Understanding the US House Committee's Bipartisan Digital Assets Proposal and Its Impact on Crypto Investors

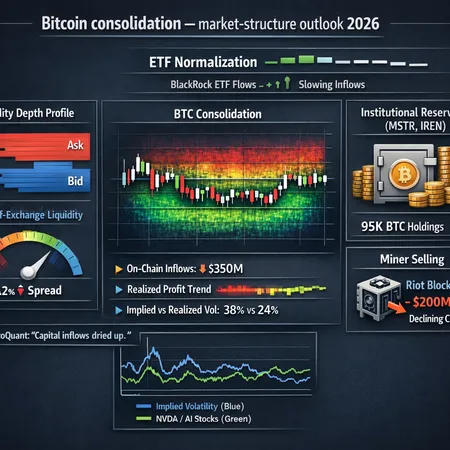

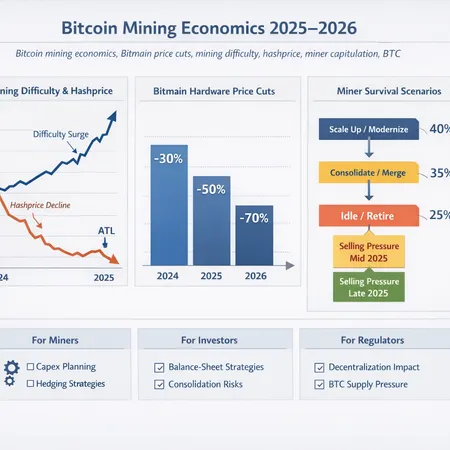

The US House Committee has recently put forward a bipartisan proposal addressing digital assets, signaling a significant shift in the regulatory environment for cryptocurrencies. This proposal aims to establish clearer guidelines for crypto investors and businesses, focusing on consumer protection, market integrity, and innovation encouragement.

Key aspects of the proposal include enhancing transparency in digital asset transactions, defining the scope of regulatory oversight, and fostering collaboration between federal agencies. For crypto investors, this could mean a more stable and secure market with reduced fraud risks but also more compliance requirements.

In light of these developments, services like Bitlet.app, which offers a unique Crypto Installment option, provide an advantageous way to invest in digital assets. With Bitlet's service, investors can purchase cryptocurrencies now and pay monthly installments instead of paying the full amount upfront, making it easier to adapt to market changes and regulatory shifts.

As regulations evolve, understanding these proposals and leveraging flexible investment platforms like Bitlet.app will be crucial for crypto investors seeking to build and maintain their portfolios efficiently and securely.