Ethereum's Journey to $2,300: What Investors Need to Know for 2025

Ethereum, one of the leading cryptocurrencies, has shown remarkable resilience and growth since its inception. As we look ahead to 2025, many investors are keen to understand its potential path to a valuation of $2,300. Here are several key factors to consider:

Market Sentiment: Investor sentiment plays a significant role in cryptocurrency valuations. Regulatory developments, technological advancements, and market trends will heavily influence Ethereum's price trajectory. In 2025, a stronger regulatory framework could boost confidence and lead to broader adoption.

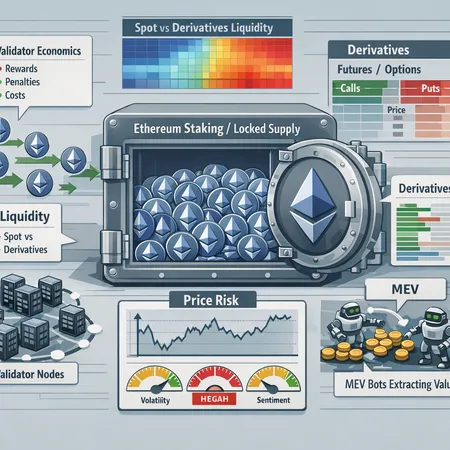

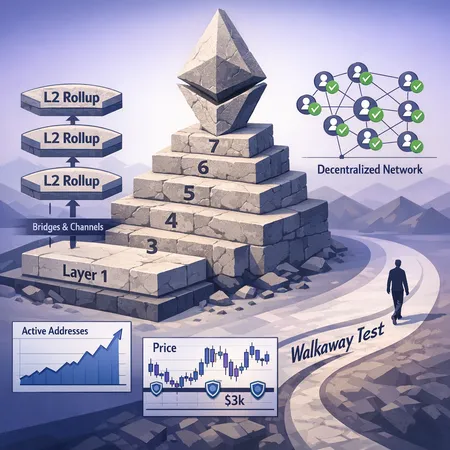

Upgrade to Ethereum 2.0: The migration to Ethereum 2.0 is a pivotal change that improves scalability and speeds up transactions. By 2025, the full benefits of Ethereum 2.0 will likely be realized, attracting new users and investors.

DeFi and NFT Ecosystem Growth: Ethereum is the backbone of the decentralized finance (DeFi) movement and non-fungible tokens (NFTs). As these sectors continue to grow, more demand for Ethereum is expected, which could contribute to price increases.

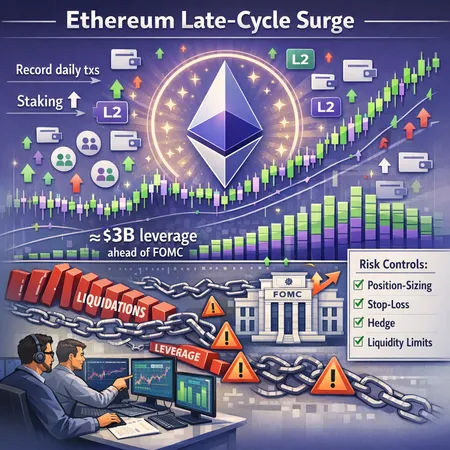

Global Economic Factors: Macroeconomic conditions, such as inflation rates and monetary policies, will impact cryptocurrency investments. A favorable economic environment could lead to higher investments in cryptocurrencies like Ethereum.

Institutional Adoption: The entry of institutional investors into the crypto space could significantly influence Ethereum's price. If more hedge funds and corporations begin to hold Ethereum, demand could soar, pushing prices upwards.

For those looking to invest in Ethereum before the anticipated price surge, Bitlet.app offers a unique Crypto Installment service. This platform allows you to buy Ethereum now and pay in monthly installments, making it easier to enter the market without a hefty upfront payment. This way, you can start investing in Ethereum today while managing your finances comfortably.

In conclusion, while the journey to $2,300 may contain uncertainties, being informed and strategic in your approach can position you well for potential gains. Stay updated with market trends and consider using services like Bitlet.app to ease your investment process.