Tokenization at Scale: Canton’s $6T and Franklin Templeton Point to Institutional Settlement Maturation

Summary

Why scale matters now

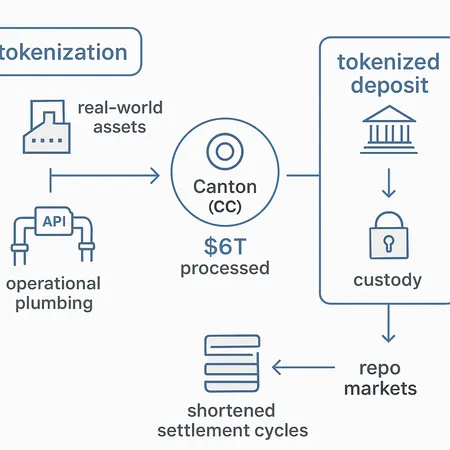

The phrase tokenization at scale has been a near-constant headline for years, but two developments make the claim harder to dismiss: Canton (CC) reporting roughly $6 trillion in processed assets across its settlement fabric, and large traditional players such as Franklin Templeton integrating tokenized workflows into fund operations. Taken together — and when viewed alongside central bank pilots like the CNB’s $1M tokenized deposit test — these data points suggest tokenized settlement is no longer confined to isolated pilots. It's entering the realm of real transaction flow for institutional counterparties.

These signals are important for allocators and product leads because scale changes the risk equation: network effects begin to reduce counterparty friction, operational edge cases are revealed and solved, and liquidity patterns start to resemble those in legacy markets. For portfolio operations teams deciding whether to move an allocation or collateral overlay onto tokenized rails, the question is no longer whether tokenization can work in principle, but whether the operational plumbing, custody model, and legal frameworks are robust enough for live, regulated use.

Tokenization matters not as an exotic architecture but as a way to make assets behave like programmable, instantly transferable instruments. And platforms such as Canton are proving that design can handle size.

Evidence from the field: Canton, Franklin Templeton, and central bank pilots

What Canton’s $6T figure means

When a settlement fabric reports $6 trillion in processed assets, it is not just a vanity metric. It signals repeated usage, composability across asset types, and that on‑chain or ledger-based message flows are interoperating with off‑chain custodians and custodial banks. For institutional operations this matters because it demonstrates throughput, exception handling, and reconciliation patterns at scale — all the mundane but essential parts of settlement.

Canton’s architecture (CC) emphasizes finality guarantees and atomic swap primitives between on-ledger tokens and off-ledger obligations. That approach reduces settlement risk and shortens the time window in which intraday credit exposures can accumulate. For product leads assessing rails, the implication is straightforward: fewer manual reconciliations, faster collateral reuse, and clearer chain-of-custody data.

Franklin Templeton’s integration as a bellwether

A major asset manager wiring tokenized products into its distribution and custody stack demonstrates enterprise buy-in. Franklin Templeton’s integration — whether for tokenized funds, share classes, or settlement staging — functionally proves that legacy operations teams can map existing processes onto token rails without rewriting the entire operations manual. For allocators, this means more counterparties become capable of receiving, safekeeping, and transferring tokenized instruments under established KYC/AML and investor‑servicing workflows.

Central banks and tokenized deposits: the CNB $1M test

Central bank experiments change the framing of tokenized settlement. A tested tokenized deposit (like the CNB $1M experiment) puts a sovereign backing on a tokenized liability model: a token that represents a central bank claim rather than a private ledger balance. Institutional nets and intraday liquidity managers start to evaluate tokenized deposits as potential settlement mediums, which could eventually coexist with or complement wholesale CBDC initiatives.

When central banks can issue or validate tokenized liabilities, market participants gain a credible medium of finality that reduces settlement and credit concerns compared with entirely private tokens. That said, broad adoption will require clear policy on legal tender status, reserve treatment, and interbank access.

The operational plumbing: how settlement actually happens

Institutional adoption hinges on plumbing: message formats, finality semantics, custody handoffs, and connectivity to payment systems. Below I break down the critical components.

Finality, atomic settlement and messaging

A core benefit of tokenized settlement is atomicity — the ability to move asset and cash legs simultaneously so neither counterparty is left exposed. To realize atomic settlement in practice, platforms implement cross‑ledger messaging and conditional settlement primitives (hash time‑locked contracts, notarized message relays, or built‑in atomic swap logic). For institutions this reduces settlement fails and short-term credit exposure.

However, finality semantics differ by system: some ledgers provide legal finality immediately; others provide probabilistic finality. Operations teams must map ledger finality to their internal risk and accounting cutoffs.

Custody: native tokens vs. wrapped representations

Custody is no longer just about key management. Institutional custody for tokenized real‑world assets requires:

- Legal title transfer mechanisms and clear documentation that token ownership equals beneficial ownership.

- Support for multi‑sig, HSM, and delegated signing patterns used by institutions and custodians.

- Managed safekeeping for on‑chain keys with reconciliation to off‑chain records.

There are two common custody models: native token custody (where a regulated custodian holds keys and validates chain activity) and wrapped‑asset custody (where a custodian issues an off‑chain obligation represented by a token). Each has tradeoffs in legal clarity and operational complexity.

