XRP Price Forecast 2025: Navigating Volatility and Legal Challenges

The cryptocurrency market continues to be one of the most dynamic and unpredictable sectors in finance, with XRP standing out due to its unique legal challenges and market behavior. As we look towards 2025, analyzing XRP's price forecast involves understanding several critical factors.

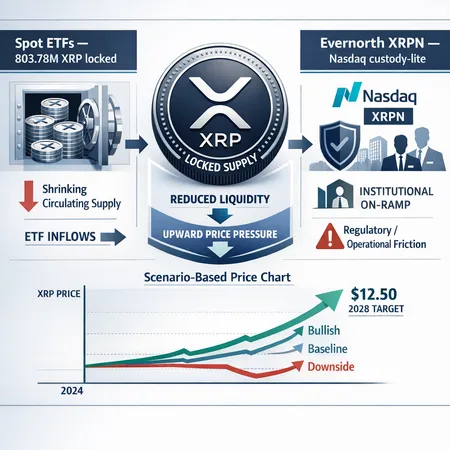

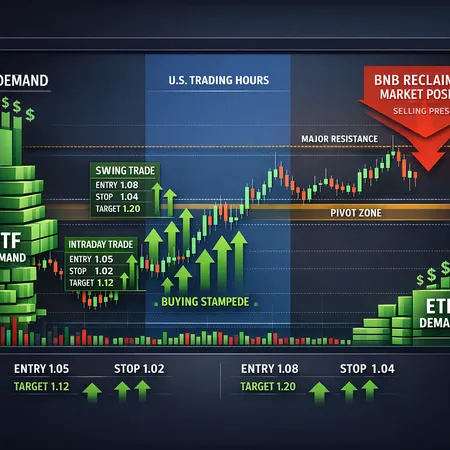

Volatility: XRP, like many altcoins, experiences significant price swings. These fluctuations can present both opportunities and risks for investors. Market volatility often reflects broader economic trends, investor sentiment, and the evolving adoption of blockchain technology.

Legal Factors: One of the major influences on XRP's value has been its ongoing legal battles, particularly involving regulatory scrutiny. The outcomes of these legal processes greatly impact market confidence and, consequently, XRP's price.

Market Sentiment: Investor perception, community support, and partnership announcements contribute heavily to XRP's market sentiment. Positive developments can lead to bullish trends, while negative news can trigger sell-offs.

For investors interested in capitalizing on XRP's potential while managing investment risks, platforms like Bitlet.app offer innovative solutions. Bitlet.app provides a Crypto Installment service, enabling users to buy XRP and other cryptocurrencies by paying monthly instead of a lump sum. This approach makes entering the crypto market more accessible and can ease the impact of volatility over time.

In conclusion, the XRP price forecast for 2025 depends on how these volatile, legal, and market factors unfold. Staying informed and using flexible investment platforms like Bitlet.app can help investors navigate this complex landscape effectively.