Pi Network Tokenomics Stress Test: Heavy Unlocks, Price Pressure, and How Holders Should Respond

Summary

Where PI stands now: price, perception, and the unlock headline

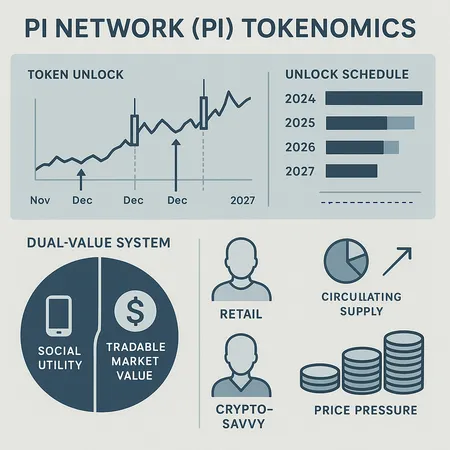

Pi (PI) is trading in a narrow range near $0.22, a level that has become a focal point for both speculative buyers and risk-conscious holders. That calm is deceptive: beneath the surface, a heavy token unlock schedule starting in November–December is set to release meaningful additional supply into the market. For retail and savvy investors this is not just about short-term volatility — it’s a long-run tokenomics story that plays out across multiple years and can reshape price behavior through 2027.

Market narratives matter. Many buyers still anchor to earlier, higher valuations, while sellers react to immediate liquidity events. Bitlet.app users and other retail traders should treat the current price as a snapshot in a much longer supply timeline.

The immediate unlock wave: November–December and why it matters

The near-term schedule is the clearest stressor. Analysts have highlighted a heavy multi-month unlock cadence beginning this period, a phase when previously illiquid PI allocations start converting into circulating supply. Coinpedia has covered the near-term dynamics, noting how Pi trades near $0.22 just as a significant unlock phase begins and how that cadence can create downward pressure when holders decide to realize gains or reallocate capital (Coinpedia: PI breakout analysis).

Why this matters:

- Increased circulating supply = more tokens available to sell, which can create price pressure if demand does not keep pace.

- The identities and incentives of unlocking parties (early contributors, node operators, team allocations) affect sell behavior.

- Market depth at $0.22 — not especially deep — makes PI more sensitive to blocks of sell-side volume.

These points mean that short-term spikes down or sideways price action are more likely than a clean move higher while large unlocks are active.

A longer runway: scheduled releases through 2027

Pi’s tokenomics are not a one-off event. The unlock schedule stretches over years, and the market will be asked repeatedly to absorb new supply. The pattern of releases — both predictable and staggered — creates multiple windows of potential price stress.

A staggered unlock schedule can be both stabilizing and destabilizing: it prevents a single catastrophic dump but ensures recurring liquidity events that test market appetite. Over time, if ecosystem growth (use cases, listings, on-chain activity) does not match the inflow of tokens, the natural result is prolonged price pressure. Analysts examining the token’s structural story highlight these headwinds and caution against assuming a quick reclaim of prior highs without fundamental adoption accelerating in parallel (Coinpedia: dual-value-system and unlock analysis).

Historical behavior around unlock events — what markets usually do

Crypto markets have established behavioral patterns around token unlocks:

- Volatility increases: order books thin and price moves amplify with modest sell volume.

- Shorts and opportunistic traders target unlock windows, adding pressure.

- Some unlocking holders sell immediately to de-risk, while others attempt staged exits — this split creates a choppy, two-way market.

For PI specifically, prior micro-events (test unlocks, announcements) have shown that markets discount future supply ahead of time: prices often drift lower as an unlock approaches and then either bounce or continue lower after the release, depending on demand.

The practical takeaway: expect volatility and plan for it rather than assume price will ignore supply dynamics.

The dual-value-system narrative and structural headwinds to reclaim past highs

One of Pi’s oft-cited selling points is a dual-value system: a utility or network value side (usage, internal economy, activities) and a speculative market value side (exchange price, investor sentiment). This framing can be powerful — but it’s also fragile when token release schedules favor supply shocks.

Why this creates structural headwinds:

- Utility value grows only if real on-chain or off-chain demand scales; without that, market value is left to macro and speculative flows.

- Reclaiming past highs requires both renewed speculative appetite and demonstrable adoption — and the unlocks increase the supply bar for that recovery.

