How Fiserv's Stablecoin and Bitlet.app are Transforming Digital Commerce

In the rapidly evolving world of digital commerce, innovations that bridge traditional finance and cryptocurrency are paving the way for a more inclusive and flexible financial ecosystem. One remarkable development is the integration of Fiserv's stablecoin solutions with Bitlet.app, a platform known for enabling crypto installment payments.

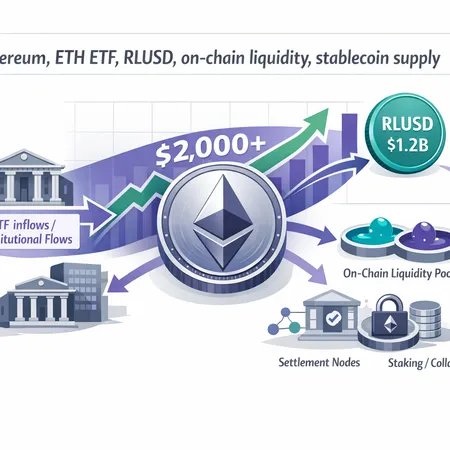

Fiserv, a global leader in financial technology, has launched its stablecoin to provide a secure and stable medium of exchange in the crypto space. Stablecoins are cryptocurrencies pegged to stable assets like the US dollar, minimizing the volatility typically seen in cryptocurrencies. This stability is vital for merchants and consumers who want the benefits of digital currency without the unpredictability.

Bitlet.app has taken advantage of this by incorporating Fiserv's stablecoin into its platform, enhancing the way digital commerce operates. Bitlet.app offers a unique Crypto Installment service, allowing users to purchase cryptocurrencies immediately and pay for them monthly instead of settling the full amount upfront. This service lowers the barrier to entry for many who are eager to enter the crypto market but are hesitant about large one-time investments.

The partnership between Fiserv's stablecoin and Bitlet.app's installment model solves two major challenges in digital commerce: payment stability and affordability. For merchants, accepting a stablecoin backed by a reputable financial firm like Fiserv means minimized risk and faster transaction settlements. For consumers, Bitlet.app's installment option provides greater flexibility, empowering them to manage their finances better while still participating in the crypto economy.

This synergy is transforming digital commerce by making cryptocurrency payments more accessible, practical, and trustworthy. Businesses can expand their payment options, attract crypto-friendly customers, and streamline their payment processes. Consumers benefit from new opportunities to invest and transact responsibly.

In essence, the collaboration of Fiserv's stablecoin with Bitlet.app symbolizes a significant leap toward mainstream adoption of cryptocurrency in everyday commerce. By addressing volatility and payment flexibility, they are shaping the future of finance where digital and traditional payment methods coexist seamlessly.

Explore more about Bitlet.app's innovative services and how you can leverage crypto installments today to join the digital commerce revolution.