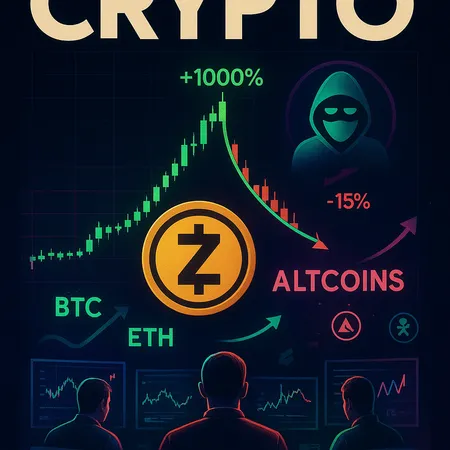

Zcash’s Parabolic Run: 1,000% Rally, 15% Pullback — What Traders Should Do Next

Summary

Zcash’s parabolic sprint and the 15% reality check

Zcash (ZEC) delivered one of 2025’s most dramatic altcoin stories — roughly a 1,000% advance over three months followed by a swift ~15% pullback as buyers paused to reassess. Market coverage of that run highlights both the size of the move and the early signs of exhaustion that followed; trade desks and charts flagged the reversal as a natural consequence of a parabolic move rather than an immediate trend death knell (BeInCrypto analysis).

For many speculative alt traders the question is simple: was that pullback a healthy reset or the start of a deeper unwind? The answer lives at the intersection of demand for privacy features, where liquidity came from, on‑chain supply behavior, and the broader sentiment that’s currently rotating through the altcoin market.

What drove the parabolic rally?

1) Renewed demand for privacy coins

Privacy narratives have an outsized effect when macro risk and surveillance concerns rise. Zcash, as a privacy coin with optional shielded transactions, benefits from a market that alternates between utility narratives and pure speculation. Renewed interest in privacy features — spurred by geopolitical headlines and trader hedging needs — helped fuel FOMO in ZEC.

2) Liquidity rotation: altcoin money that left BTC/ETH pain

When Bitcoin and major Layer‑1 tokens experienced bouts of pain or consolidation, traders rotated into smaller, high‑volatility names seeking outsized returns. The broader alt rotation is visible in several recent winners; some smaller tokens like RAIN even cracked the top 100 as fresh capital chased momentum (CryptoPotato roundup). This pattern — capital fleeing one part of the market and finding another — amplifies moves in illiquid assets.

3) Speculative focused order flow and concentration

Parabolic rallies are often driven by concentrated flows from early holders, market‑making quirks, and social momentum. When a thin order book meets urgent buyer demand, prices can accelerate far faster than fundamentals justify. That’s a key explanation for why ZEC quadrupled many times over a short window.

Technical exhaustion and on‑chain supply dynamics

Parabolic patterns, volume, and indicators

A classic parabolic rally shows three signals of near‑term exhaustion: a sharp divergence on momentum indicators (RSI, MACD), rising price on declining volume, and repeated failed attempts to meaningfully close above new highs. The 15% pullback is consistent with a market flushing overheated levered positions and letting liquidity rebuild.

On‑chain signs: supply concentration and exchange flows

Beyond charts, on‑chain metrics matter. When a meaningful portion of the circulating supply is held by a small number of addresses or when wallets that held through earlier stages begin to move coins to exchanges, those are caution flags. Conversely, prolonged accumulation on non‑custodial wallets can suggest stronger holder conviction. Reports during ZEC’s move pointed to distinct inflows and short‑term profit‑taking that temporarily hit order books, reinforcing the technical pullback narrative (BeInCrypto analysis).

Key risk factors traders must watch

Regulatory scrutiny of privacy coins

Privacy coins occupy a regulatory gray zone. Exchanges and jurisdictions periodically reassess listings, and privacy protocols are uniquely exposed to AML enforcement conversations. A regulatory notice or delisting threat can cause outsized price damage in a coin like ZEC — more so than for a mainstream token — so monitoring policy developments is essential.

Liquidity fragility and concentrated profit‑taking

Liquidity that looks ample at the peak often vanishes during a reversal. The recent Dogecoin ETF debut is useful context: ETF optics can deliver headlines without meaningful inflow, exposing how fragile apparent demand can be (CryptoSlate analysis of DOGE ETF flows). The same illusion occurs at smaller scales: social fervor and headline grabs can attract order‑book light buying that disappears when profit‑taking accelerates.

Market breadth vs. single‑asset mania

ZEC’s move happened alongside other alts posting huge gains; RAIN’s emergence into the top 100 is a signal of market breadth but also of speculative clustering. Breadth can support a rally but can also indicate a broad, momentum‑driven environment where exits can be simultaneous and fast (CryptoPotato coverage).

Trading strategies: capture continuation, manage reversals

Below are pragmatic approaches for speculative traders who want exposure to ZEC while controlling downside.

A) If you’re targeting continuation (trend‑following)

- Scale in on measured pullbacks: avoid buying right at new highs. Use Fibonacci or recent consolidation ranges to layer buys.

- Use trailing stops rather than static targets in a parabolic environment — they let winners run while protecting profits. Tighten stops as volatility compresses.

- Confirm with volume and on‑chain flows: prefer to add if exchange outflows or accumulation on non‑custodial addresses persist.

- Keep position size small relative to portfolio — parabolic names can mean re‑rate quickly.

B) If you’re planning for reversal or mean reversion

- Consider entering small short hedges on confirmed break of key support (daily close under a defined level), or buy protective puts where options exist.

- Use layered take‑profits: lock gains at incremental levels to avoid being stopped out by whip‑saws.

- Watch exchange order books and large depositor addresses — sudden spikes in exchange inflows often presage sharper downside.

C) Risk controls and execution details

- Predefine your maximum loss per trade (e.g., 2–4% of portfolio) and stick to it.

- Use limit orders to avoid slippage in thin markets; market orders can blow through liquidity and increase realized losses.

- Avoid chasing size during headlines — if you miss the move, it’s often safer to wait for a clearer re‑entry.

- For more sophisticated traders: hedge correlated exposure with a short position on a broad alt index or via inverse ETFs/derivatives on larger venues.

How ZEC compares with other recent alt movers (RAIN and friends)

ZEC’s narrative rests on a utility story — privacy — combined with speculative momentum. By contrast, some recent top‑100 entrants like RAIN rode pure narrative and momentum without the same grounded utility; that explains rapid ranking gains but also elevated fragility (CryptoPotato on RAIN’s rise). In short: breadth helps a rally, but it doesn’t guarantee sustainability. Traders should separate coins with durable on‑chain activity and adoption from those riding zeitgeist.

Practical checklist before risking capital in ZEC

- Confirm the macro tech signals (RSI divergence, volume profile).

- Check on‑chain flows: exchange inflows/outflows, large wallet movement.

- Size positions for volatility and use layered entries.

- Set stops or buy protection; consider options if available.

- Monitor regulatory news related to privacy coins and exchange listings.

- Keep an eye on market breadth — are many alts running together, or is this isolated?

If you use third‑party platforms, remember to verify liquidity and withdrawal controls; services like Bitlet.app can help traders assess exchange options and P2P liquidity when planning execution.

Final take: interpret the pullback, don’t overreact

The ~15% retracement after a 1,000% surge is not unusual; it can be a breathing spell or an early signal of distribution. For traders, the right approach is less about predicting a single outcome and more about managing risk: scale entries, watch on‑chain supply behavior, and be prepared to pivot if regulatory noise or sudden liquidity exits emerge. Parabolic rallies make fortunes and losses in equal measure — disciplined sizing and clear rules are the best hedge.