- Large-cap or institutional buyers that could soak supply are not guaranteed to step in unless they see sustainable demand signals.

The result is a higher asymmetry of risk: upside requires sustained user adoption and capital inflows, while downside can arrive quickly as new tokens hit the market. Coinpedia’s analysis of Pi’s dual-value-system emphasizes how unlocking dynamics are a core driver of price fluctuations rather than a peripheral issue (Coinpedia: dual-value-system analysis).

How scheduled supply releases through 2027 could shape price action and investor behavior

Thinking in calendar blocks is useful. Each major unlock window forms a decision point for holders and markets:

- Early unlocks (now–2025): Likely high volatility as larger allocations become tradable. Short-term traders may profit from swings; long-term holders will face repeated liquidity temptations.

- Mid-term (2025–2026): Market begins to price in long-term adoption signals. If on-chain activity and listings grow, this period could see consolidation or selective recoveries. If not, continued downward drift is possible.

- Long-term (2026–2027): The cumulative effect of many unlocks will be apparent — either absorbed by real demand or reflected in persistently lower price multiples.

Investor behavior will mirror incentives: participants with short-term liquidity needs or lower conviction will likely sell early, whereas committed builders and believers may hold or stagger exits. The key market variable is demand: without a clear, growing utility economy for PI, scheduled supply releases will keep caps on price appreciation.

Risk-managed approaches for holders and potential entrants

For retail and crypto-savvy investors, a sober, actionable approach beats hope. Consider these practical steps:

- Map the unlock schedule: know when sizable allocations vest and who holds them. If you can’t do that precisely, assume November–December is high-risk and plan accordingly.

- Position sizing and allocation: limit exposure to an amount you can afford to hold through multiple unlock windows. Treat PI as a higher-risk alt with potential high volatility.

- Staged selling: instead of an all-or-nothing exit, consider selling portions across unlock events or price milestones to reduce timing risk.

- Dollar-cost averaging (DCA): if adding exposure, use DCA rather than lump-sum buys during active unlock phases.

- Use stops and alerts cautiously: given volatility and thin order books, aggressive stop-losses can be gamed; instead use mental stops or staggered limit orders.

- Monitor on-chain and off-chain adoption signals: listings, active wallets, merchant or partner integrations, and developer activity. These are the best indicators that demand may absorb supply.

- Hedging and alternatives: advanced traders can hedge with short positions or options where available, but hedging costs and liquidity constraints matter.

These moves help preserve capital and optionality while the tokenomics stress test plays out.

Scenario planning: three plausible outcomes

It helps to think in scenarios rather than predictions:

- Controlled absorption: demand grows (listings, partnerships, real utility), big holders sell slowly, and PI consolidates higher over many months. This requires tangible adoption.

- Repeated pressure, slow grind lower: unlocks outpace demand, price trends downward as incremental supply meets insufficient bids. Volatility remains high.

- Rapid sell-off followed by reset: a cluster of selling triggers panic, price collapses briefly, then finds a new equilibrium once most motivated sellers have exited.

Which scenario unfolds depends on adoption, macro flow into risk assets, and holder behavior.

Practical checklist before you act

- Review the published unlock schedule and note major vesting dates.

- Decide your time horizon: are you a trader (weeks–months) or a holder (years)? Align position size.

- Set clear rules for staging sells or buys; write them down.

- Track liquidity (order book depth) at your exchange of choice and avoid market orders in thin markets.

- Keep some dry powder: if you believe in PI long-term, having capital to average down after major sell-offs can meaningfully improve outcomes.

Final thoughts: sober realism over wishful thinking

Pi Network’s tokenomics stress test is real and will be iterated through multiple unlock windows into 2027. The immediate November–December wave is the first publicized pressure point, and historical patterns suggest heightened volatility and downside risk during unlocks. The dual-value-system narrative offers a plausible path to recovery, but it depends on measurable demand growth that outpaces scheduled supply releases.

For retail investors and crypto-savvy holders, the prudent approach is a combination of awareness, size discipline, and staged actions. Don’t anchor to past highs — instead, map the unlocks, plan entries and exits around them, and watch tangible adoption signals. For tools and P2P options while managing positions, some users find platforms like Bitlet.app helpful for diversified strategies, but platform choice should come after you’ve built your risk plan.

If you hold PI, think in unlock windows, not headlines. That framework will keep risk manageable and decisions clearer as tokenomics play out.