Monad (MON): Protocol Potential vs. the 'VC Dump' Argument — An Investigative Explainer

Summary

Executive summary

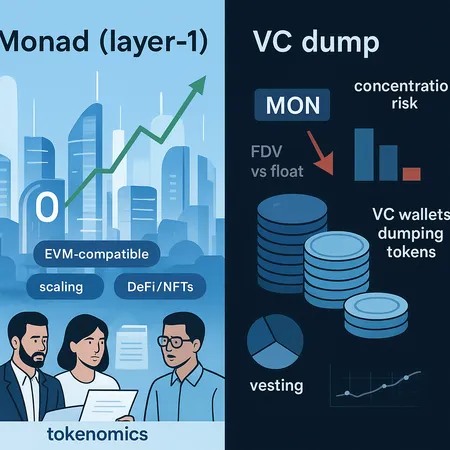

Monad (MON) is being pitched as a modern EVM‑compatible layer‑1 with ambitions to attract developers, DeFi projects, and NFT use cases. That technical narrative has attracted bullish price forecasts and long roadmaps from some commentators and price‑prediction sites. At the same time, high‑profile critics — most visibly Arthur Hayes — have argued the token’s distribution is structured to favor early VCs and insiders, creating a risk of heavy sell pressure when allocation cliffs and unlocks occur. This piece contrasts those narratives, explains the FDV/float mechanics driving the criticism, and offers concrete risk‑management steps retail holders can use while evaluating early‑stage layer‑1 exposure.

What Monad claims: EVM compatibility and use cases

Monad markets itself as an EVM‑compatible layer‑1 that aims to run smart contracts faster and with lower cost overhead than legacy chains. The pitch centers on practical developer incentives: existing Ethereum tooling (solidity, wallets, dev frameworks) should work with minimal migration friction. In plain terms, that lowers the barrier for DeFi teams and NFT builders to deploy on Monad, which is the primary network effect the team is selling.

Beyond raw compatibility, Monad’s roadmap highlights tooling, RPC improvements, and ecosystem grants intended to bootstrap activity — common playbook moves for new layer‑1s. These features are attractive if you believe that interop and developer experience win the next wave of applications. For many traders and analysts, that technical promise sits alongside macro liquidity trends — remember how Bitcoin and broader market cycles can amplify or suppress adoption narratives.

The bullish case and long‑term roadmaps

Bullish coverage emphasizes two arguments: first, that a compact, well‑engineered EVM alternative can capture developer mindshare; second, that token adoption will follow protocol usage as apps migrate or launch on the network. Some price outlooks that project a long horizon argue MON’s utility (gas fee capture, staking, governance) should underpin appreciation as usage grows. For a representative bullish take and forward‑looking price arguments, see a forecasting overview that lays out product utility and optimistic long‑term scenarios.

These bullish stories usually assume steady organic growth, partnerships, and a gradual unlocking schedule that doesn’t swamp markets. They also rely on optimistic adoption curves — which are possible, but not guaranteed. Realized outcomes hinge on both technical execution and the economic design of the token itself.

The critique: "VC dump" and tokenomics red flags

Not everyone buys the bullish narrative. Prominent skeptics, including Arthur Hayes, have labeled MON a potential "VC dump" — arguing the tokenomics structurally favors early investors and leaves retail holders exposed to concentrated sell pressure. Two accessible summaries of this line of critique are covered in this reporting and this follow‑up piece.

What critics highlight, in plain language, are two related tokenomic facts: high fully diluted value (FDV) relative to the circulating float, and sizable allocations to VCs/insiders with vesting schedules that eventually release large quantities of tokens. FDV is the market cap if all tokens were circulating today; a high FDV with a small float means the current tradable supply can be tiny compared to the total cap. If sizeable percentages are controlled by a handful of wallets (or by VCs with the right to sell as soon as cliffs pass), then the market faces a future where liquidity needs jump sharply when unlocks happen.

Critics argue that when unlocks are front‑loaded or feature shallow vesting (short cliffs followed by large, fast releases), VC holders can materially increase sell pressure. That dynamic can produce outsized volatility, and in worst cases, dramatic crashes as buyers fail to absorb the newly available tokens.

Why concentration risk matters for market mechanics

Concentration risk is not an abstract accounting detail — it changes how supply and demand interact. An otherwise promising chain can suffer severe price drawdowns if a few holders decide to exit. The reasons are simple: thin order books amplify the price impact of large sell orders; locked incentives to build on the chain can disappear if token value collapses; and negative price spirals can reduce user and developer confidence.

There are concrete ways concentrated ownership shows up on the market: repeated whale transfers to exchanges ahead of unlocks, sudden spikes in on‑chain sell transactions, and a mismatch between FDV and real liquidity. That’s why analysts track not just total allocations, but the unlock calendar, the identity (or behavior) of large addresses, and the typical cadence of VC sales in comparable projects.

How to read token distribution tables

When you open a token’s tokenomics table, pay attention to these items: the percent allocated to private/seed rounds, the vesting cliff length, the release cadence (monthly, quarterly), and whether tokens are held in multisig or escrow with visible rules. Short cliffs followed by long, front‑loaded releases are a red flag. Also check whether the public float is a small fraction of the FDV — that mismatch is the numerical expression of concentration risk.

On‑chain explorers and vesting dashboards can reveal when large allocations are scheduled to hit exchanges. Combine that with on‑chain balance tracking to see whether those large allocations move from cold storage to exchange addresses — a frequent precursor to selling.

Practical risk‑management steps for retail holders

If you hold (or are considering buying) MON, treat protocol belief and token economics as separate assessments. Here are practical actions you can take:

Position sizing: Limit any single‑position exposure to an amount you can tolerate losing. Early‑stage layer‑1s with concentrated tokenomics belong in the speculative slice of a portfolio.

Monitor unlock schedules: Use project docs and community tools to track the token unlock calendar. Note cliffs and the percentage of total supply unlocking at each milestone.

Watch on‑chain flows: Track large transfers from known VC or treasury addresses to exchange wallets. These flows are leading indicators of potential sell pressure.

DCA and installment plans: If you want exposure but fear timing risk, use a dollar‑cost averaging approach. Some platforms (for example, Bitlet.app offers installment features) can mechanize that process to avoid lump‑sum timing mistakes.

Use limit orders and pre‑set exits: Trading with limits reduces slippage and prevents emotion‑driven impulse selling during a panic.

Consider liquidity of alternatives: If you rely on staking rewards or protocol incentives, ensure those rewards compensate for the liquidity risk and the potential devaluation from future unlocks.

Diversify and hedge: Balance high‑risk tokens with more liquid and established assets; consider options or futures to hedge downside if you are a sophisticated trader.

Keep time horizon aligned to risk: If you are a short‑term trader, be prepared for spikes and rapid price movements; if you are a long‑term believer in the protocol, accept that token price volatility can be extreme and may not correlate neatly with technical progress.

Sober take: balancing protocol potential with tokenomics risk

Monad’s engineering narrative and roadmap may well be attractive to developers and end users; EVM compatibility is a real gating factor for adoption. But tokenomics — particularly FDV, allocation to early VCs, and unlock mechanics — are an equally important part of the investment story. A strong protocol but poor token distribution can still produce painful price action for holders.

Putting it together: evaluate the chain’s technical merit independently, then overlay tokenomic stress tests. Ask: how much of the upside depends on organic adoption versus concentration of ownership? How soon do large supplies unlock, and how likely are early backers to realize gains quickly? Answering those questions will help you decide whether to participate, and on what terms.