Navigating the Dark Side of Crypto: Safety Tips for Investors

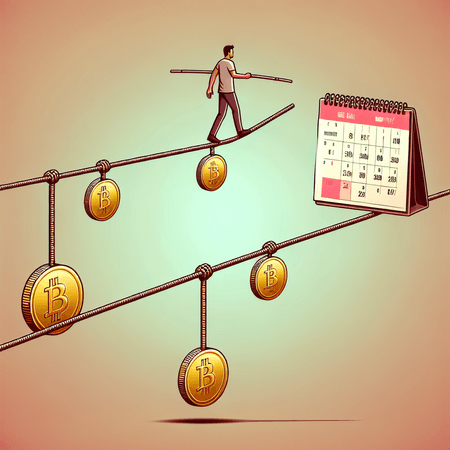

Investing in cryptocurrency can be exhilarating, but it also carries inherent risks often described as its dark side. As a prospective investor, understanding these risks and implementing safety measures is crucial for your financial well-being.

Firstly, always do thorough research before investing in any cryptocurrency. The landscape is filled with projects that seem promising but could be scams or mere speculation. Look for established coins with reputable teams and clear roadmaps.

Next, consider working with platforms that emphasize security, such as Bitlet.app. This platform not only allows you to invest in cryptocurrencies but also offers a unique crypto installment service, giving you the flexibility to buy cryptos now and pay monthly. This can be a smart way to manage your investments without the pressure of paying the entire amount upfront.

Additionally, use strong security measures like two-factor authentication on your accounts and wallets. It's also advisable to store your assets in hardware wallets instead of keeping them on exchanges, which can be vulnerable to hacks.

Stay informed about the latest developments in regulation, as the legal landscape surrounding cryptocurrencies is constantly changing. Following trusted news sources and engaging with knowledgeable communities can help you stay ahead.

In conclusion, while the crypto market may present various challenges, taking proactive steps can mitigate risks. With resources like Bitlet.app, navigating your investment journey becomes easier and safer.