Zcash’s Rebound: Coinbase Search Spike, $1,000 Resistance, and the Privacy-Coin Question

Summary

Why ZEC suddenly mattered to retail: the Coinbase search spike

Last week Zcash (ZEC) climbed to the top of Coinbase’s most-searched list — an attention grab that made traders and crypto-watchers ask whether a genuine narrative shift was underway or if this was another, short-lived retail fascination. Media coverage amplified the moment: industry outlets noted the flip in search interest, signaling a retail curiosity spike that often precedes higher intraday volatility. See the report that highlighted how ZEC briefly outranked more familiar names on Coinbase searches here.

Search trends matter because they often translate into order book pressure: people searching tend to convert into buys on easy on-ramps and exchanges. But search data alone is noisy. What traders need is confirmation from volume, order flow and real on-chain engagement before declaring a sustained regime change.

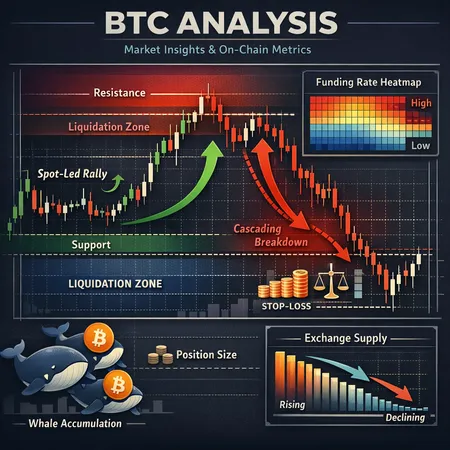

The technical picture: testing the $1,000 resistance

Technical analysts have pointed to a clear level near $1,000 that will act as a make-or-break zone for ZEC. Recent chart work argues that bulls have defended key pivot levels, opening a run toward that resistance band; conversely, failure to clear it could quickly sap momentum. A concise technical take that highlights the $1,000 resistance and bullish scenarios is available in this analysis here.

From a trader’s perspective, the metrics to watch are:

- Volume on breakouts: A clean close above $1,000 on elevated volume suggests institutional or sustained retail follow-through. Low-volume spikes are vulnerable to quick unwinds.

- Order book depth and bids: How much liquidity stands under current prices will determine how far stop-hunts can push the market.

- Volatility context: With the broader market showing pressure at times (see live altcoin coverage), ZEC’s moves are likely to be amplified by market-wide sentiment shifts. Recent coverage on altcoin pressure and market-wide selloffs provides useful background on volatility risks here.

A disciplined trader will treat a $1,000 break as conditional: only meaningful if accompanied by expansion in on-chain metrics and reduced exchange selling pressure.

On-chain interest: signals that matter (and those that don’t)

On-chain data can separate a headline-driven pump from sustainable adoption. For ZEC the most relevant indicators are:

- Active addresses and transaction counts: A rise in unique active addresses and transactions suggests growing real usage beyond simple curiosity. Recent weeks have shown modest upticks, but not the explosive growth that historically signals durable network adoption.

- Exchange flows (balances and net flows): Sustained withdrawals from exchanges into private wallets can signal accumulation by retail or long-term holders. Conversely, rising exchange balances often precede selling pressure.

- Shielded activity: Zcash’s privacy value proposition relies on shielded transactions (Sapling and z-address adoption). Despite headlines, shielded txs historically represent a relatively small share of total ZEC activity. A genuine privacy-driven revival would require a meaningful increase in shielded usage — something that, to date, remains limited.

- Long-term holder distribution: Increasing supply in long-term wallets (older than 6–12 months) indicates accumulation that supports higher prices; supply concentration among short-term traders or exchanges raises the odds of quick profit-taking.

Taken together: recent on-chain signals show higher interest but fall short of the sustained, structural changes you want to see for a long-term bull thesis. If search interest converts into real shielded flows or steady withdrawals from exchanges, the case strengthens. Until then, the rally risks being a retail-driven spike.

How regulatory pressure reshapes the privacy narrative

Privacy coins sit at the intersection of user demand for confidentiality and regulators’ concerns about illicit finance. That tension has been intensifying. Policymakers in several jurisdictions have signaled tighter controls on privacy-enhancing tokens, which complicates routing, custodial support and exchange listings.

This matters for ZEC specifically because listings and on-ramp access determine the liquidity pool available to buyers. If major exchanges or regulatory frameworks restrict privacy-coin trading, retail-driven spikes — even if large — can evaporate quickly when buyers find fewer exit points. At the same time, geopolitical and macro tailwinds (e.g., capital flight, censorship-resistant use cases) could support niche demand for privacy tools. The result is a bifurcated outcome: strong usage in certain scenarios, constrained mainstream adoption.

Regulatory uncertainty therefore increases both upside and downside volatility. Traders should price in asymmetric outcomes: either a constrained, higher-premium niche market or increased friction that curtails growth.

Is this a breakout or a blip? A practical framework for traders

For practitioners deciding whether to treat ZEC’s run as a tradable breakout or a transient curiosity, here’s a compact checklist:

- Volume confirmation: Does a move above $1,000 happen on materially higher trading volume? No volume, no trust.

- On-chain follow-through: Look for rising active addresses, growing shielded transaction share, and net outflows from exchanges. These are higher-quality signs of interest than search metrics alone.

- Liquidity and market structure: Check order book depth and options/derivative positioning (if available). Thin liquidity amplifies risk.

- News and regulatory headlines: A favorable listing or a glaring regulatory clampdown will move the needle faster than organic growth.

- Macro correlation: Is ZEC moving with broader risk appetite (altcoins) or decoupling as a privacy-specific play? Correlation matters for hedging.

Scenario outcomes:

- Bull case: Clean break above $1,000 with expanding volume, exchange withdrawals, and rising shielded activity — leads to a sustained multi-week or multi-month move.

- Bear/Blip case: Sharp spike tied to Coinbase search and social chatter but lacking exchange withdrawals and shielded uptake — likely fast fade and mean reversion.

Actionable trade ideas and risk controls

If you’re trading ZEC around this narrative, consider these practical rules:

- Use staggered entries: take partial positions on the breakout and add only if on-chain and liquidity conditions improve.

- Tighten stops under key intraday support levels; privacy coins can gap quickly when liquidity thins.

- Size positions for event risk: regulatory headlines can create outsized moves.

- Watch related market signals: for many traders, Bitcoin remains the bellwether — a broad market selloff will likely drag ZEC down even if coin-specific narratives are positive.

Also keep an eye on cross-market interest in privacy narratives within broader ecosystems like DeFi, where privacy tools could find incremental use cases (e.g., private swaps or confidential lending) that materially change on-chain demand.

Bottom line

ZEC’s leap to the top of Coinbase search charts is meaningful as a short-term liquidity and volatility trigger — it put privacy coins back on many traders’ radars. But conversion from headline attention to a sustainable uptrend requires coordinated confirmations: a decisive technical breakout above the ~$1,000 band on strong volume, clear on-chain metrics showing increased real usage (especially shielded transactions and net exchange outflows), and manageable regulatory risk.

In the current environment, Zcash sits in a high-conviction, high-risk category: attractive for event-driven traders who manage position sizing and news risk, less so for passive investors seeking predictable, long-term adoption. Monitor the technical resistance, watch for on-chain follow-through, and factor regulation into any allocation. For those seeking convenient execution while researching the trade, platforms such as Bitlet.app make it easy to track order flow and market access — but the core decision should rest on volume, flows and regulatory clarity.

Stay cautious, and treat the Coinbase search trend as one signal among many rather than a standalone green light.