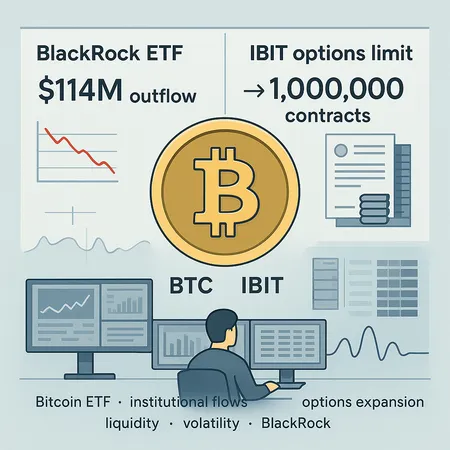

Institutional Rotation in Bitcoin Products: What $114M BlackRock Outflows and IBIT Options Expansion Mean

Summary

Executive overview

Institutional activity in Bitcoin-linked products is increasingly the dominant short-term driver of price moves. A recent $114M net outflow from BlackRock’s Bitcoin ETF — reported as evidence of institutional caution — and iShares’ bid to raise IBIT options position/exercise limits to 1,000,000 contracts are not isolated headlines: they are connected shifts in market structure. Understanding how ETF creations/redemptions interact with options expansion, dealer hedging, and liquidity provision is essential for allocators and derivatives traders who want to manage risk or find alpha in BTC markets.

Below I unpack the timeline and mechanics, explain why these developments matter for liquidity and volatility, and offer practical steps for trading desks and allocators.

Timeline and recent flow dynamics

Institutional flows into and out of spot-linked ETFs have become a near real-time barometer for sentiment and risk appetite. CryptoBriefing reported a $114M net outflow from BlackRock’s Bitcoin ETF, a concrete sign that some institutional holders have reduced exposure amid recent volatility. That outflow sits alongside continuing, smaller toggles across competing ETFs — inflows, outflows, and occasional redemptions that together create an ebb and flow of underlying spot demand.

What to watch on the timeline:

- Initial accumulation phase: Many institutions bought ETF shares as a convenient, custodial-access vehicle for BTC exposure, supporting steady creation activity and upward spot pressure.

- Volatility or macro shocks: When risk appetite wanes, ETF shares are redeemed or sold; authorized participants (APs) either return ETF baskets or sell spot BTC acquired via redemption into the market.

- Strategic rebalancing: Institutions rebalance exposure based on risk budgets, quarterly reporting, and macro views — leading to predictable windows of selling or buying pressure.

The $114M BlackRock outflow is notable because BlackRock’s ETF is large and liquid; a move there ripples through AP flow desks and hedging engines. While $114M is small relative to the global size of BTC markets, it represents concentrated selling pressure at the margin, which can move prices in low-liquidity windows and force short-term re-pricing across futures and options.

How ETF creation/redemption mechanics transmit to spot and derivatives

ETF creations and redemptions are the primary plumbing connecting institutional demand to the underlying asset. When APs create shares, they deliver BTC into the ETF vehicle (or cash to buy BTC), reducing spot sell pressure; when they redeem, they receive BTC that often enters the market. That conversion is mechanical, fast, and capable of transiently altering liquidity.

Derivatives desks step in to hedge flow-induced exposures. If an AP must sell BTC received from a redemption, market-makers will hedge delta exposure via:

- Spot trades or block sales when liquidity supports it.

- Futures/perpetuals for quick delta offset, often using nearby contracts with deep liquidity.

- Options: dealers selling calls or buying puts to offset directional risk, which generates further gamma/delta-hedging flows.

These hedges create feedback loops. A redemption that forces a futures sell into a thin order book can depress spot, prompting options dealers to re-hedge and amplify the move. Institutional deleveraging is particularly potent when several large players act in the same direction simultaneously.

IBIT’s options expansion: mechanics and market-structure implications

Nasdaq/ISE’s filing to raise IBIT options position/exercise limits to 1,000,000 contracts, now under SEC review, signals the potential for far larger concentrated options positions tied to an ETF wrapper. TheCurrencyAnalytics explains why the exchange requested this sizable increase and why the SEC’s review matters for clearing and systemic risk oversight.

Mechanics to understand:

- Position/exercise limits set the maximum exposure a single entity can hold in listed options. Raising the cap allows institutions to express larger directional or volatility views via listed options instead of OTC markets.

- Listed options on an ETF like IBIT are margin-cleared through standard exchange and clearinghouse infrastructure, which changes counterparty credit considerations versus bespoke OTC trades.

- Large listed positions concentrate delta and gamma exposures in the hands of market-makers and clearing firms, potentially increasing the size of daily re-hedging flows.

