Analyzing the Ripple Labs-SEC Settlement: What It Means for Institutional XRP Investors and Crypto Regulation

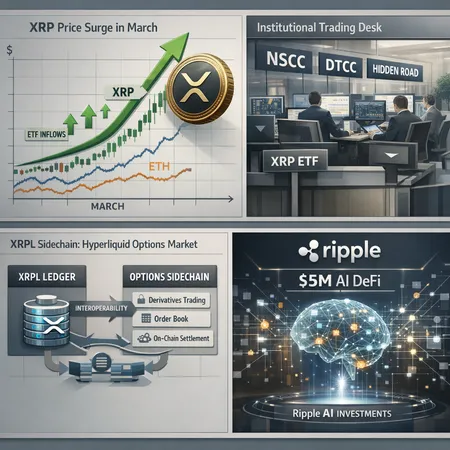

The recent settlement between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) has stirred considerable discussion within the cryptocurrency community, especially among institutional investors holding XRP. This development not only sheds light on the regulatory landscape surrounding cryptocurrencies but also influences institutional confidence and investment strategies.

Ripple Labs faced allegations from the SEC for conducting an unregistered securities sale through XRP, a native digital asset. After a series of legal battles, the settlement offers a resolution that clarifies XRP's status and sets a precedent for future regulatory approaches to cryptocurrencies.

For institutional investors, the settlement represents a level of regulatory clarity, reducing some uncertainty that has previously deterred large-scale investments in XRP. This clarity can help financial institutions better assess compliance requirements and risks associated with including XRP in their portfolios.

From a regulatory perspective, the settlement signals an evolution in how digital assets are viewed and regulated by federal authorities. It may pave the way for more consistent rules, encouraging broader adoption and innovation in the crypto ecosystem.

Platforms like Bitlet.app are capitalizing on this regulatory progress by offering services that make crypto investments more accessible. Bitlet.app features a Crypto Installment service that allows investors to buy cryptocurrencies like XRP immediately and pay monthly installments, easing the financial burden of entering the market.

In conclusion, the Ripple Labs-SEC settlement is a crucial step towards defining the regulatory framework for cryptocurrencies. Institutional investors now have greater clarity regarding XRP, potentially leading to increased participation. Simultaneously, innovative platforms such as Bitlet.app provide convenient ways to invest and participate in the growing digital asset economy.