Can Native Staking Transform the XRPL? Tokenomics, DeFi, and the Road Ahead

Summary

Executive snapshot

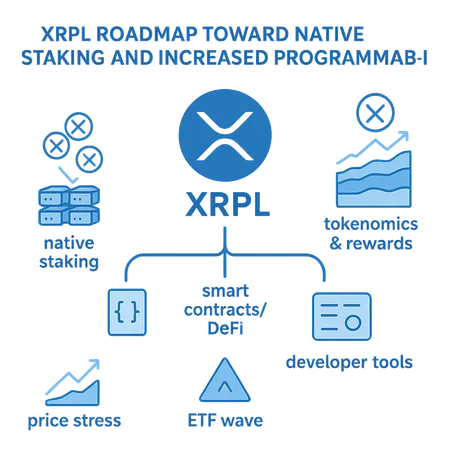

The XRP Ledger (XRPL) is at an inflection point: engineering work and public comments from Ripple leaders have signalled moves toward native staking and increased on-ledger programmability. That combination could turn XRPL from a highly efficient payments-focused ledger into a platform that supports yield-bearing positions, more complex DeFi primitives, and new tokenomics. But the path is neither automatic nor risk-free.

This article unpacks the technical analysis led by J. Ayo Akinyele of RippleX, synthesizes leadership remarks about the XRPL evolution, and assesses the likely economic and market effects — especially in the context of spot ETF momentum and recent price stress documented by market analysts.

Where XRPL sits today: design and constraints

The XRPL today is fast, low-cost, and designed around a quorum-based consensus (the XRPL Consensus Protocol with Unique Node Lists). Unlike proof-of-stake blockchains, XRPL historically hasn’t had native staking that locks balance to secure the network. Instead, the ledger’s economics are shaped by a fixed supply of XRP, transaction fees (which are burned), and application-layer innovations such as Hooks (a lightweight programmability effort).

That architectural baseline matters because introducing staking changes assumptions about censorship resistance, validator incentives, and on-chain reward flows. Changes must be backward compatible, preserve the ledger’s low-latency transactions, and avoid centralization regressions.

What J. Ayo Akinyele proposes: technical realism about native staking

RippleX Head of Engineering J. Ayo Akinyele has publicly explored how XRPL could support native staking without breaking its core properties. His analysis (covered by Tokenpost) is instructive because it doesn’t present staking as a single flip from one consensus to another; instead, it lays out pragmatic options and trade-offs.

Key takeaways from Akinyele’s write-up:

- Native staking need not imply a wholesale swap to a classical PoS design; hybrid approaches and carefully scoped mechanisms can introduce rewards and slashing-like deterrents while preserving XRPL’s consensus strengths.

- Any staking design must address validator selection and turnout: staking can’t hand control to a small set of well-resourced actors without clear decentralization safeguards.

- Integrating staking with existing features (burn mechanics, Hooks, token issuance) requires explicit tokenomic modelling to avoid unintended inflations or reward arbitrage.

Read the full breakdown and reasoning in Tokenpost’s coverage of Akinyele’s analysis: Akinyele on XRPL staking.

Ripple leadership: roadmap signals and programmability

Ripple’s senior technical voices and leadership have publicly described a roadmap for XRPL that emphasizes both evolution and caution. Coinpedia has summarized comments from Ripple leaders that the ledger is expected to receive iterative upgrades to support new use cases while maintaining performance and security guarantees. See coverage here: Ripple leaders outline XRPL evolution.

Programmatic primitives such as Hooks and other future modules are intended to bring limited smart-contract-style capabilities without the opaqueness of full Turing-complete virtual machines. The result could be a middle ground: richer programmability than payments rails, but simpler and faster than some DeFi ecosystems.

Tokenomics: how native staking would change yield, supply, and incentives

Introducing native staking alters three core tokenomic levers:

Reward distribution: staking rewards create a flow of yield to token holders who lock funds. Those rewards must come from somewhere — new token issuance, redistribution of fees, or third-party incentives.

Effective supply and dilution: issuance-based rewards increase circulating supply over time (inflation). If rewards are funded from fees (burn offsets), the deflationary mechanics change.

Security economics: staking ties network security to economic skin in the game. But that also creates concentration risks where large stakers (or custodial pools) wield outsized influence.

Design choices matter. Akinyele’s analysis flags hybrid designs that combine modest issuance with fee-based sinks to keep inflation in check. Conversely, if exchanges and institutional custodians aggregate staked XRP to serve ETF-like demand, a large share of staked supply could become centrally managed — affecting both governance and the perceived decentralization premium.

Staking, ETFs, and the current price environment

The macro picture is complex. On one hand, the wave of spot ETFs for major tokens has drawn institutional allocation and liquidity into crypto markets, and narrative momentum often supports assets with yield-bearing stories. On the other hand, XRP has recently faced price stress: analysts have noted a collapse in XRP ‘profit-share’ and lingering weakness despite ETF activity, suggesting that market flows are not uniformly bullish for every ledger or token class. CryptoPotato’s analysis on XRP profit-share highlights this fragility: XRP profit-share collapse analysis.

How staking would interact with ETFs and price stress:

- Demand coupling: native staking could make XRP more attractive to investors seeking yield on top of capital appreciation, potentially deepening demand during bullish cycles.

