Sierra Protocol Launches SIERRA: First Liquid Yield Token (LYT) on Avalanche — What Product Managers Need to Know

Summary

Why SIERRA and Liquid Yield Tokens matter right now

Sierra Protocol’s launch of SIERRA, billed as the first Liquid Yield Token (LYT) on Avalanche, arrives at a moment when yield products are evolving beyond plain staking and centralized savings accounts. Product managers and advanced yield-hunters are watching for primitives that offer instant yield, composability across AMMs and lending markets, and clearer separation between principal and yield. In short: a token that represents a claim on an income stream from day one can change how DeFi liquidity is structured and monetized.

LYTs are designed to pay yield immediately — no unstaking windows, no delayed validator rewards, and no custodial lockups that you typically see in CeFi savings products. For Avalanche DeFi this could mean LPs can earn while they provide liquidity, integrate yield directly into strategies, and design vaults that distribute income continuously rather than waiting for epoch-based rewards.

DeFi protocols, VCs, and institutional treasuries that follow Avalanche will want to understand not just the marketing claim of “instant yield” but the on-chain mechanics that underpin SIERRA.

What is a Liquid Yield Token (LYT)? Core mechanics explained

An LYT is a transferable token that represents a claim on ongoing yield produced by an underlying reserve or revenue stream. Key mechanical elements typically include:

- Immediate accrual: When a user mints SIERRA, yield rights begin accruing to the token holder rather than waiting for epoch settlements. Mechanisms to deliver this include continuously rebasing balances, yield-per-token accounting, or a streaming reward contract.

- Separation of principal and yield: The LYT separates the capital stake (the backing assets held by the protocol) from the flow of future yield. That enables trading the right to future income independently of the capital asset.

- Reserve composition: Underlying reserves can be staked assets, yield-bearing strategies, lending positions, or stablecoin reserves that earn interest. The protocol manages that basket to generate the underlying income.

- Minting and redemption: Users mint SIERRA by depositing collateral (AVAX, stablecoins, or other qualifying assets). Redemption burns tokens and returns principal according to protocol rules — sometimes with a settlement delay mitigated by reserve liquidity.

- Accounting and tokenomics: Yield-tokenomics define fee splits, streaming rates, rebase rules, and governance parameters that determine how yield is distributed and how protocol revenue is allocated.

In SIERRA’s case, the offering emphasizes instant yield accrual and composability on Avalanche, making it attractive for strategies that require yield to be available to vaults, AMMs, or cross-chain bridges without stake- or epoch-based latency.

How LYT (SIERRA) differs from liquid staking derivatives and CeFi yield

There are three product archetypes to compare: Liquid Staking Derivatives (LSDs), CeFi yield products, and LYTs like SIERRA.

Liquid Staking Derivatives (LSDs): Protocols like Lido mint derivatives (e.g., stETH) that represent staked principal plus accrued staking rewards. LSDs mirror protocol-native staking economics and are tightly coupled to validator mechanics and reward timings. Accrued rewards are typically realized via rebase or redemption when the underlying chain finalizes rewards.

CeFi yield products: Centralized platforms pool assets and pay out interest from their internal lending and market operations. These are custodial, off-chain black boxes with counterparty and withdrawal liquidity risk. Yields can be stable but rely on the provider’s solvency and risk management.

Liquid Yield Tokens (LYTs) such as SIERRA: LYTs prioritize delivering a tradable claim on income that starts immediately. Unlike LSDs, LYTs can be backed by diversified income sources (e.g., lending strategies, AMM fees, stablecoin reserves) rather than staking rewards tied to validator performance. Unlike CeFi, LYTs are non-custodial by design: yield accrues on-chain according to deterministic tokenomics.

In short: LSDs = stake + rewards coupling; CeFi = off-chain custody; LYT = immediate income claim + on-chain reserve diversification.

Why Avalanche is a natural fit for SIERRA

Avalanche’s fast finality, low fees, and growing DeFi stack make it attractive for tokenized yield products. The ability to stream rewards or rebase frequently without prohibitive gas costs allows SIERRA to deliver noticeable instant yield to smaller holders, not just whales. Developers can integrate SIERRA into AVAX-native AMMs, lending markets, and stablecoin pools with low friction.

For context on network performance and integration design, see Avalanche’s docs and architecture: https://docs.avax.network/.

Potential benefits for AVAX liquidity providers and stablecoin-backed strategies

LYTs like SIERRA can unlock several practical advantages:

- Composability at mint: Because yield rights accrue instantly, vaults and LP strategies can start compounding immediately. That helps automated strategies capture more alpha and simplifies yield routing.

- Improved capital efficiency: GLP-style or AMM LPs can collateralize positions with SIERRA to convey future income streams to liquidity providers without locking the underlying principal.

