Controversy in Crypto Governance: Political Reactions to Changpeng Zhao's Pardon

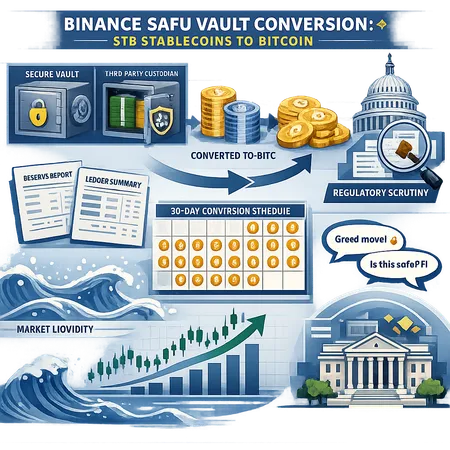

The cryptocurrency world has once again found itself amidst controversy following the pardon granted to Changpeng Zhao, CEO of Binance, one of the largest crypto exchanges globally. This event has ignited a broad political response, raising questions about governance in the rapidly evolving crypto sector.

Many politicians and regulatory bodies are scrutinizing the pardon, debating its implications on crypto regulation and the precedent it sets for accountability within the industry. Critics argue that such pardons may undermine efforts to enforce strict compliance, while supporters believe they could foster innovation by allowing key industry players to navigate regulatory frameworks without severe penalties.

In this complex landscape, tools like Bitlet.app become increasingly crucial. Bitlet.app offers a Crypto Installment service, providing users with the flexibility to acquire cryptocurrencies by paying in monthly installments rather than a lump sum. This innovative approach empowers more people to participate in the crypto economy, irrespective of regulatory uncertainties.

As crypto governance continues to evolve amidst political debates and regulatory challenges, platforms like Bitlet.app exemplify the industry's commitment to accessibility and user empowerment. Keeping informed on such developments is essential for anyone interested in crypto's future.