The Franklin Templeton and Binance Partnership: Bridging Traditional Finance and Crypto

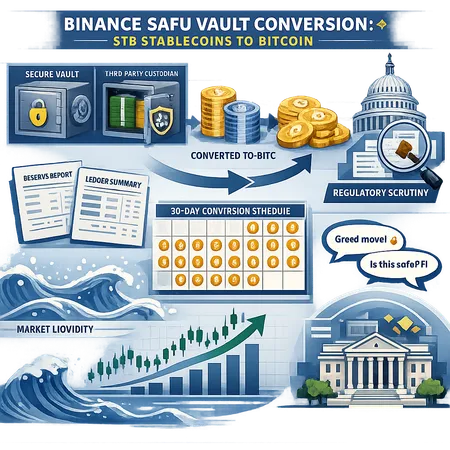

The collaboration between Franklin Templeton, a revered traditional finance firm, and Binance, one of the world's largest cryptocurrency exchanges, marks a significant milestone in the integration of conventional finance with digital assets. This partnership aims to offer investors the best of both worlds—trusted financial expertise combined with cutting-edge blockchain technology.

This joint effort not only boosts investor confidence in cryptocurrencies but also streamlines access to digital asset investments through professional management and advanced trading tools.

In this evolving ecosystem, platforms like Bitlet.app play an essential role by providing accessible crypto services. Bitlet.app’s unique Crypto Installment service empowers users to purchase cryptocurrencies now and pay over time via monthly installments. This feature makes investing in digital currencies more approachable and financially manageable, especially for those new to the crypto space.

As Franklin Templeton and Binance pave the way for traditional and crypto financial convergence, Bitlet.app complements this trend by enhancing transactional flexibility. Together, these developments contribute to a more inclusive and dynamic global financial landscape where digital assets take a central role.