- Predictable cash flows: For treasury managers building stablecoin-backed yield strategies, a token that streams yield allows straightforward accounting and revenue recognition.

- Lower friction for hedging and derivatives: Traders and market makers can hedge yield exposure explicitly by trading SIERRA, rather than approximating with complex positions across LSDs or staking derivatives.

- New liquidity primitives: SIERRA can serve as a building block for structured products — e.g., senior/junior tranches that split principal risk from yield risk — useful for institutional onboarding.

These features make SIERRA attractive for advanced yield-hunters and DeFi product teams aiming to create multi-layered yield strategies on Avalanche.

Risks and failure modes product teams must consider

No product is without trade-offs. Key risks for SIERRA and LYT designs include:

- Reserve shortfall / liquidity mismatch: If redemptions spike and reserve liquidity is insufficient, the protocol may impose delays or use market sales, creating slippage and loss for redeemers.

- Smart contract vulnerabilities: Streaming reward contracts, rebasing logic, and multi-contract coordination expand the attack surface. Audits and bug bounties are essential.

- Oracle manipulation and accounting mismatch: Incorrect yield-rate feeds or stale valuation oracles can over/understate accruals and distort minting/redemption math.

- Peg and market risk: For stablecoin-backed LYTs, exposure to stablecoin depegs or reserve assets losing yield can stress the token’s value.

- Concentration and counterparty risks: Relying on a few protocols or custodians for yield generation recreates centralization risks similar to CeFi.

- Regulatory and compliance risk: Tokenized income streams for institutions can attract securities scrutiny in some jurisdictions; compliance-ready features (KYC, on-chain traceability) may be required.

Mitigations include over-collateralization buffers, multiple independent yield engines, on-chain transparency of reserve composition, conservative redemption windows, and proactive governance frameworks.

Adoption pathways for institutional stablecoin pools

Institutional adoption requires more than yield arithmetic. Product managers should map a clear pathway:

- Transparency and attestations: Regular reserve audits and realtime dashboards that show reserve composition and live yield rates (e.g., streaming rate per SIERRA) reduce counterparty concerns. Links to audited statements or on-chain proof-of-reserve matter.

- Custody & compliance integrations: Support common institutional custody integrations and KYC/AML optional modules. Partnerships with regulated custodians can placate treasury teams.

- Accounting & reporting: Offer granular accrual reports, per-block or per-hour yield logs, and tax-ready statements to integrate into institutional accounting systems.

- Liquidity provisioning: Seed deep pools with market makers and incentivize AMM pairs (SIERRA/USDC, SIERRA/AVAX) so treasury desks see low slippage when allocating capital.

- Conservative tokenomics: Institutions prefer predictable fees and fee floors; governance levers should not enable sudden changes that could affect yield. Consider configurable locks for large redemptions.

- Legal framing: Clear terms of use, whitepaper-level clarity on yield sources, and legal opinions on whether SIERRA constitutes a security in target jurisdictions.

Institutional stablecoin pools (USDC, USDT) could use SIERRA as a way to offer a tokenized coupon-style yield on deposits — with stablecoin reserves earning in lending markets and the yield streamed to SIERRA holders. Circle’s reserve transparency model is a useful reference point when designing institutional confidence features: https://www.circle.com/en/usdc.

Practical checklist for DeFi product managers evaluating SIERRA-style LYT

If you’re considering building or integrating SIERRA or similar LYT vehicles, evaluate these items:

- Reserve composition and diversification rules

- Streaming accounting model (rebasing vs per-token accrual)

- Redemption mechanics and emergency liquidity provisions

- Oracle design and fallback strategies

- Fee model and yield splits (protocol vs suppliers)

- Audit history, formal verification, and bug bounty coverage

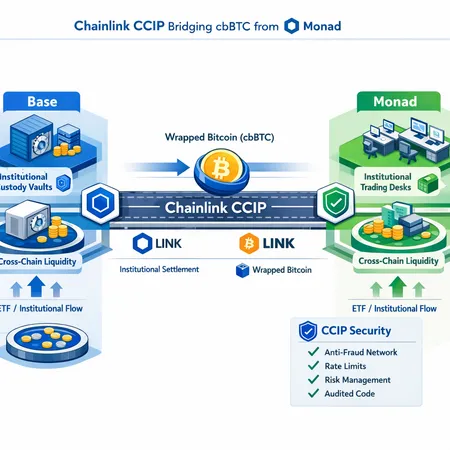

- Integration primitives for AMMs, vaults, and cross-chain bridges

- Compliance hooks and institutional onboarding flow

A rigorous due-diligence checklist reduces operational surprises and makes integration into treasury stacks and yield aggregator strategies cleaner.

Where this fits in the broader crypto market

LYTs sit between liquid staking derivatives, yield strategies, and CeFi savings. They can be less