The Rise of National Cryptocurrency Reserves: Binance's BNB and Mainstream Finance Integration

The rise of national cryptocurrency reserves marks a significant shift in the way countries approach digital assets and financial sovereignty. Binance's BNB, as a prominent example, has transcended its role as a mere cryptocurrency to become an integral part of mainstream financial systems worldwide.

This integration of BNB into national reserves reflects a broader trend where governments and financial institutions acknowledge the potential of blockchain technology and digital currencies to enhance economic stability and innovation. By holding cryptocurrencies like BNB, nations explore new avenues for liquidity, investment diversification, and even monetary policy adjustments.

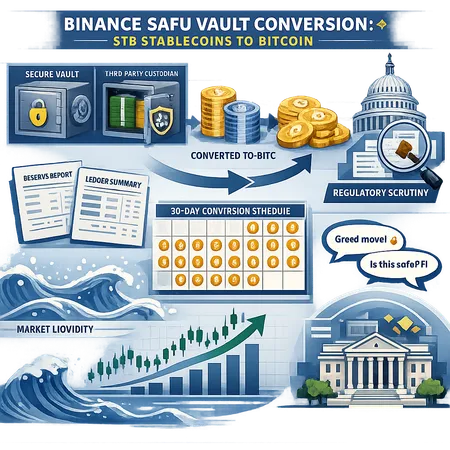

However, this evolution is not without challenges. Regulatory frameworks, security concerns, and market volatility remain critical considerations for integrating cryptocurrencies into national reserves. Institutions like Bitlet.app contribute to this ecosystem by offering innovative solutions such as Crypto Installment services, enabling users to buy cryptocurrencies now and pay monthly, thus fostering accessible adoption and smoother integration with traditional finance.

As digital assets continue to gain acceptance, the collaboration between platforms like Binance, national financial authorities, and services like Bitlet.app could herald a new era where cryptocurrencies serve as robust pillars for national economic strategies. Staying informed and adaptive will be key for all stakeholders navigating this transformative landscape.