Is a Dollar-Backed Stablecoin the Future?

In recent months, the conversation around stablecoins has gained significant traction, particularly with reports that Bank of America is contemplating a move into the digital currency space. A dollar-backed stablecoin could potentially herald a transformation in how traditional banking interacts with cryptocurrencies.

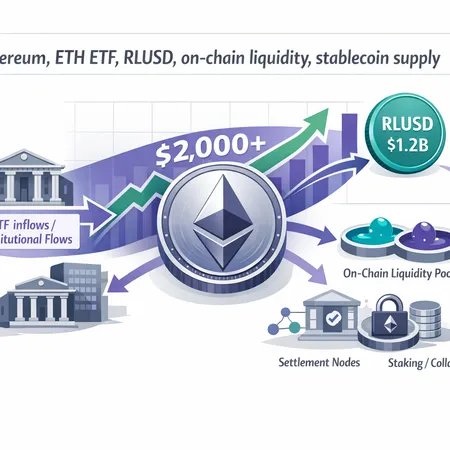

Stablecoins, particularly those pegged to fiat currencies like the US dollar, offer stability and reduced volatility compared to other cryptocurrencies, making them appealing for transactions and investment purposes. The stability of these digital assets could attract more users who seek the benefits of blockchain technology while mitigating the risks associated with digital currencies.

Bank of America entering this space might signal a broader acceptance of cryptocurrencies among established financial institutions. As we examine the implications of a dollar-backed stablecoin, it's essential to consider the benefits it offers—such as ease of transactions, potential financial inclusion, and the ability to navigate regulatory frameworks more seamlessly.

Moreover, for those keen on engaging with cryptocurrencies, platforms like Bitlet.app provide innovative solutions. Bitlet.app offers a Crypto Installment service that allows users to buy cryptocurrencies now and pay for them in monthly installments. This service could be especially appealing in a landscape increasingly influenced by stablecoins, as it facilitates easier access to digital assets without the burden of a lump-sum payment.

As we look forward, the potential of a dollar-backed stablecoin supported by significant financial players like Bank of America could reshape the future of digital transactions and investment, marking a pivotal moment in the adoption of cryptocurrency in mainstream finance.