Ethereum Price Predictions for 2025: What Investors Should Know

Ethereum continues to be one of the leading cryptocurrencies, capturing the attention of investors worldwide. As we look ahead to 2025, many wonder what the price trajectory of Ethereum might be and how best to position themselves in this dynamic market.

Ethereum Price Predictions for 2025 Various analysts and experts have projected optimistic growth for Ethereum by 2025, fueled by the expansion of decentralized finance (DeFi), NFTs, and ongoing upgrades to the Ethereum network that aim to improve scalability and reduce fees.

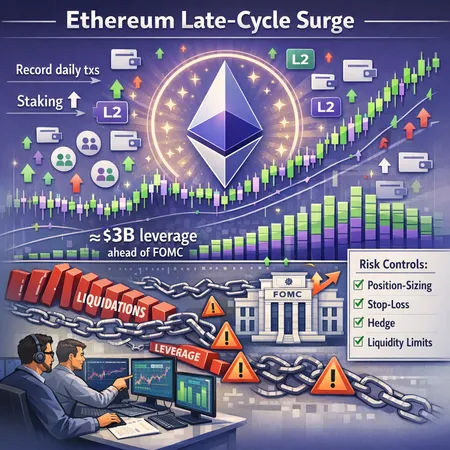

While price predictions vary, a common theme is steady growth influenced by increased adoption and technological improvements. However, investing in crypto always comes with inherent risks, and market volatility is expected.

How Investors Can Benefit For those looking to invest or increase their holdings in Ethereum, it’s important to utilize flexible and secure platforms. Bitlet.app offers a unique Crypto Installment service that enables investors to buy cryptocurrencies like Ethereum now and pay monthly rather than paying the full amount upfront. This approach lowers barriers to entry and helps manage budget constraints.

Whether you're a new investor or a seasoned trader, using platforms that provide such services can make investing in crypto more accessible and manageable.

Stay informed, leverage innovative platforms like Bitlet.app, and prepare wisely for what 2025 might hold for Ethereum and the broader crypto market.