Navigating the GENIUS Act 2025: Stablecoin Regulations and Flexible Investment Options with Bitlet.app

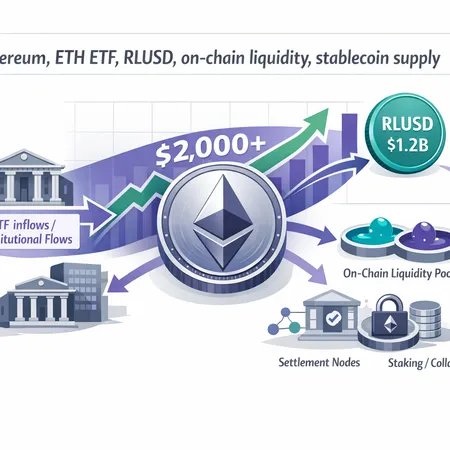

The introduction of the GENIUS Act 2025 marks a significant milestone in the regulation of stablecoins, aiming to establish clearer legal frameworks and promote safer, more transparent usage of these digital assets. As stablecoins continue to grow in popularity, regulatory clarity is critical for investors and businesses alike.

Bitlet.app stands out as a forward-thinking platform during this transition. Recognizing the evolving regulatory landscape shaped by the GENIUS Act, Bitlet.app offers users flexible investment options, including a unique Crypto Installment service. This feature allows investors to purchase cryptocurrencies immediately and pay over time with manageable monthly payments, making crypto investing more accessible and budget-friendly.

By leveraging Bitlet.app's Crypto Installment service, users can effectively navigate the new regulatory environment with more confidence and liquidity. This flexibility is particularly valuable as the GENIUS Act introduces compliance requirements that may impact how investors manage their crypto portfolios.

In summary, the GENIUS Act 2025 is setting the stage for a more regulated stablecoin market, and Bitlet.app is empowering investors with innovative tools designed to adapt to these changes. Whether you're a seasoned crypto enthusiast or just starting, Bitlet.app's flexible payment options can help you stay ahead in this dynamic space.