Tether’s Reserve Shift: Bitcoin, Gold and the Systemic Stability Question

Summary

Why Tether’s reserve mix matters now

Tether is the plumbing of modern crypto: USDT liquidity underpins trading, lending and collateral across centralized exchanges and DeFi protocols. When the issuer’s attested reserve composition shifts materially, it’s not merely an accounting update — it changes the economic profile of that plumbing.

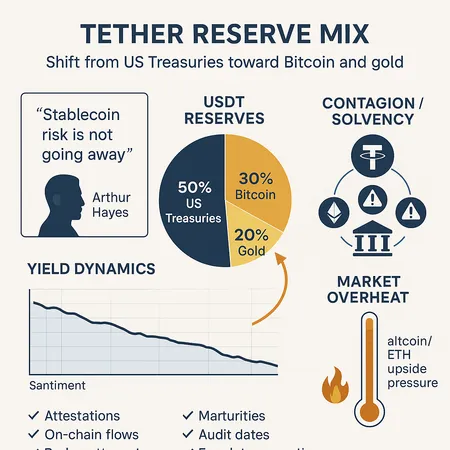

Shortly after Tether’s latest attestation disclosed a decline in Treasury holdings and an increase in Bitcoin and gold exposure, Arthur Hayes flagged the move as a meaningful risk signal. Hayes’ interpretation — covered in reporting from CoinGape and Blockonomi — is that Tether appears to be tilting reserves away from cash‑like Treasuries toward BTC and gold, potentially to capture upside ahead of favorable macro developments like a Fed rate cut. See Hayes’ comments here and here for his reading of the figures. His thesis is straightforward: holding more volatile or non‑cash assets in a vehicle used as a stable medium of exchange creates a structural tradeoff between yield/return and stability.

That tradeoff is what institutional risk officers must quantify. A reserve that looks liquid on paper (e.g., a gold spot position) may behave very differently under a fast redemption shock than an equivalent amount of cash or short‑dated Treasuries.

Interpreting Hayes’ critique: intent, plausibility and limits

Hayes argues the change is intentional allocation rather than a temporary trading position. It’s plausible for several reasons: issuers face pressure to earn on large float, and BTC/gold can offer asymmetric upside if macro conditions shift. But intent alone doesn’t equal insolvency. The key questions are about magnitude, liquidity and transparency — how big are the allocations, how readily can assets be converted to USD in a stress scenario, and how frequently are attestations produced to validate the picture?

Two further nuances matter:

- Timing and valuation: cryptocurrencies and commodities can swing fast. A large BTC position looks fine during calm markets but can erode reserve value quickly under correlated sell pressure.

- Operational liquidity: selling a position on the market versus using OTC desks or in‑kind redemptions has different market impact. Institutional buyers and OTC counterparties might absorb flows, but at what price and delay?

Hayes’ public warnings should be seen as an input — a red‑flag prompting scenario analysis rather than proof of imminent failure.

Contagion and solvency risk scenarios

When an issuer of a widely used stablecoin reduces the share of cash‑like instruments in its reserves, two broad failure modes emerge: liquidity mismatch and solvency erosion. They are related but distinct.

Liquidity mismatch: the run dynamic

If a significant share of reserves is held in BTC or gold, the issuer faces a mismatch: short‑dated redemption obligations met from longer‑dated or volatile assets. In a redemption surge, the issuer must either sell assets quickly (risking fire‑sale losses) or temporarily pause redemptions. Either outcome can cause knock‑on effects:

- Forced selling depresses BTC and gold prices, amplifying reserve shortfalls and prompting further selling (a feedback loop).

- Paused redemptions erode confidence in USDT, driving users to swap into other stablecoins or fiat — pressuring other issuers and central‑limit liquidity at exchanges.

A liquidity shock to USDT can cascade through exchanges (where USDT pairs are dominant), into lending desks that use USDT as funding, and into smart‑contract protocols that accept USDT as collateral.

Solvency erosion: valuation shocks and counterparty exposures

Solvency risk arises when asset devaluation is large enough that reserve market value falls below outstanding USDT. For example, if a meaningful portion of reserves is denominated in BTC and BTC experiences a rapid decline, the mark‑to‑market loss could create a capital shortfall.

Even without immediate insolvency, balance‑sheet uncertainty can create counterparty reaction: exchanges, market makers, or lending desks may limit USDT acceptance or apply haircuts. That reduction of utility leads to liquidity fragmentation, precipitating price dislocations across spot, margin and derivatives markets.

Plausibility and thresholds

To move from theory to practice, risk officers should model stress scenarios rather than rely on qualitative rhetoric. Useful scenario parameters include the share of reserves in volatile assets, the correlation of those assets with on‑exchange flows, and the market depth for rapid liquidation. Small allocations to BTC/gold are manageable; large allocations are not. The tipping point depends on absolute amounts and market microstructure — not just percentage allocation.