- Liquidity friction: if large ETF custodians or exchanges stake significant holdings, liquid supply could tighten and magnify volatility when funds are needed for redemptions or arbitrage.

- Perception & flows: during price stress, staking yields can encourage holders to lock tokens, reducing sell pressure. But if yields are insufficient relative to risk, staking won’t offset macro-driven outflows.

Real-world impact depends on implementation details: whether staking is voluntary, whether exchanges can offer liquid staking derivatives, and how rewards are funded.

DeFi prospects: what richer programmability enables — and what it doesn’t

Adding staking and expanded on-ledger programmability places XRPL closer to DeFi conversations. Practical outcomes could include:

- Native staking pools and delegation primitives that allow smaller holders to earn yield without running validators.

- Permissionless composability for payment rails — e.g., automated market makers tuned to XRPL’s settlement model and low fees.

- New custody flows: staking-aware wallets, custodial staking for institutions, and liquid-staking tokens that preserve capital efficiency.

But some limits remain. XRPL has historically traded full programmability for safety and speed. If upgrades preserve that philosophy, DeFi on XRPL may favor predictable, audited primitives (AMMs, stable swap rails, yield aggregators) rather than open-ended, high-risk smart contracts. For many developers, that’s attractive: simpler semantics reduce attack surfaces. For others, it’s constraining when compared to fully expressive platforms.

XRPL’s shift would also require extensive developer tooling, bridges, and incentive programs to attract liquidity. Akinyele’s engineering realism underscores that programmability must be tightly integrated with consensus and staking primitives — something that takes time and careful design.

Adoption hurdles and governance questions

Technical and economic design is only half the battle. Adoption hurdles include:

- Validator decentralization: staking must avoid concentrating control. That may require protocol limits on validator influence, delegations rules, or slashing mechanisms that are robust in practice.

- Exchange and custodian integration: major exchanges need clear operational APIs and custodial models to stake holdings securely while supporting withdrawals and ETF custody.

- Regulatory clarity: staking yields introduce securities-like considerations in some jurisdictions; institutions will seek legal certainty before providing or custodying staking services.

- Developer tooling and composability: SDKs, audited standard contracts (or Hooks libraries), and cross-chain bridges are essential for a functional DeFi stack.

Operationally, the community must also decide on governance cadence: how are upgrades adopted and who signals acceptance? Ripple’s leadership has committed to iterative evolution, but the community dynamics around a staked XRPL will matter.

Practical scenarios: conservative, hybrid, and aggressive

Three plausible outcomes over a 12–36 month horizon:

- Conservative: Minimal staking features that enable delegation to validators but no major issuance. This preserves XRPL’s low inflation profile while offering basic yield.

- Hybrid: Modest issuance-based rewards + fee sinks; limited programmability via Hooks extensions. This balances yield with deflationary pressure and opens moderate DeFi use-cases.

- Aggressive: Full staking with liquid-staking derivatives, broad programmability, and active DeFi ecosystem. This maximizes developer possibilities but raises centralization, security, and regulatory stakes.

Which path plays out will depend on engineering trade-offs that Akinyele and RippleX have already started exploring and how market participants (exchanges, custodians, ETF providers) react.

Takeaways for developers and investors

- Developers: Expect incremental, backwards-compatible upgrades. If you build for XRPL’s future, prioritize composable, audit-friendly patterns and stay current with Hooks tooling. Extensive testing against validator scenarios will be essential.

- Investors: Native staking can add a yield narrative to XRP, but the long-term price impact depends on reward funding and liquidity behavior, especially given recent price weakness noted by market analysts.

For market participants exploring custody or staking services, platforms like Bitlet.app could play a role in providing staking-as-a-service once protocol-level decisions are finalized.

Conclusion

Native staking and increased programmability on the XRPL represent meaningful strategic shifts, not mere feature toggles. J. Ayo Akinyele’s engineering analysis and Ripple leadership commentary frame a cautious, pragmatic approach that seeks to preserve XRPL’s speed and safety while enabling new economic models.

Whether staking materially changes tokenomics and DeFi prospects depends on the chosen reward mechanism, governance safeguards, and how institutional actors (exchanges, ETF custodians) integrate staking into their flows. Given current market fragility in XRP noted by analysts, careful design that balances yield with decentralization will determine if staking becomes a catalyst for deeper adoption — or an added complexity that magnifies concentration and regulatory risk.

For further technical reading, see Tokenpost’s coverage of Akinyele’s analysis (https://www.tokenpost.com/news/investing/17629), BeInCrypto’s primer on XRPL staking and DeFi possibilities (https://beincrypto.com/xrp-ledger-staking-defi/), Ripple leadership updates summarized by Coinpedia (https://coinpedia.org/news/xrp-news-ripple-leaders-outline-new-changes-coming-to-the-xrp-ledger/), and market context regarding XRP’s profit-share dynamics at CryptoPotato (https://cryptopotato.com/ripple-xrp-profit-share-collapses-to-58-5-could-a-major-correction-be-looming/).

For many traders, XRP sits somewhere between a payments rail and a traded asset; XRPL’s programmability ambitions put it in direct conversation with broader DeFi narratives — and how those conversations resolve will shape the ledger’s role for years to come.