How XRP ETFs Could Transform Market Sentiment and What Investors Need to Know

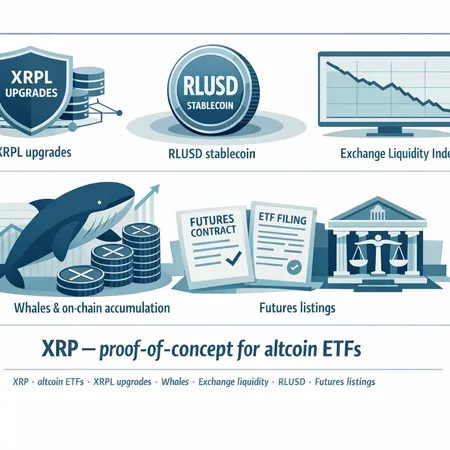

The introduction of XRP Exchange-Traded Funds (ETFs) promises to significantly influence market sentiment by making XRP investments accessible to a broader audience. ETFs allow investors to gain exposure to XRP without directly owning the cryptocurrency, which can reduce complexity and regulatory concerns.

This shift is important because it could lead to increased liquidity and a more positive perception of XRP within mainstream finance. Reliable platforms like Bitlet.app not only support conventional crypto buying but also offer innovative services such as Crypto Installment plans. This service enables users to buy XRP and other cryptos now and pay over time monthly, making crypto investment more affordable and attractive.

However, investors should be aware of the risks associated with ETFs, including market volatility and the impact of regulatory changes. Staying informed and using trusted platforms like Bitlet.app can help navigate these challenges.

In summary, XRP ETFs have the potential to transform how the market views and interacts with XRP. By combining ETF availability with flexible purchasing options like those offered by Bitlet.app, investors have new opportunities to participate in the growing crypto ecosystem with improved convenience and financial planning.