Avalanche

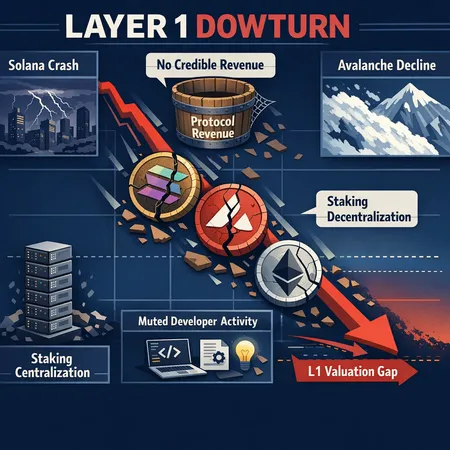

In 2025 major Layer‑1 tokens like SOL and AVAX plunged as market expectations collided with weak protocol revenue and growing centralization risks. This post‑mortem explains what broke, with a practical investor framework to separate durable L1s from hype.

A practical breakdown of AVAX’s near-term bullish thesis: why a MACD-driven breakout could lift price into a $20–$25 range, and how swing traders should size positions and place stops around the ~$15.62 support. Includes scenario math (28–60% upside), relative strength vs other L1s, and concrete risk rules.

Sierra Protocol introduces SIERRA, a Liquid Yield Token (LYT) on Avalanche that accrues yield instantly without staking delays. This feature explores SIERRA’s mechanics, contrasts with liquid staking derivatives and CeFi yield, and outlines benefits, risks, and institutional adoption paths for AVAX DeFi and stablecoin pools.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility