Inside the BROCCOLI Incident: How a Market-Maker Account Compromise Turned Into a $1M Trade and What Exchanges Should Fix

Summary

What happened with BROCCOLI — a quick, reconstructed narrative

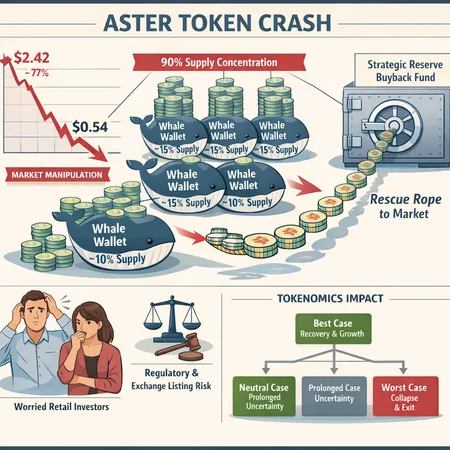

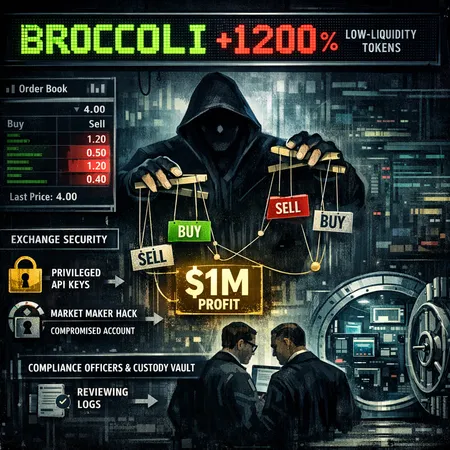

In late 2025 an outsize, short-lived rally in the low-liquidity token BROCCOLI on Binance attracted immediate attention. Market observers flagged trade sizes, orderbook behavior and suspicious account patterns that didn’t match normal market-making activity. Initial reporting suggested the anomaly originated from a market-maker account that was either compromised or misused to push prices and create a profitable arbitrage window for one or more counterparties. Early coverage connecting the unusual activity to account misuse can be found in reporting from Cryptopolitan, which first drew attention to the anomalous boost, and a follow-up analysis that details how the flow may have been converted into roughly a $1M trader profit is summarized by TokenPost.

This incident is not just a quirky crypto headline. It’s an object lesson in how low-liquidity tokens, privileged account access, and thin markets combine into a high-risk surface for manipulation. For many traders, including those who monitor major digital assets like Bitcoin, such events are a reminder: liquidity is the defense that often prevents these exploits, and when it’s absent, bad actors can move prices with relatively small capital.

Timeline and how the $1M window opened

- Pre-event: BROCCOLI traded with very low depth on Binance — small bids and asks, wide spreads, and limited resting liquidity.

- Trigger: A market-maker account—reported to have privileged API or direct trading access—began sending aggressive orders that pushed price away from the last traded levels. Cryptopolitan’s piece links the unusual surge to a possible hacker or misuse of such an account.

- Exploitation: The rapid price moves created a temporary price-dislocation across venues and within Binance’s own orderbook. A trader or group of traders detected the mismatch and executed one or more trades timed to extract the spread and subsequent liquidity imbalance.

- Cash-out: According to TokenPost’s analysis of on-chain and orderbook traces, the exploit window was converted into an approximate $1M gain for the trader who acted on the arbitrage (the article outlines how covert market-maker manipulation can be monetized and cites the ~$1M figure).

Both reports point to a pattern: privileged account activity moved a thin market just enough to create a profitable trading corridor, and the speed of execution mattered more than the capital deployed.

Why low-liquidity tokens like BROCCOLI are turnkey opportunities for manipulation

Low-liquidity tokens have structural features that make them attractive targets:

- Thin orderbooks: A few aggressive orders can swing prices by tens or hundreds of percent. When there aren’t deep resting bids or asks, market impact per dollar traded is large.

- Latent concentration of inventory: Market-makers or token teams often hold concentrated inventory. If those accounts are used improperly, they can move price with seemingly legitimate flow.

- Privileged API and custodial links: Market-makers typically need elevated API privileges (fast order placement, high rate limits, conditional orders). If those credentials are compromised or misused, someone can generate synthetic liquidity or execute outsized, rapid fills.

- Cross-venue arbitrage gaps: Tokens listed on fewer venues create larger inter-exchange price gaps, so a local price shock on one venue can be exploited elsewhere.

Together, these factors create a low-cost, high-leverage attack surface for actors seeking to move price or extract spreads.

Technical vulnerabilities that enabled the BROCCOLI move

Below are the most salient operational and technical weaknesses that allow a market-maker account compromise or misuse to become a systemic problem.

Privileged API access and poor key segregation

Market-making accounts frequently require broad API rights: cancel/replace orders, large rate limits, and withdrawal access in some setups. When these keys are embedded in a single environment or shared across teams, they become a single point of failure. Attackers who gain those credentials can place or cancel orders at will, simulate volume, or spoof liquidity.