How stablecoin yields and demand fit into the picture

Santiment’s analysis draws attention to low stablecoin yields as an indicator that the market isn’t overheated and that capital could flow into risk assets like ETH. Lower lending yields on USD‑pegged instruments typically reflect abundant stablecoin supply or limited demand for leverage — both of which can precede risk‑on moves into altcoins and ETH. See Santiment’s note for the empirical view.

But the yield signal must be read against the reserve profile. If issuers are chasing returns by tilting reserves into BTC and gold to offset low lending yields, that raises the systemic stakes: issuers are implicitly taking market risk to defend peg economics or improve profitability. In benign markets, low stablecoin yields plus issuer return‑seeking can amplify a rally in ETH as liquidity finds risk assets. In stressed markets, however, the combination of lower yield margins, concentrated redemptions and volatile reserve assets can accelerate contagion.

A useful framing for risk officers: low yields reduce the immediate incentive for arbitrageurs to redeem stablecoins for yield chasing, but they also push issuers toward riskier reserve exposures to improve returns — increasing tail risk.

Monitoring metrics and red flags for institutional risk officers

Institutional risk teams should convert the narrative into a short, actionable dashboard. Below are prioritized metrics and how to interpret them.

Reserve and disclosure metrics

- Reserve composition (public attestations): percentage in cash, short‑dated Treasuries, commercial paper, BTC, gold, other assets. Rapid changes or opaque line items are red flags.

- Attestation frequency and granularity: monthly attestations with line‑item detail are preferable to sparse summaries.

- Market value vs par value: mark‑to‑market figures for volatile holdings and disclosed haircuts or liquidity buffers.

Liquidity and market flow metrics

- Net USDT mint/burn flows (on‑chain): sustained net minting alongside reserve shifts could indicate growth funded by alternative assets.

- Exchange USDT balances: rising balances on exchanges often precede selling pressure; falling balances can indicate withdrawals into custody or alternative coins.

- Large transfers to OTC or mixing addresses: concentration of movements to a few counterparties increases counterparty risk.

Yield and leverage metrics

- Stablecoin lending rates on major platforms and derivatives funding rates: divergence between lending and implied repo costs can signal arbitrage pressure.

- ETH inflows from stablecoins and DEX swap volumes: sudden reallocation of stable liquidity into ETH/altcoins is an early sign of risk‑on rotation.

Stress and scenario indicators

- Price impact of hypothetical liquidations: estimate how much reserve value could be lost if X% had to be sold within Y hours.

- Counterparty concentration: the share of reserves held with a few custodians or OTC desks.

- Redemption latency: how long would it take the issuer to meet redemptions under various market depth assumptions?

Practical thresholds will be institution specific, but as a rule of thumb: any material, sustained increase in volatile reserve assets above low‑single‑digit percentages of total liabilities should prompt heightened monitoring and scenario stress testing.

Regulatory questions and governance gaps to watch

Tethers’ reserve mix debate highlights several policy levers regulators should consider and that risk officers should lobby for clarity on:

- Definition of ‘high‑quality liquid assets’ for stablecoin backing. Should only cash and short‑dated sovereign paper qualify?

- Required liquidity buffers and minimum cash holdings to meet a one‑week or one‑month stress scenario.

- Attestation/audit cadence and scope: independent third‑party attestations or audits with public disclosure of asset granularity.

- Redemption rules and segregation: guarantees that funds backing redemptions are ring‑fenced and not rehypothecated.

- Concentration limits on volatile or hard‑to‑liquidate assets (including limits on crypto holdings in stablecoin reserves).

Regulatory clarity on these items would lower systemic fragility by aligning short‑term issuer incentives with market stability.

Practical steps for institutional investors and risk teams

- Build scenario models that combine reserve composition with market‑impact functions for BTC and gold.

- Establish counterparty exposure limits to any single stablecoin issuer and require contingency funding sources denominated in fiat or other high‑quality assets.

- Diversify settlement rails and stablecoin exposure — consider multi‑stablecoin and fiat alternatives for large treasury or custody operations.

- Demand higher‑frequency attestations and granular breakdowns before increasing exposure; incorporate attestation cadence into credit risk models.

- Monitor real‑time on‑chain flows and exchange balances; set automated alerts for abnormal minting, large transfers, or sudden balance shifts.

Platforms such as Bitlet.app can help monitor liquidity flows and trading counterparty exposures, but bespoke models are essential for large institutional positions.

Conclusion: a balanced vigilance

Tether’s increasing exposure to BTC and gold — and Arthur Hayes’ vocal critique — are timely reminders that stablecoins combine monetary utility with issuer risk. Low stablecoin yields suggest the market may still have room to run, potentially supporting ETH and altcoin upside, but they do not eliminate the structural fragility introduced by a less cash‑like reserve mix.

For institutional risk officers the path forward is pragmatic: convert headlines into quantified scenarios, insist on stronger disclosure, and stress test operational plans for redemption and counterparty contagion. The question isn’t whether reserve tilts are inherently bad — it’s whether the market can absorb them without turning a liquidity mismatch into a solvency crisis.