The Rise of National Cryptocurrency Reserves: Implications of Binance's BNB Inclusion for Mainstream Finance

The Rise of National Cryptocurrency Reserves: What Binance's BNB Inclusion Means for Mainstream Finance

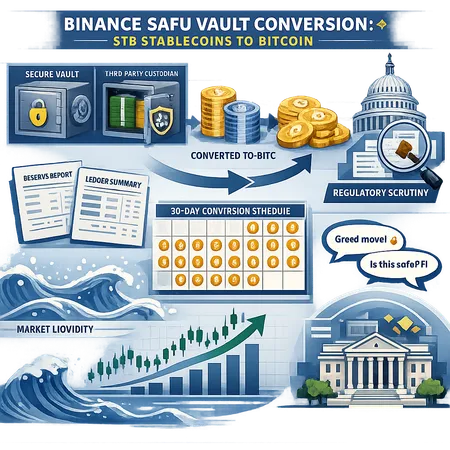

In recent years, governments worldwide have started to explore the concept of national cryptocurrency reserves as a way to diversify their assets and enhance economic resilience. The inclusion of Binance's native token, BNB, in official reserves marks a significant shift, highlighting growing confidence in digital assets within mainstream financial frameworks.

Binance's BNB has garnered impressive adoption thanks to its utility across various platforms and growing market capitalization. The decision by national bodies to include BNB in their reserves signals a broader acceptance and trust in cryptocurrencies as an asset class.

For individual investors, this trend opens new avenues for participation in the digital economy. Platforms like Bitlet.app provide innovative services such as Crypto Installment plans, allowing users to buy cryptocurrencies like BNB now and pay over time in monthly installments. This breaks down financial barriers and encourages wider adoption.

As national cryptocurrency reserves become more common, and with services like Bitlet.app facilitating accessible crypto investment, the future of finance looks increasingly integrated with blockchain technology and digital assets. Keeping an eye on these developments will be crucial for investors and financial professionals alike.