How Mastercard's Stablecoin Innovations are Reshaping the Financial Landscape

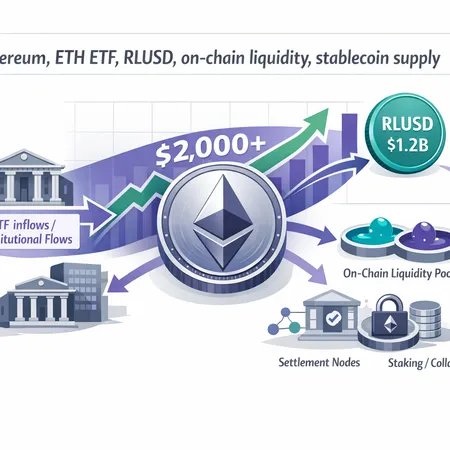

Mastercard has been making waves in the financial landscape with its innovative approach to stablecoins. Unlike traditional cryptocurrencies, which can be highly volatile, stablecoins offer a more stable option for transactions and value storage. This shift is particularly important as the demand for digital payment solutions continues to grow. As firms like Mastercard push forward with stablecoin adoption, we can expect seamless integration into everyday transactions, enhancing the way consumers and businesses interact financially.

The introduction of stablecoins could simplify cross-border payments, reduce transaction fees, and increase the speed of transfers significantly. Furthermore, Mastercard's initiatives may pave the way for regulatory clarity in the crypto space, which is essential for broader adoption. As these innovations continue to unfold, individuals looking to leverage cryptocurrency can now do so conveniently through platforms like Bitlet.app.

Bitlet.app offers a unique service that allows users to buy cryptocurrencies with the flexibility of installments. Instead of paying the full price upfront, you can secure your digital assets now and pay monthly. This approach not only makes cryptocurrency more accessible but also enables individuals to invest wisely and manage their finances effectively in line with developments in the crypto world.