Interoperability and settlement rails

Real-world asset flows require interoperation between token rails, banking rails, and messaging standards (e.g., ISO 20022). Bridges, notary services, and standardized event schemas are essential. For instance, to settle a tokenized bond against bank cash, the token platform must interoperate with a payment system or a tokenized deposit mechanism — otherwise you recreate the same settlement latency in a different ledger.

Regulatory and custody hurdles product teams must solve

Adopting tokenized settlement isn’t just an engineering exercise — it’s a regulatory and legal one.

Securities law and legal wrappers

Tokens that represent securities must be wrapped in legal structures that satisfy securities law and transfer restrictions. Product teams need enforceable smart contract logic, transfer agents that reflect on‑chain transfers into shareholder registries, and legal opinions tying token transfers to beneficial ownership.

Custody licensing, fiduciary duty and third‑party custodians

Regulated custodians must reconcile statutory custody obligations with the cryptographic realities of private key control. This often leads custodians to layer legal agreements (custody contracts and indemnities) and technical controls (threshold keys, hardware security modules). Firms must also anticipate auditability and proof-of-reserve expectations from regulators and clients.

Cross‑border AML/KYC and reconciliation

Tokenized flows blur jurisdictional boundaries. AML/KYC obligations remain: token transfers must carry attestations of KYC or be restricted to whitelisted counterparties. Moreover, cross-border settlement requires harmonized tax reporting and reconciled recordkeeping to satisfy diverse regulator demands.

Where tokenized collateral adds value to repo markets

Repo markets are a natural fit for tokenized collateral because they depend on speed, divisible value, and re-use efficiency.

Increased collateral velocity and lower intraday liquidity needs

Tokenized collateral can be transferred instantly and programmatically re-pledged, cutting the time and manual steps needed to move securities between triparty agents, clearing banks, and custodians. Faster settlement reduces the need for intraday liquidity facilities and margin buffers, lowering costs for both lenders and borrowers.

More precise rehypothecation controls

Smart contract–based control layers make it possible to encode rehypothecation rights, haircuts, and automated margin calls directly into the token or its governing contract. That transparency reduces disputes and can allow for more aggressive collateral optimization while still enforcing legal limits.

Expanded asset classes and fractionalization

Tokenization makes smaller denominations practical. That can broaden collateral sets available in repo markets (e.g., private credit tranches or fractionalized commercial real estate), increasing market depth and potentially lowering financing costs for real‑world asset issuers.

Risks specific to tokenized repo

Tokenized collateral changes risk profiles: smart contract bugs, oracle failures, and bridge vulnerabilities are operational hazards. Institutions must pair smart contract risk mitigation with legal fallback procedures so that a technology failure does not upset the enforceability of claims in insolvency.

How traditional asset managers can shorten settlement cycles using token rails

Asset managers and product leads have several pragmatic levers to shorten settlement cycles and improve collateral efficiency.

Practical steps and guardrails

- Start with custody and legal certainty: contract with a regulated custodian that offers institutional key management and an explicit legal opinion on token ownership.

- Limit initial use cases: pilot tokenized settlement for intra‑fund transfers, cash management, or bilateral repo before moving to broad client distribution.

- Use standardized token interfaces: pick tokens and rails that support programmatic margin calls and standardized event logs for reconciliation.

- Build fallbacks: ensure a fallback process to legacy settlement in case of ledger outages or regulatory holds.

Integration with back‑office systems

Shorter settlement cycles demand tighter integration between ledger events and portfolio accounting systems. Managers should invest in middleware that maps on‑chain events to general ledger entries, corporate actions workflows, and investor NAV calculations.

Counterparty and liquidity considerations

Before reducing settlement buffers, confirm counterparties accept the same token standards and have compatible custody arrangements. Liquidity needs to be tested in stressed scenarios — tokenized markets may show different liquidity dynamics than legacy markets.

Governance, standards and the next 12–24 months

For tokenized settlement to become mainstream, three developments should progress in parallel: stronger legal frameworks (clarifying property rights and insolvency treatment), custody/regulatory standards (for institutional key management and proof-of-reserves), and interoperability protocols (for cross‑ledger atomic settlement and messaging). Institutional pilots by managers and custodians, combined with central bank experiments like CNB’s, create momentum but require coordinated standard setting.

Bitlet.app and similar platforms will play a role in productizing these primitives for fund operations, but ultimate scale depends on legal clarity and counterparty adoption.

Conclusion: from pilots to transaction flow

Canton’s $6T processing milestone, Franklin Templeton’s integration, and central bank tokenized deposit pilots together paint a picture of maturation: tokenized settlement is transitioning from isolated proofs to viable transaction rails for institutions. The benefits for repo markets and fund operations — faster settlement, improved collateral velocity, and programmable rehypothecation controls — are real, but so are the challenges around custody, legal wrappers, and cross‑border compliance.

For institutional allocators and product leads, the opportunity is tactical and strategic: run narrow, well-governed pilots that integrate custody and accounting, pressure-test liquidity in realistic stress scenarios, and engage with custodians and regulators early. If those steps are taken, tokenized settlement can shorten settlement cycles materially and change how collateral efficiency is achieved in modern portfolio operations.