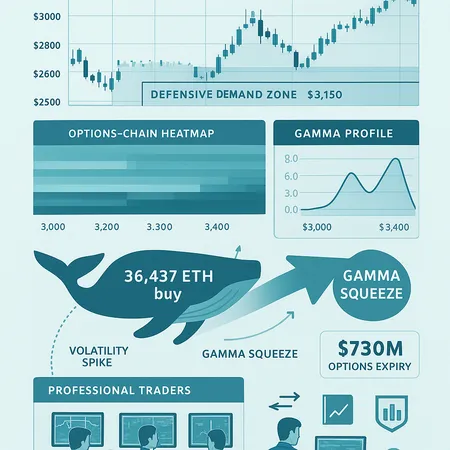

How the $730M ETH Options Expiry and a 36,437‑ETH Whale Buy Reshaped Short‑Term Volatility

Summary

Executive snapshot

The recent expiry of roughly $730 million in Ethereum options concentrated open interest into a narrow frontier of strikes and expiries, creating asymmetric, short‑term risk for dealers and market makers. At the same moment, chain data and exchange reporting showed a single buyer expanding a position by 36,437 ETH, a large accumulation that changes the supply/demand equation in spot liquidity pools. Together these events redefined short‑term gamma, increased the chance of abrupt volatility spikes, and carved out actionable plays for options traders and prop desks.

Why large options expiries amplify moves (mechanics)

Options expiries matter because of dealer hedging. When dealers sell options to clients, they typically hedge by buying or selling the underlying to remain delta‑neutral. Near expiry, that hedge ratio (gamma exposure) changes nonlinearly: as strikes move in‑ or out‑of‑the‑money, the hedges must adjust quickly. If a large chunk of OI is clustered around certain strikes, these dynamic trades can cascade into a gamma squeeze—the underlying moves force hedges that further push the underlying in the same direction.

Skew and strike concentration amplify the effect. Heavy put OI can lead to put‑pinning or concentrated buying if dealers are short puts and need to buy spot into weakness; conversely, concentrated call OI can create upside squeezes. Size matters: the reported ~$730M expiry is large enough to create localized liquidity stress in tight markets, especially in front months where liquidity is shallower (source reporting the expiry).

What the $730M expiry implies for short‑term ETH gamma and volatility

Ahead of expiry, implied volatility (IV) tends to rise as market participants reposition; delta hedging activity can make realized volatility overshoot IV. Immediately after expiry, two competing dynamics appear:

- Net gamma is often reduced after large expiries because open interest clears and dealer hedging requirements drop, which can lower dealer‑induced volatility (short‑term calming effect).

- But if large OI was concentrated into a few strikes and price moves toward one of those strikes during expiry, reactive hedging can cause a transitory spike in realized volatility and intraday liquidity stress.

The practical takeaway: front‑month IV may be elevated into expiry and then normalize—but intraday whipsaws are more probable during the roll/settlement window. Traders should watch option skew, front‑month gamma maps, and order‑book depth on major venues.

On‑chain accumulation: the 36,437 ETH buy and its implications

Chain and market reports indicate a whale expanded a position by 36,437 ETH, bringing their holdings into the billions in USD terms. That level of accumulation is material for several reasons: it represents a buyer willing to absorb sizable liquidity, it can provide a psychological backstop to price declines, and it can make short squeezes more painful if the buyer refrains from selling into drawdowns (reporting on the whale buy).

From a trading desk perspective, a large buy lowers the marginal supply available in on‑chain liquidity pools and centralized exchange order books. If this whale is strategic (long term), their unwillingness to sell can steepen the short‑term supply curve—making price more reactive to flows from deleveraging or liquidations.

The technical anchor: $3,150 demand zone

Independent technical analysis identifies roughly $3,150 as a defended demand zone where buyers step in repeatedly. That zone becomes more meaningful when combined with options expiries and institutional accumulation: it acts as a natural stop‑hardness area and a place where dealers may see reduced efficacy of forced selling (analysis of the demand zone).

Risk managers should treat this zone as a reference for: stop placement, sizing thresholds, and potential liquidity cliffs. If price approaches $3,150 during a volatile roll, hedge ratios and execution algorithms should account for the higher likelihood of either aggressive absorption or a sudden breakdown if the zone fails.

Playbook: strategies for options desks

Pre‑expiry, determine your net gamma exposure by expiry bucket. If you are net short gamma into a large expiry, consider:

- Reducing position sizes or converting to spreads (e.g., buy wings to cap downside) to limit acute hedging sensitivity.

- Rolling short dated OTM positions to wider strikes or later expiries to lower gamma.

Use calendar or diagonal spreads to harvest term premium while capping short‑dated gamma. These structures let you remain long vega while lowering immediate re‑hedging needs.

For directional views, prefer defined‑risk structures: vertical spreads or ratio spreads where the max loss is explicit. In a highly concentrated expiry environment, open uncovered naked short positions invite gamma risk.

Gamma scalping discipline: if you choose to remain short gamma, ensure high‑quality delta hedging (tight re‑hedge thresholds during roll windows) and account for slippage costs; expect transient liquidity evaporation.

Skew arbitrage: if skew is rich on puts versus calls, a put‑sell position can pay off, but size conservatively—being short tail puts into a large expiry with a nearby demand zone is risky if liquidity dries.

Playbook: strategies for spot desks and prop traders

Execution: for large buys/sells use TWAP/POV or block trades via OTC desks to avoid moving price into your own execution. If you suspect a gamma squeeze, avoid aggressive taker orders that exacerbate the move.

Liquidity layering: break orders into multiple venues and venues' native pools (AMMs vs CEX orderbooks). Watch slippage against liquidity at $3,150—orders executed there may meet resting bids from the defensive buyer.

Pair trades: hedge directional risk with options (buy put protection) if you carry inventory through expiry. A small put purchase can dampen P&L volatility if dealer‑induced whipsaws occur.

Size and ruin risk: define maximum position size as a fraction of realized daily volume and portfolio VaR—large on‑chain accumulation means you may be squeezed on the margin more easily.

Operational checklist for the roll window

- Pre‑expiry: map front‑month gamma heatmap; flag top strikes by OI.

- Execution: pre‑announce large fills to OTC counterparties; avoid market‑sweep taker fills in narrow books.

- Hedging: tighten delta hedge thresholds and have contingency liquidity for rapid rebalancing.

- Monitoring: watch on‑chain whales, funding rates, and liquidation ladders in real time.

Final thoughts

Large expiries like the recent ~$730M event and concentrated on‑chain buys (36,437 ETH) are not binary signals but forces that change the microstructure around ETH. They increase the chance of short, violent moves driven by dealer hedging and liquidity cliffs, while defended demand zones such as $3,150 provide useful anchors for risk frameworks. Options desks should prioritize explicit max‑loss structures and gamma maps; spot desks should focus on execution and inventory protection.

For traders building tooling and automation around these events, incorporate real‑time OI, skew, funding, and on‑chain alerts into your dashboards—and consider plugging such feeds into execution systems used by platforms like Bitlet.app to reduce slippage during concentrated flows.

Keep a short list of signals to act on: concentrated front‑month OI, widening skew, whale accumulation activity, and price approach to key demand zones. When several line up, tighten risk controls rather than widen them.