user protection, the shift arguably weakens immediate liquidity guarantees unless Binance keeps a separate, unencumbered stablecoin or fiat buffer explicitly ring-fenced for redemptions.

Regulatory optics and governance questions

Regulators evaluate both capital adequacy and transparency. Several regulatory red flags emerge:

- Transparency: Was the conversion and schedule disclosed proactively? Late or opaque communication invites scrutiny about whether the reserve’s stated purpose matches practice.

- Consumer protection: Holding volatile assets for an insurance fund may be viewed as exposing users to operational risk. Regulators could demand clearer disclosures, segregation of funds, or minimum cash-equivalent thresholds.

- Market manipulation concerns: Publicly executing large buys raises questions about market manipulation and fair access, particularly if the exchange benefits from being both the buyer and the marketplace where price moves occur.

The Cointelegraph piece flagged similar concerns, asking whether conversion of SAFU raised questions about user protection and the appropriateness of such uses of insurance funds (https://cointelegraph.com/news/binance-to-convert-1-billion-safu-fund-btc?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound). Regulatory agencies in multiple jurisdictions have been focusing on exchange custody, reserve claims, and the separation of customer funds — this decision will likely invite fresh scrutiny and calls for clearer guardrails.

Community reaction: trust, signaling, and narrative risk

Reaction has been mixed. Some traders praised the move as a bullish, pragmatic use of capital to backstop the market. Others criticized it as a misuse of an insurance fund, arguing that SAFU should prioritize immediate liquidity and user redress. CryptoNews and other outlets covered the backlash and subsequent defense from Binance leadership (https://cryptonews.com/news/binance-converts-1b-safu-fund-to-bitcoin-following-criticism-is-a-rally-coming/).

Narrative matters in crypto. Exchanges derive trust not only from solvency but from consistent, conservative reserve policies. A once-off strategic allocation can be tolerable; a pattern of using safety nets as trading capital erodes credibility and may push custodial demand toward specialized custodians and non-custodial solutions.

Practical takeaways for institutional and retail users

- Ask for clarity: Request specifics on custody arrangements, multi-sig controls, and whether any portion of SAFU remains in instant-liquidity form.

- Demand regular proof-of-reserves: Independent attestations or frequent proof-of-reserves snapshots reduce asymmetry of information.

- Stress-test assumptions: Model scenarios where BTC falls 30–50% and examine whether the reserve still covers credible loss scenarios.

- Diversify custody exposure: For large positions, consider splitting custody between exchange accounts, institutional custodians, and cold storage.

- Watch execution details: If you trade around large scheduled buys, be aware of potential front-running and liquidity squeeze risks.

Final assessment

Binance’s conversion of $1B of SAFU into BTC is a consequential risk-management choice that blends treasury strategy with a public insurance promise. It can provide short-term demand to BTC markets and reflect confidence in the asset, but it also shifts the reserve’s profile toward volatility and custody complexity. For both institutional and retail users, the move is a reminder to prioritize transparency, independent attestations, and clear contractual protections around custodial reserves.

For those evaluating exchange reserve policies, the key questions remain: is the reserve governed conservatively with explicit thresholds for liquidity, or is it being used as an active investment vehicle? Answers to that will determine whether the conversion is a savvy treasury play or a weakening of user protection. As always, consider custody diversification and independent verification — and keep an eye on regulatory follow-up. If you want a practical comparison of custody models and reserve checks, Bitlet.app and other custody-focused platforms can provide alternative solutions and benchmarks.

Sources

- https://www.coinspeaker.com/binance-to-allocate-1b-safu-fund-into-bitcoin-amid-price-dips/

- https://cointelegraph.com/news/binance-to-convert-1-billion-safu-fund-btc?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- https://cryptonews.com/news/binance-converts-1b-safu-fund-to-bitcoin-following-criticism-is-a-rally-coming/

- https://www.cryptopolitan.com/binance-to-shift-1b-safu-fund/

For many traders, Bitcoin remains the primary market bellwether — but reserve strategy, governance and custody now matter just as much as price signals. References to broader topics like NFTs and DeFi remain relevant as users increasingly move between custodial and non-custodial services.