XRP Surge Explained: 140% On‑Ledger Jump, Escrow Unlocks and the Memo Confusion

Summary

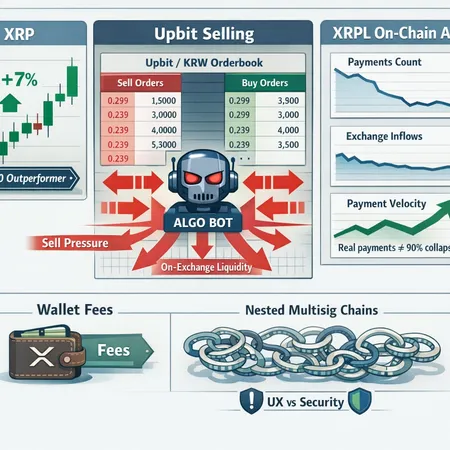

What happened: a big jump in on‑ledger activity

In mid‑period reporting, several on‑ledger metrics for XRP showed a sharp uptick — most notably a ~140% rise in payments and transaction volume on the ledger. That figure, reported in on‑chain coverage, points to materially higher settlement activity on the Ripple ledger over a compact window, not just a handful of exchange transfers or gas‑spam.

Why that matters: XRP was designed for cross‑border settlement and high‑speed payments. When payments — the actual use case — spike, it's a signal that more real economic activity is moving through the ledger, not only speculative orderflow. For payments‑focused analysts this is the kind of data that deserves attention alongside price charts.

The escrow unlock mechanism: rules, rhythm and market psychology

Ripple’s escrow system is mechanical: Ripple placed a large supply of XRP into time‑locked escrows and has historically released up to 1 billion XRP per month back to the company’s addressable balance. That release is a scheduled liquidity event, not inherently a sale. The market treats it as a potential selling supply because unlocked tokens can be sold, deployed for operations, or used in programmatic liquidity provisioning.

Mechanics to keep top of mind:

- Releases are scheduled and public — the timing and amount are not secret.

- Released XRP can be held, sold, or used for on‑ledger programs and institutional deals.

- The market impact depends on how much of the released supply reaches exchanges quickly and how deep the orderbook is at the time.

A recent episode added noise: a widely circulated escrow memo claiming a sale or transfer intention turned out to be fake, but not before it sparked short‑term selling pressure and headlines. Coverage of that episode helps illustrate how fragile sentiment can be when on‑chain annotations (like escrow memos) are misread or manipulated. Crypto reporting on the event documented the confusion and subsequent market reaction.

The fake memo incident: why an annotation can move markets

Escrow memos and auxiliary transaction metadata are easily visible to blockchain watchers. When a memo purportedly announces a large sale or transfer, traders — especially algo desks and high‑frequency strategies — can react immediately. In this case, the memo turned out to be disinformation, yet the market initially responded as if it were a credible signal.

A useful rule: verify provenance before trading on memo signals. The memo itself is not an enforceable instruction; it’s metadata. Operators that watch escrow releases should cross‑reference official Ripple statements and exchange flows. Coverage of the fake memo incident and its limited long‑term impact shows that markets eventually differentiate noise from verified action, but not before volatility and slippage occur.

For a contemporary read, see reporting that chronicles both the memo confusion and market reaction on this escrow unlock episode.

Technicals: buy signals and early revival signs

Amid the noise, several technical indicators flashed bullish signals that some traders interpreted as an early price revival. Momentum oscillators, breakout patterns and increasing on‑chain buying were cited as catalyzing evidence in market notes. Technicals don’t live in isolation — they’re most persuasive when aligned with improving fundamentals such as rising payment volumes and active addresses.

One report flagged a “major buy signal” for XRP that coincided with improving price structure and on‑chain accumulation. Those patterns matter: short‑term traders can exploit them, while longer‑term payments investors should treat them as complementary evidence rather than proof of a regime change.

How to weigh ledger fundamentals versus price noise

For payments‑focused investors and token analysts, the decision framework differs from momentum traders. Here’s a practical hierarchy to consider when assessing events like escrow unlocks and memo controversies:

- On‑ledger economic activity (first order)

- Payments volume, active wallets, and settlement velocity are direct proxies for the network’s payments utility. The 140% payment jump should be tested for persistence: is it a one‑off payroll cycle, an exchange routing change, or sustained adoption?

- Supply mechanics and unlock cadence (second order)

- Scheduled escrows are known; model their potential market impact by estimating the fraction that flows to exchanges versus being retained for corporate use or OTC deals.

- Transaction provenance and metadata (third order)

- Memos and labels can mislead. Always cross‑verify with official channels and on‑chain flow analysis before assigning market intent.

- Price technicals and liquidity (adjunct)

- Use technical buy signals as a cross‑check. If price is improving but on‑ledger use is flat or declining, the rally may be speculative.

This ordering keeps the payments narrative front‑and‑center while still acknowledging market microstructure.

Practical trader checklist: how to act on an escrow unlock day

- Verify: cross‑check memo claims against official Ripple communications and reliable chain analytics before reacting.

- Monitor real flows: watch whether unlocked XRP moves to centralized exchange cold wallets or to long‑term custody addresses.

- Watch depth and slippage: if exchanges show shallow orderbooks, even modest selling can move price. Size positions accordingly.

- Time horizon matters: escrow sales tend to pressure spot short‑term liquidity; longer‑term payment adoption reduces that risk over months.

- Use staggered orders: if buying, ladder entries to avoid chasing noise; if selling, consider limit orders to protect against sudden washouts.

Platforms that track ledger metrics — including those that power payment rails and settlement analytics — can cut through the noise. Bitlet.app and others now surface on‑ledger payment metrics that help separate genuine adoption spikes from one‑off flow events.

Interpreting the 140% jump: hype or durable signal?

A 140% increase in on‑ledger payment activity is notable; the next question is durability. Analysts should ask:

- Is the flow concentrated among a few addresses? (concentration reduces signal quality)

- Is the increase tied to a known payment use case (remittances, exchange settlement, institutional settlement)?

- Are active wallets and trust lines also increasing, or is this purely volume from a small number of counterparties?

If the spike comes with broader participation and repeated cycles of volume growth, it’s a structural signal supporting the payments narrative for XRP. If it’s concentrated and ephemeral, treat it as a catalyst for short‑term volatility rather than a permanent shift.

Final takeaways for payments‑focused investors

- Ledger fundamentals matter: a jump in payment volume is more relevant to the payments thesis than ephemeral price swings.

- Escrow unlocks are predictable but their market impact is variable. Don’t assume unlock = immediate sell‑off; measure where the supply actually lands.

- Memo data can mislead. Always verify provenance and corroborate with exchange inflows and official statements before acting.

- Use technicals as supporting evidence. When buy signals align with rising on‑ledger adoption, conviction is stronger.

In short: treat the recent events as a case study in how on‑chain economic activity and market mechanics interact. For payments analysts, the ledger — not the noise — should remain the primary source of truth.

Sources

- Coverage of the 140% jump in payment volume and network activity: U.Today report.

- Reporting on the 1B escrow unlock and the fake memo incident: Crypto.News analysis.

- Technical buy signal and early revival signs: CryptoPotato note.

For broader market context, remember that macro bellwethers like Bitcoin still influence risk appetite, and cross‑sector liquidity moves in DeFi can ripple into payment rails. Analyze both ledger evidence and market microstructure before assigning a long‑term payments thesis.