Fiserv's Stablecoin and the Future of Digital Commerce: Unlocking Opportunities with Bitlet.app's Installment Services

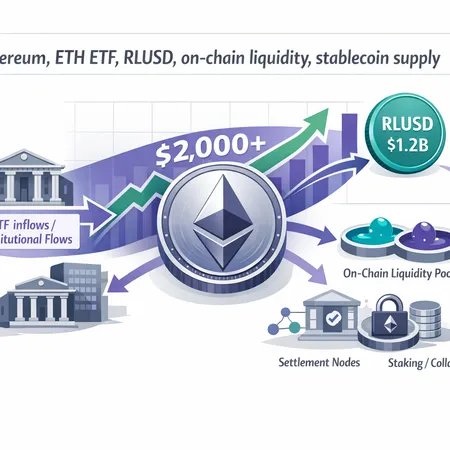

Fiserv, a global leader in financial technology, is pioneering the future of digital commerce through the development of its stablecoin. Stablecoins, being digital assets pegged to stable fiat currencies, enable faster, more secure, and transparent transactions — a crucial advancement for digital merchants and consumers alike.

The emergence of Fiserv's stablecoin signifies a transformative moment in how businesses and individuals engage in commerce online. By leveraging the security and efficiency of blockchain technology, digital payments become more accessible, trusted, and cost-effective.

This is where Bitlet.app steps in with its innovative crypto installment service. Recognizing that upfront payments for cryptocurrencies can be a barrier for many, Bitlet.app allows users to buy cryptos now and pay monthly installments rather than lump sums. This financial flexibility empowers more people to enter the digital asset space, enhancing adoption and liquidity.

Through Bitlet.app's platform, consumers can seamlessly integrate Fiserv's stablecoin and other cryptocurrencies into their spending routines while benefiting from manageable payment plans. This synergy between cutting-edge stablecoin technology and user-friendly installment options paves the way for a more inclusive and dynamic digital commerce ecosystem.

In summary, the collaboration between Fiserv's stablecoin innovations and Bitlet.app's installment services opens exciting opportunities for merchants and consumers by combining stability, convenience, and accessibility in the rapidly evolving world of digital finance.