Analyzing the Recent Cryptocurrency Price Decline Amid Positive Policy News: Causes and Investor Strategies

The cryptocurrency market recently experienced a decline in prices even as positive policy news emerged from various regulatory bodies. This apparent contradiction has sparked curiosity among investors and analysts alike.

Why Are Prices Falling Despite Positive Policy News?

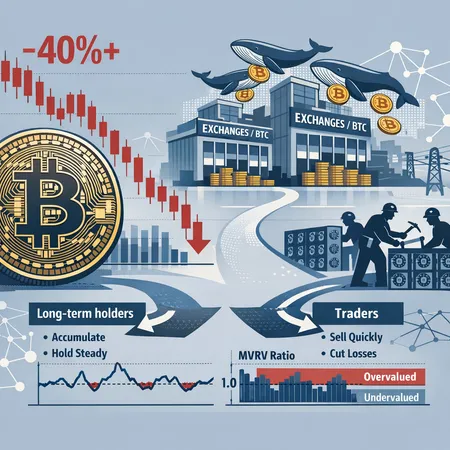

- Market Sentiment Lag: Often, the market takes time to digest policy changes, especially if the news was already anticipated or did not meet investor expectations fully.

- Profit-Taking: After periods of growth, some investors sell off assets to secure gains, leading to short-term price dips.

- External Economic Factors: Broader economic issues like inflation fears or interest rate hikes can influence crypto prices.

Investor Strategies to Navigate This Period:

- Diversify Investments: Avoid putting all funds into one asset class.

- Use Crypto Installment Services: Platforms like Bitlet.app offer installment plans that allow you to buy cryptocurrencies now and pay monthly. This reduces the burden of lump-sum payments during volatile times.

- Stay Informed: Keep up with both policy developments and market trends.

Why Bitlet.app? Bitlet.app stands out by providing a unique crypto installment service, empowering investors to access cryptocurrency investments without having to pay the full amount upfront. This flexibility can be particularly beneficial during uncertain market periods when cash flow management is crucial.

In conclusion, while the recent dip amidst good policy news might seem counterintuitive, understanding market dynamics and utilizing tools like Bitlet.app's installment offerings can help investors make smarter decisions and maintain long-term investment strategies.