Thin orderbooks and lack of liquidity safeguards

Exchanges sometimes list small-cap tokens without enforcing minimum liquidity bootstraps. Without minimum resting depth checks or liquidity recency tests, automated flows (or compromised accounts) can push prices with minimal capital.

Insufficient real-time surveillance and anomalous flow detection

Standard surveillance tuned to spot price manipulation in major tickers may miss nuanced manipulative patterns in low-cap tokens. Anomalous order types, rapid cancels, or patterns consistent with a market-maker misusing privileged access require specialized, adaptive detection logic.

Weak separation of custody and trading rights

When access to trading keys is co-located with hot wallets or when custodial signing operations are not compartmentalized, there’s an elevated risk that a single compromise affects both orderflow and asset custody.

Lack of contractual and operational guardrails with market-makers

Exchanges may grant market-makers broad privileges without enforceable operational rules: activity windows, max order sizes relative to displayed depth, or mandatory third-party audits. Those gaps let improper behavior continue longer before manual intervention.

Concrete exchange controls and monitoring fixes

Exchanges that want to avoid repeat incidents should combine policy, architecture and tooling changes. Below are practical controls operators can implement.

Strengthen access control and API hygiene

- Enforce role-based API keys: split privileges by function (order entry vs. withdrawals vs. reporting).

- Rate-limit and geofence high-privilege keys.

- Mandate hardware-backed key storage (HSMs) for signing high-value operations.

Liquidity and market-quality protections

- Minimum resting depth and spread gates for new or low-cap listings.

- Circuit breakers that pause trading in a token when a price moves beyond dynamic thresholds relative to recent volatility.

- Minimum visible size requirements for orders from designated market-makers before those firms can claim market-maker status.

Enhanced surveillance tuned for low-liquidity markets

- Behavioral models that detect rapid cancels, repeated pull/push patterns, or asymmetric fills indicative of manipulation.

- Cross-venue price monitoring to highlight orphaned price shocks that suggest local manipulation.

Contractual and operational changes for market-maker programs

- Require market-makers to prove custody controls and operational resilience (audits, SOC2-type evidence).

- Time-box privileged windows: grant elevated privileges only during scheduled, auditable windows.

- Enforce slippage and position limits per account tied to median market depth.

Emergency response capabilities

- Fast manual kill-switches for specific tickers that allow instant suspension of trading when abuse is detected.

- Audit trails and immutable logs for all privileged API activity to accelerate investigations.

Custody best practices to reduce attacker blast radius

Custodians and exchanges must treat trading keys and asset custody as distinct security domains:

- Multi-sig and split custody: ensure withdrawals require multiple independent signers separate from trading credentials.

- Cold/hot wallet separation: trading operations should be funded from small hot pools, replenished with strict approvals.

- Key rotation and ephemeral credentials: market-maker APIs should be short lived and automatically rotated; long-term static keys are dangerous.

- Dedicated market-maker vaults: segregate inventories used for quoting from general cold reserves with tighter controls.

Bitlet.app and custodial platforms emphasize these separations as foundational — prudent operators will treat market-making access like a privileged cloud IAM role.

How regulators and institutional counterparties should respond

This is not just an exchange ops problem. Market integrity requires coordination across market participants and regulators.

For regulators and exchanges compliance teams

- Require transparent disclosures around market-maker privileges and any incidents affecting trading integrity.

- Mandate demonstrable surveillance for market abuse and periodic stress testing of low-liquidity listings.

- Encourage or require proof-of-reserves and custody audits that separately demonstrate control over trading keys and withdrawal keys.

For institutional counterparties and prime brokers

- Incorporate liquidity risk stress scenarios that specifically model privileged-account failures and thin-book manipulation.

- Demand contractual indemnities or clawback mechanisms when counterparty wrongdoing (or account compromise) creates outsized P&L swings.

- Perform due diligence on exchange operational practices — how they detect and remediate account compromise and whether they run independent real-time surveillance for low-liquidity tickers.

Market structure and listing policy changes

Regulators could require exchanges to apply graduated listing standards: more stringent checks for tokens with small free float, opaque tokenomics or concentrated issuer holdings. That will raise the cost of listing manipulative instruments and improve market robustness.

Practical takeaways for security-conscious traders

- Be cautious with low-liquidity tokens: one large or privileged account can move price far more than you expect.

- Watch for tell-tale orderbook signals: large invisible liquidity, rapid cancels, or price moves unaccompanied by cross-venue arbitrage opportunities.

- Prefer venues that publish surveillance and proof-of-reserve evidence and that demonstrate strong custody separation.

Closing thoughts

The BROCCOLI episode on Binance is emblematic: when privileged access meets thin liquidity, the outcomes can be both dramatic and profitable for opportunistic traders — sometimes to the tune of about $1M, as analysts summarized — and costly for everyone else. Fixing this requires better technical controls, contractual discipline for market-makers, stronger custody separation and regulatory expectations that reflect the reality of token market fragility.

Exchanges, custodians and counterparties that treat market-maker keys as the highest-risk artifacts, and that instrument their low-liquidity listing pipelines with appropriate gates and surveillance, will reduce the odds of the next BROCCOLI-style incident.