Market-making and risk-capital impact:

- Market-makers will need more capital or tighter spreads to warehouse larger option blocks. Higher capital commitments increase the cost of liquidity, which can widen bid-ask spreads in stressed conditions.

- Large options positions magnify gamma risk: as the underlying moves, dealers must adjust delta hedges aggressively, producing significant directional trading in futures and spot.

- Because the expansion would be tied to IBIT, a large options block could translate into concentrated selling or buying of ETF shares and the underlying BTC via AP activities, linking listed options risk to spot liquidity.

Why institutional caution and deleveraging amplify short-term moves

Institutional flows have features that retail flows do not: size, coordination (or coincident timing), and more rigorous risk management that can force mechanical actions (liquidations, redemptions, portfolio rebalances). These traits create a few amplification channels:

- Concentration: Even moderate outflows from large ETFs can require the sale of large spot blocks, especially when APs redeem.

- Hedging loops: Dealers quote options markets, but when those options move into loss, gamma-driven hedging (buying into strength, selling into weakness) can exacerbate volatility.

- Liquidity mismatch: Spot liquidity is granular and time-varying; a large order that would be neutral in normal conditions becomes price-moving in thin markets.

For derivatives desks, the combination of ETF-led spot selling and larger listed options positions means hedging demand can spike unpredictably. That creates short-term dislocations in basis (futures-spot spread), implied volatility, and funding rates in perpetual swaps.

Quantifying the transmission (framework, not exact numbers)

Traders should think in elasticities rather than absolutes. Useful diagnostics:

- Flow-to-price sensitivity: estimated price impact per $1M of net ETF outflow in given liquidity windows (varies by time of day and venue).

- Delta/gamma hedging ratio: options Greeks exposure per $1M notional of options position tied to IBIT; how many contracts translate into how much underlying delta for dealers.

- Basis sensitivity: how much futures premium changes per unit of spot selling pressure.

A practical model combines expected AP sale size, prevailing book depth on spot and futures, and dealer gamma exposure to simulate likely short-term moves and margin implications.

Practical takeaways for allocators and derivatives traders

Allocators

- Treat ETF flow data as a high-fidelity sentiment indicator: monitor large daily net flows for early signs of institutional rotation and adjust rebalancing windows accordingly rather than trading midflow.

- Use layered execution: avoid hitting the market with single large orders; use VWAP/TWAP, dark pools, and block trades through OTC desks to reduce market impact.

- Consider liquidity buffers: increase cash or liquid collateral during windows when options limits or large ETFs could concentrate risk.

Derivatives desks and market-makers

- Stress-test gamma scenarios: if IBIT options limits rise, simulate much larger concentrated options positions and the resulting intraday hedging requirements; ensure capital and margin buffers match worst-case re-hedging needs.

- Reprice liquidity: larger permitted options positions raise the cost of risk for market-makers — expect wider spreads in off-peak hours and higher fees for block trades.

- Hedge adaptively: use a mix of spot, futures, and options to manage delta and gamma. Consider using cross-exchange liquidity (spot venues, derivatives venues, and ETF desks) to minimize impact.

Risk managers

- Monitor counterparties: clearinghouses will see greater notional; keep an eye on margin rules and concentration limits at CCPs and prime brokers.

- Scenario plan for cascade events: a coordinated institutional drawdown can stress funding markets (perpetual funding rates) and cause knock-on margin calls.

Where this leaves market liquidity and volatility

If the SEC approves a sizable options limit increase for IBIT, markets will likely see greater capacity for large, listed options bets — which is a double-edged sword. On one hand, more institutional flows onto listed venues bring transparency and standardized clearing (reducing bilateral counterparty risk). On the other hand, the potential for larger concentrated positions increases the scale of dealer hedging flows that can destabilize liquidity in tight windows.

Net result: baseline liquidity may improve as more institutional participants engage through regulated venues, but intraday volatility spikes and temporary liquidity dry-ups will become more frequent during large flow events. That’s why tickers like BTC and ETF instruments need active monitoring by trading desks, and why products and platforms — including Bitlet.app for certain institutional workflows — will matter for execution and risk management.

Final checklist for immediate action

- For allocators: watch daily ETF net flow reports, avoid trading into reported redemptions, and maintain execution discipline.

- For traders: update hedging models to reflect larger listed options capacity and run high-frequency stress tests on gamma re-hedging scenarios.

- For operations and risk teams: validate margin and clearing capacity with counterparties and prepare contingency plans for rapid deleveraging.

Sources

- CryptoBriefing: BlackRock clients offload $114 million Bitcoin amid volatility

- The Currency Analytics: BlackRock’s Bitcoin ETF moves closer to major options expansion as SEC reviews 1 million contract limit

(For further reading on ETF mechanics and derivatives interactions, see topics like Bitcoin and how liquidity pools interlink with centralized and decentralized venues.)