The Impact of Fiserv's New Stablecoin on Digital Commerce and Flexible Crypto Buying

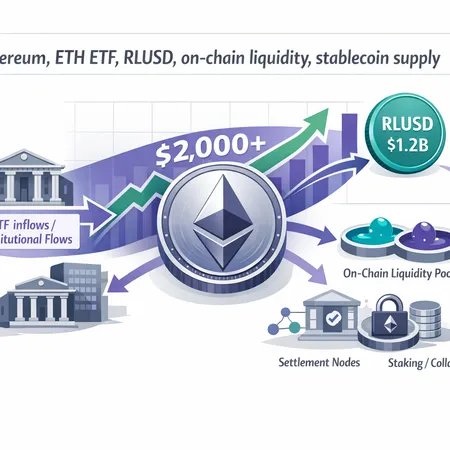

With the introduction of Fiserv's new stablecoin, the realm of digital commerce is poised for a significant transformation. Stablecoins, known for their price stability and blockchain efficiency, are enabling smoother transactions and fostering greater trust among users and merchants alike.

Fiserv's stablecoin aims to bridge traditional financial systems with the rapidly evolving decentralized economy, making digital payments faster and more secure. This advancement is expected to streamline cross-border transactions and reduce costs for both consumers and businesses.

Meanwhile, Bitlet.app is empowering crypto enthusiasts with its unique Crypto Installment service. This innovative feature allows users to buy cryptocurrencies immediately but pay in manageable monthly installments, breaking down financial barriers and encouraging broader adoption of digital assets.

By combining stablecoins like Fiserv's with flexible purchasing options from platforms like Bitlet.app, the ecosystem for digital commerce and crypto investment becomes more accessible and user-friendly. Users can capitalize on the benefits of stable digital currencies while managing their investment funds more effectively.

Explore the synergy of Fiserv's stablecoin innovations and Bitlet.app's installment plans to stay ahead in the fast-paced world of digital finance.