How Tether's $600 Million Adecoagro Acquisition Highlights the Stablecoin-Traditional Assets Connection

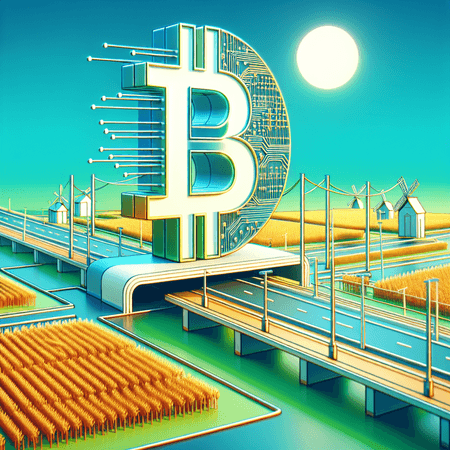

Tether, one of the largest stablecoins by market capitalization, recently made headlines with its $600 million acquisition of Adecoagro, a leading agro-industrial company. This strategic move underscores the increasing confluence between stablecoins and traditional asset markets.

Stablecoins like Tether are designed to maintain stable value by being pegged to traditional currencies, typically the US Dollar. However, Tether’s investment into Adecoagro represents a pioneering step towards blending crypto assets with tangible, income-generating enterprises. This acquisition not only diversifies Tether's asset base but also signals a future where stablecoins could serve as bridges linking the digital and real-world economies.

The integration of stablecoins with traditional investments opens new avenues for investors looking to combine the stability of fiat currencies with the growth potential of sectors like agriculture, real estate, and commodities. Moreover, this synergy can enhance transparency, liquidity, and accessibility in financial markets.

At Bitlet.app, we embrace such innovative developments in the crypto space. Our platform offers a unique Crypto Installment service, empowering users to buy cryptocurrencies now and pay monthly, making crypto investments more accessible and aligned with traditional financial habits.

As the boundaries between digital and traditional finance continue to blur, Tether's Adecoagro acquisition stands as a landmark example of how stablecoins are becoming integral to the broader financial ecosystem. This advancement promises a future where crypto assets are more deeply embedded within everyday economic activities, benefiting both cryptocurrency enthusiasts and traditional investors alike.